Yesterday, Federal Reserve Chairwoman Janet Yellen said something during a speech that resonated throughout financial media.

Replying to a question about the financial systems stability, she said:

"Will I say there will never, ever be another financial crisis? No, probably that would be going too far. But I do think we’re much safer and I hope that it will not be in our lifetimes and I don’t believe it will."

Yellen is turning 71 this August, so I would like her to define what is "our lifetimes." Also, what does she consider a financial crisis?

When another question had asked about share price valuations, Yellen admitted "by standard metrics, some asset valuations look high." But before striking worry into the heart of Bulls she added, "[though] there is no certainty about that."

As always, it wasn't hard to predict this was how a Yellen interview would have gone. The usual, "everything is fine. Don't panic. Things are safer than ever," rhetoric was loud and clear.

I believe it is all for show. As I have said before, imagine what the financial markets would do if she said anything to the contrary.

Finally, the markets are starting to lose confidence in the Fed's words. . .

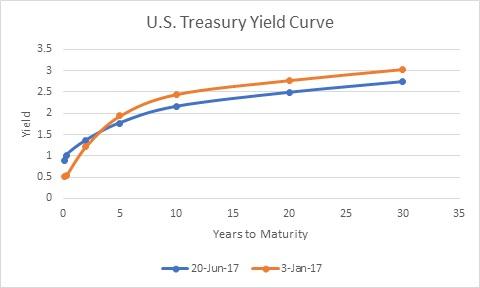

First it was the bond market. While the Fed jawbones about a recovery and fully expecting GDP and inflation to rise, the bond market is expecting the opposite. They are actually predicting deflation and a recession. The yield curve flattening is proof of this.

Short term yields have risen from the beginning of the year, while longer term yields are lower.

Short term yields have risen from the beginning of the year, while longer term yields are lower.

"A flatter yield curve hurts bank profits, stability, and willingness to lend. Also, a flatter yield curve is viewed as a sign of upcoming weakness," said Bob Johnson, Morningstar's director of economic analysis. "If long-term and short-term rates are close, markets must be expecting little growth or lenders would demand a bigger time premium."

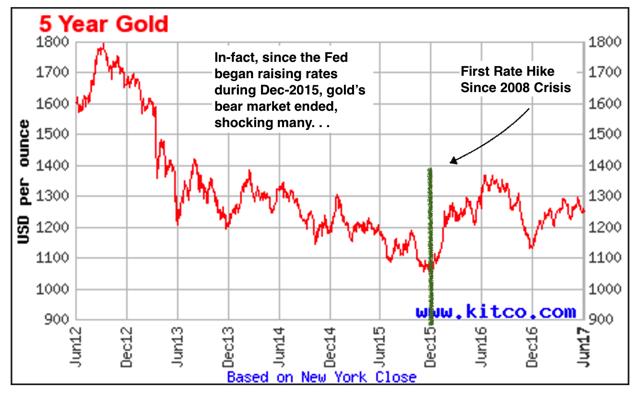

Secondly, gold(GLD) investors have not been deterred against Fed hiking.

Actually, it is the exact opposite. The first rate hike that happened December 2015 sparked the life back into gold after 3.5 years of a brutal bear market.

Actually, it is the exact opposite. The first rate hike that happened December 2015 sparked the life back into gold after 3.5 years of a brutal bear market.

Rising interest rates should have sent gold plunging.

With the economy recovering, inflation low, the US Dollar at multi-year highs, and higher yield securities becoming available, there was a lot going against gold.

That is, if you believed what the Fed was preaching. . .

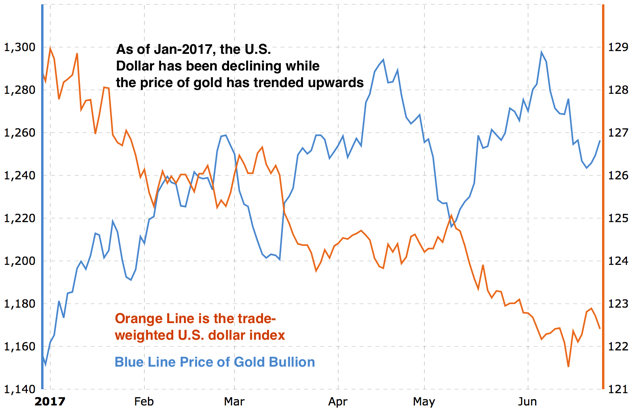

But gold has held relatively steady in the face of multiple rate hikes and a strong dollar. And since 2017, the price of gold has strengthened, while the U.S. dollar has trended lower.

Both bond investors and gold investors aren't buying the Fed's recovery hype. But after Yellen spoke Tuesday, the stock market is also having doubts.

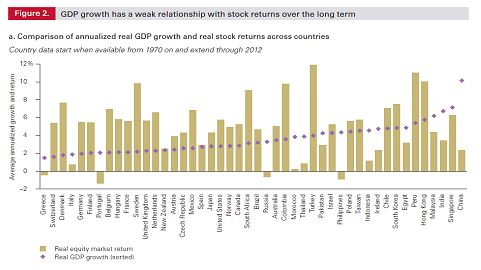

To start, the idea there is a correlation between stock prices and a country's GDP is a myth.

What drives equity prices are the returns offered per share of a company's capital business. GDP rates, which many believe are significant drivers of stock prices, don't historically correlate.

The idea that nominal equity market returns approximate the country’s GDP growth rate is historically uninformed and intellectually dishonest. If there were any merit to the idea that equity market returns should approximate GDP growth rate, we would see this in a tight relationship between the two variables across countries. But we don’t - wrote Advisors Perspective.

Of course, a growing economy is healthy for business, as sales and profits increase. But, as we have all learned throughout history, a stock's price doesn't simply reflect a business' health. Lousy debt-ridden companies with inflated promotional hype can have high valuations. Meanwhile a business with a clean balance sheet, but in a boring sector, can have a low valuation.

But today, the U.S. stock market doesn't need a rising GDP or inflation to push valuations higher. Why? Because they have the Fed. After the infamous 'Greenspan Put' during the 1990s, where former Fed Chairman Alan Greenspan propped up asset prices by lowering interest rates, markets suffer from insane moral hazard.

Add Ben Bernanke, the successor to Alan Greenspan, and his introduction of 'Quantiative Easing' (all three rounds of it) and markets are heavily addicted to stimulus.

Bond investors and gold investors and stock investors are all doubting the Fed's talk about growth and inflation. Watching President Trump's difficulty to get anything done in office, his promises of 'bigly tax cuts' and infrastructure spending projects seem like pipe dreams. That is why they are preparing for once the Fed ends up putting their foot in their mouth and quickly reverse this tightening course.

If the equity market truly believed the Federal Reserve's assertion that the economy is strong enough to withstand higher interest rates, it would be fleeing from stocks offering high yields.

It's doing the opposite. . .

Companies in sectors that serve as bond proxies — telecom, utility, and real estate — were the only ones to see net buying last week, along with industrials, according to client data compiled by Bank of America Merrill Lynch.

Thus, the big 3 markets are pricing in, and preparing for, rate cuts and more stimulus. . .

That is why we haven't seen gold drop below $1000. This is why long term bonds, like the 10 & 30 year, are falling while the Fed hikes. This is why the stock investors aren't fleeing from stocks offering higher yields and equities prices continue their bull run even as economic data deteriorates.

All three asset classes will greatly benefit from more stimulus. And they know its coming.

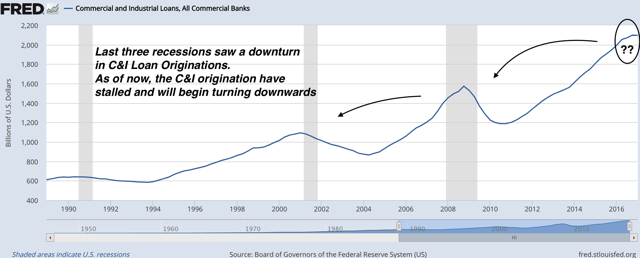

The Fed's constant enthusiasm is a facade. Nothing more. The economy is anemic at best. Growth and inflation are softening. And even more daunting, the origination of loans are collapsing.

It seems that no one believes the words the Fed is desperately telling us. But, again, what could we expect otherwise?

It isn't like Yellen would go on TV and say, "Oh yeah, by the way, we are preparing for the next recession. It could be storming in any month now. We hope our balance sheet can sustain more bond buying without investors losing confidence in the dollar. We secretly want stocks much higher because it creates the wealth effect. We really need inflation higher to inflate our way out of some debt over the next couple decades, but we can't let dollar holders realize this. Otherwise, the good news is the unemployment rate is looking good."

Wouldn't that be something?