Summary

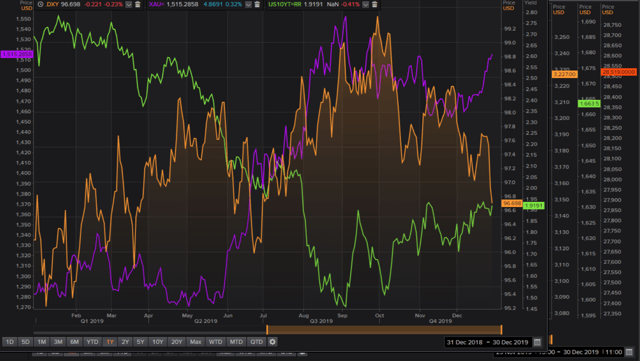

- Equities price action is consistent with a top having been seen. But the 10yr yield looks different. Maybe just Wave 2 action (an irregular) which is confirming a quadruple top.

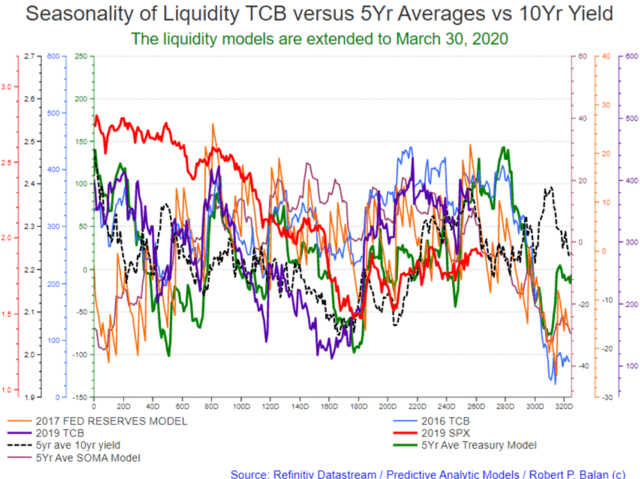

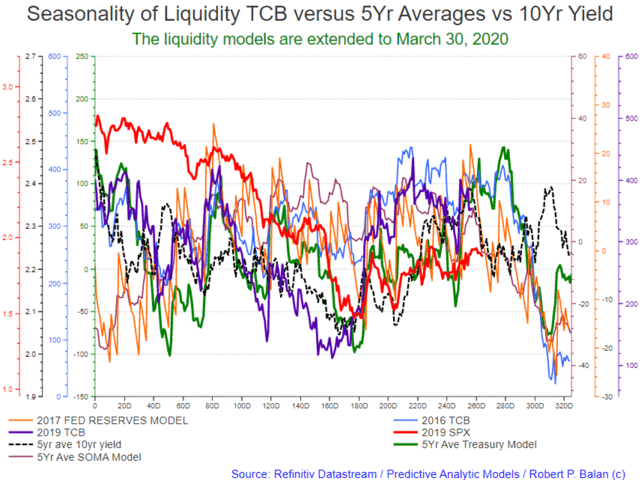

- Liquidity models suggest a trough still due in 7 to 9 trading days in yields. The five-year 10yr yield average also shows that, then sharp yield upticks until mid-March.

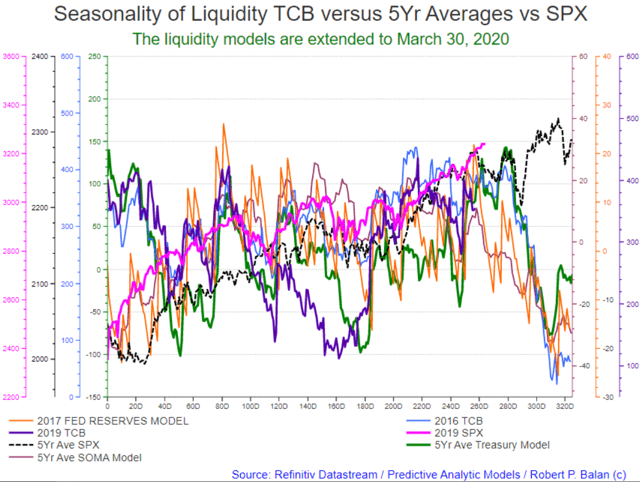

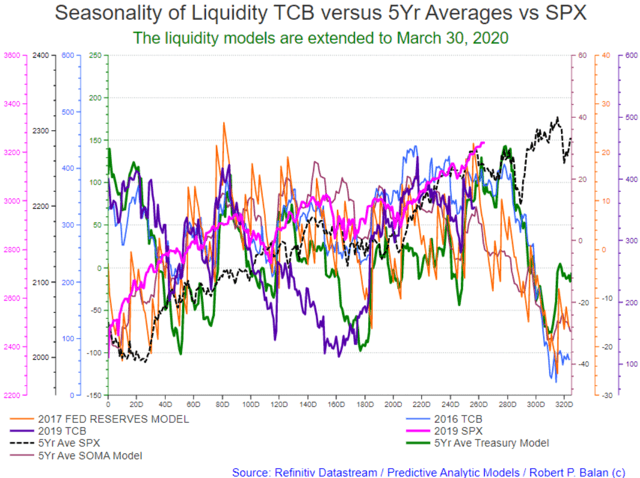

- Today's action in the SPX is starting to look like wave 2 consolidation pattern, and should be followed by more equity declines. This is consistent with SPX, yield liquidity models.

- The key for the other risk assets today will be how equities behave during NY trade. Our thesis is that the mini-liquidity drought has started to bite, and we are confirming that a major top in equities was seen yesterday. This follows the peak and inflection point in yields three days ago.

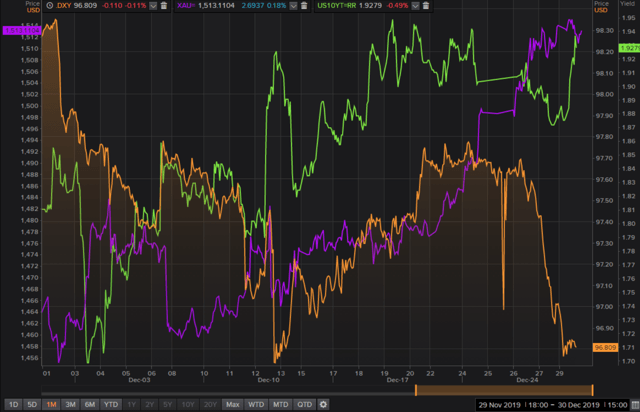

- Here is the tell to the yield outlook: we believe that Gold is on wave 3 of Wave 5 to new higher highs, and DXY is on wave 3 of Wave 3. Gold will rally very hard, and DXY has to fall significantly. For all of these these to happen, the 10yr yield and equities have to fall hard, very hard as well.

(This actual Market Report was written pre-NY market opening, on December 30, 2019, and was updated until the NY market closed. Seeking Alpha has been encouraging SA service providers to become more transparent, and show actual reports and interaction between providers and subscribers. We are providing this report to showcase what PAM provides to the members of the community).

Rida Morwa, principal at the High Dividend Opportunities, the #1 Seeking Alpha service provider at the MarketPlace, the largest community of income investors and retirees with +3000 members and ranked #1 in dividend,income and retirement, has this to say about Predictive Analytic Models (PAM):

Rida Morwa • Dec. 14, 2019 10:28 PM

Best Predictive Analysis!

"I have followed Robert on Seeking Alpha for a long time and decided to subscribe. He is one of the best analysts out there in his predictive models. You will get much more value out this membership than its cost. Robert talented with a very strong track record. Highly recommended. Take a 2-week free trial and see it for yourself!"

See all PAM Member reviews here

Why not take a free two-week trial subscription, have a look at us and see if this community of veteran investors is a good fit for you?

Please go here

-------------------------------------------------

Robert P. Balan @robert.p.balanLeaderDec 30, 2019 3:02 PM

GOOD MORNING

Market Report At the Chat, Dec 30, 2019

No snowflakes here: U.S. consumers will keep the economy humming through 2020

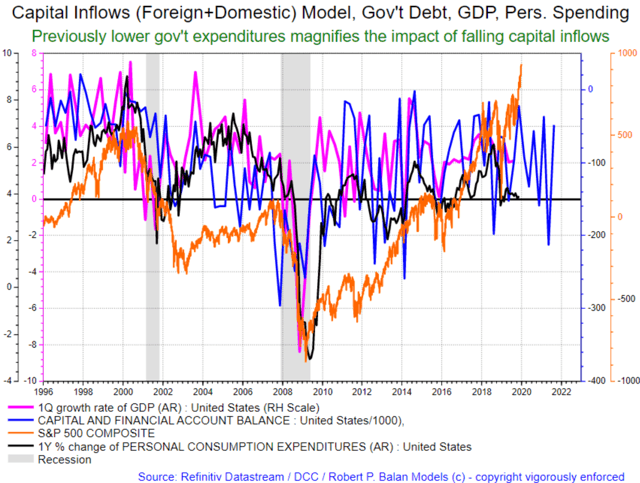

Nice headline: There is just one problem -- personal consumption expenditures lag behind GDP growth. Personal spending does NOT make the econony -- it is the economy (and the stockmarket) which determine the level of personal spending.

No snowflakes here: U.S. consumers will keep the economy humming through 2020

"Despite Washington drama, a lingering trade war, market volatility, and endless chattering-class worries, American consumers are hanging tough: packing the..."

But we should see personal spending rise sharply in Q1 2020 -- nice underlying support for stocks catering to consumer spending (see chart below).

But we should see personal spending rise sharply in Q1 2020 -- nice underlying support for stocks catering to consumer spending (see chart above).

Equities price action is consistent with a topping out pattern. But the 10yr yield looks different. Maybe just a Wave 2 action (an irregular) which is confirming a quadruple top. We will know soon enough, We may get some ideas from the liquidity models we have been tracking for a while.

In yield, it Looks like a trough still due in 7 to 9 trading days. We will be getting clues from the 5 year 10yr yield average until a get a sharp uptick in yields until mid-March. The liquidity models should be providing the underlying prime moving factor. Note the steep liquidity fall by mid-March (see chart above).

The action in the SPX chart above is starting to look like a consolidation pattern to us, and should be followed by more equity declines. That is highly consistent with what we see in the liquidity models. See chart below.

Both Gold (XAU) and DXY are not reflecting the impact of the rise in yields, at least not yet, If equities continue to drift lower, maybe this time yields will follow suit, lower (see chart below).

Crude oil and gasoline followed yields higher. NatGas turning lower again, away from the descending trendline (see chart below).

Crude oil and gasoline followed yields higher. NatGas is turning lower again, away from the descending trendline (see chart above).

The key for the other risk assets today will be how equities behave during NY trade. Our thesis is that the mini-liquidity drought has started to bite, and we are confirming that a major top in equities was seen yesterday. This follows the peak and inflection point in yields three days ago.

Open to discussions.

Barry_Opseth @barry.opsethDec 30, 2019 3:44 PM

Good morning Robert. Behavior in the repo market is not a one off situation. The recent huge liquidity infusion provided by the Fed, has pumped up many assets, but seasonal trends most likely will prevail. We seem to be seeing a repeat of mid-Sept, when bond yields peaked before falling. This seasonal trend also occurs year end for reasons you have pointed out in prior articles. PAM’s models provide a good look as to how the market should behave in the coming weeks. Thanks.

Robert P. Balan @robert.p.balanLeaderDec 30, 2019 3:58 PM

Thanks Barry. equities are breaking down. Let's see what happens next.

Robert P. Balan @robert.p.balanLeader

Dec 30, 2019 4:04 PM

Here is the tell to the yield outlook:

We believe that Gold is on wave 3 of Wave 5 to new higher highs, and DXY is on wave 3 of Wave 3. Gold will rally very hard, and DXY has to fall significantly. For all of these these to happen, the 10yr yield and equities have to fall hard, very hard as well.

Robert P. Balan @robert.p.balanLeaderDec 30, 2019 4:12 PM

Look at this chart again (see below), and imagine how that is done, if it is possible at all.

Robert P. Balan @robert.p.balanLeaderDec 30, 2019 4:17 PM

And below for the SPX, which is now at the edge of a cliff.

foleo @foleoDec 30, 2019 4:31 PM

Robert, any plans to add to the TMF position on this dip?

Robert P. Balan @robert.p.balanLeaderDec 30, 2019 4:33 PM

We added quite a few more TMF tranches two days ago. Mr. TK wanted to reserve remaining capital for equities when we are convinced this is for real; we will add more SDOWs probably tomorrow. But go ahead with the additional TMFs if you are so inclined.

foleo @foleoDec 30, 2019 4:33 PM

thank you

vjapn @vjapnDec 30, 2019 4:54 PM

Robert, yields really not falling even with ES falling. Quite a surprise.

JdEFP @jdefpDec 30, 2019 5:07 PM

EUR/USD making a new 10 day high.

Either USD has to start heading up or yields have to fall to get back in sync. Is that what you are pointing to above robert.p.balan ?

Robert P. Balan @robert.p.balanLeaderDec 30, 2019 5:54 PM

vjapn --- market sectors do not really trade tit for tat.

jdefp -- DXY and yields have their own cadence. DXY lags behind yields by 3 days most times.

User 12932881 @User.12932881Dec 30, 2019 6:20 PM

Here's an item for discussion when we revisit PAM's eurodollar hedging by primary dealers:

ippy04 @ippy04Dec 30, 2019 7:40 PM

2YR yields hitting lower lows... hopefully TNX follows...

JdEFP @jdefpDec 30, 2019 10:50 PM

Will we get a 5th wave down in ES overnight or tomorrow? ... Would be nice to see an impulsive move down off the high.

MARKETS CLOSED

Predictive Analytic Models (PAM) is the sole advisory service at SA which provides REAL-TIME trading execution, and investment analyses / commentaries.

Join us for a free, two-week trial today!

Please go here

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Good read, but one of your images isn't displaying.