Original post:https://twitter.com/RobertPBalan1/status/1403306566812590080?s=20

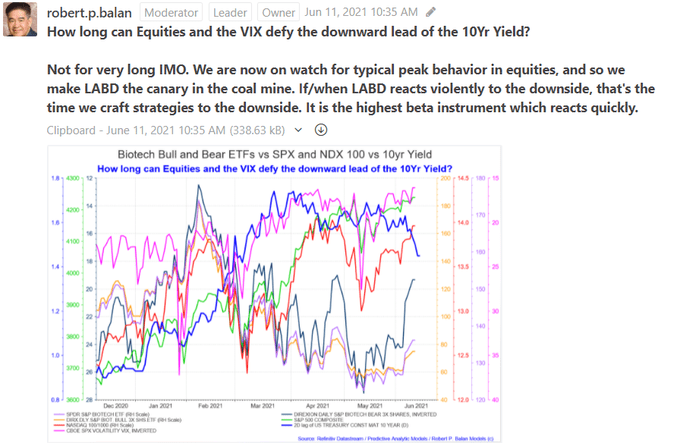

How long can Equities and VIX defy the downward lead of the 10Yr Yield? Not for very long IMO. We're now on watch for typical peak behavior in equities, so we make LABD the canary in the coal mine. If/when LABD reacts violently to the downside, that's the time we craft strategies to the downside. It is the highest beta instrument which reacts quickly.

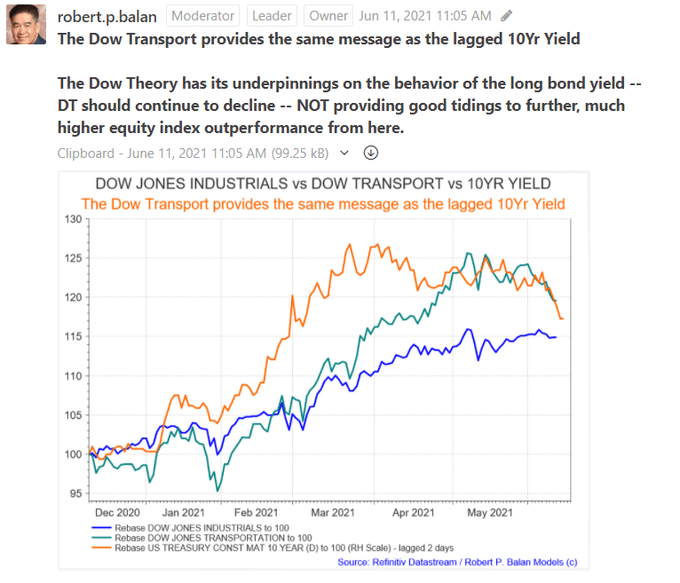

The Dow Transport provides the same message as the lagged 10Yr Yield The Dow Theory has its underpinnings on the behavior of the long bond yield -- DT should continue to decline -- NOT providing good tidings to further, much higher equity index outperformance from here.

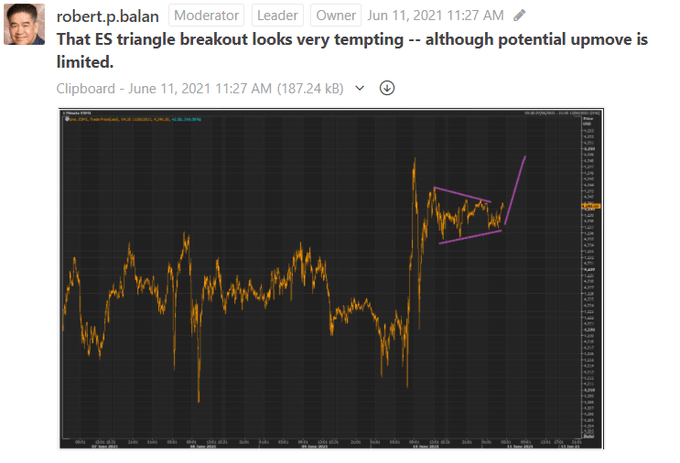

The Dow Transport provides the same message as the lagged 10Yr Yield The Dow Theory has its underpinnings on the behavior of the long bond yield -- DT should continue to decline -- NOT providing good tidings to further, much higher equity index outperformance from here. That ES triangle breakout looks very tempting -- although potential upmove is limited.

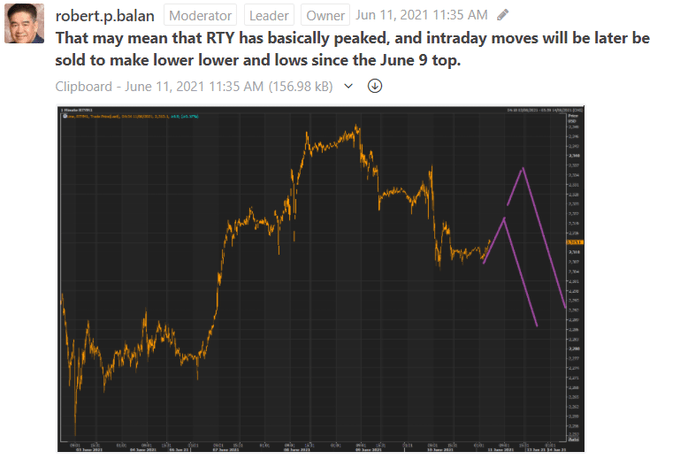

That ES triangle breakout looks very tempting -- although potential upmove is limited. That may mean that RTY has basically peaked, and intraday moves will be later be sold to make lower and lower lows since the June 9 top.

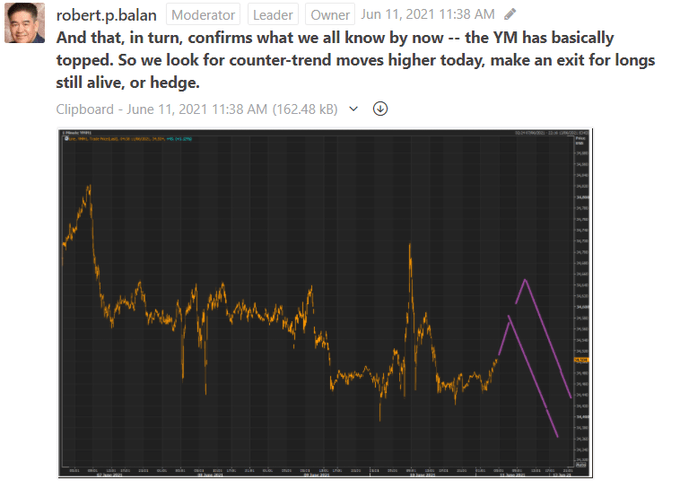

That may mean that RTY has basically peaked, and intraday moves will be later be sold to make lower and lower lows since the June 9 top. And that, in turn, confirms what we all know by now -- the YM has basically topped. So we look for counter-trend moves higher today, make an exit for longs still alive, or hedge.

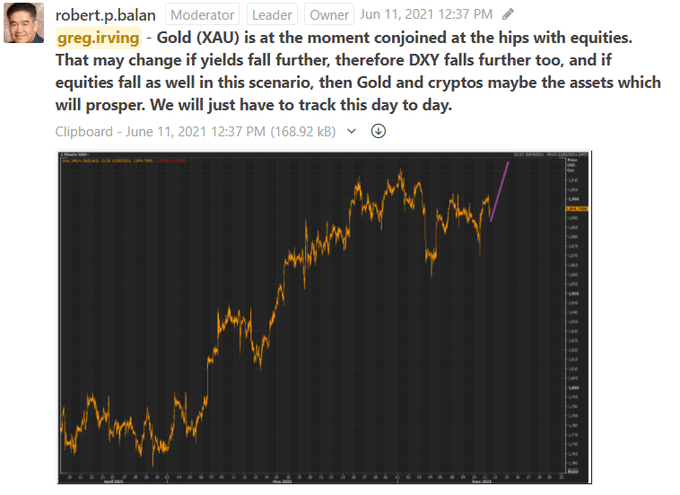

And that, in turn, confirms what we all know by now -- the YM has basically topped. So we look for counter-trend moves higher today, make an exit for longs still alive, or hedge. Gold (XAU) is for the moment conjoined at the hips with equities. That may change if yields fall further, therefore DXY falls further too. If equities fall as well in this scenario, Gold and cryptos maybe the assets which will prosper. We'll just have to track it day to day.

Gold (XAU) is for the moment conjoined at the hips with equities. That may change if yields fall further, therefore DXY falls further too. If equities fall as well in this scenario, Gold and cryptos maybe the assets which will prosper. We'll just have to track it day to day.

Well, Hello Dolly! . . breakout is upon us -- no time to be greedy. We exit the long NQ and ES scalpers we bought this morning, early Europe, pronto. Now, you guys are happy. This is providing a very sumptuous lunch in Europe trade -- grilled plump profits as entree!

------------------------------------------------------------------------------------

This is the latest performance of PAM's One-Contract Portfolio, with a margin capital of $100,000, making the same trades as the flagship Swing Fund, but doing consistent, one contract-trades.

----------------------------------------------------------------------------------------

Here is the current status of the PAM flagship Swing Fund, which includes open and closed trades.

During the first five months of 2021, PAM delivered phenomenal real-dollar Hedge Fund trading performance, the best at Seeking Alpha:

PAM's flagship Swing Portfolio, year-to-date (May 30, 2021) delivered $97, 370,488.48 net profit on $11,172,813 margin capital.

Year-to-date performance: 830.23%.

........