Original Post:https://twitter.com/RobertPBalan1/status/1415958978039844864?s=20

JULY 16, 2021 ASIAN MORNING BRIEF

1X The 10Yr yield has bottomed. The next move higher in yields colors the way the indexes would move from here. Our illustration pre NY Close Thursday seems correct.  2/X If so, we look for 10Yr yield rally back to just below 1.40 handles again, then revert, and test the 1.29 recent lows again. A Yield rise of that magnitude should give YM and RTY a kick-in-the-pants, and these duo should lead the rest of the equity futures higher.

2/X If so, we look for 10Yr yield rally back to just below 1.40 handles again, then revert, and test the 1.29 recent lows again. A Yield rise of that magnitude should give YM and RTY a kick-in-the-pants, and these duo should lead the rest of the equity futures higher. 3/X I expect to see analogous moves in YM, reflecting a Yield rise. If the Yield outlook is correct, then YM should go off the chart.

3/X I expect to see analogous moves in YM, reflecting a Yield rise. If the Yield outlook is correct, then YM should go off the chart. 4X This may also mean a brief sojourn of the RTY under the sun and some needed uplifting. But RTY will probably trail the YM.

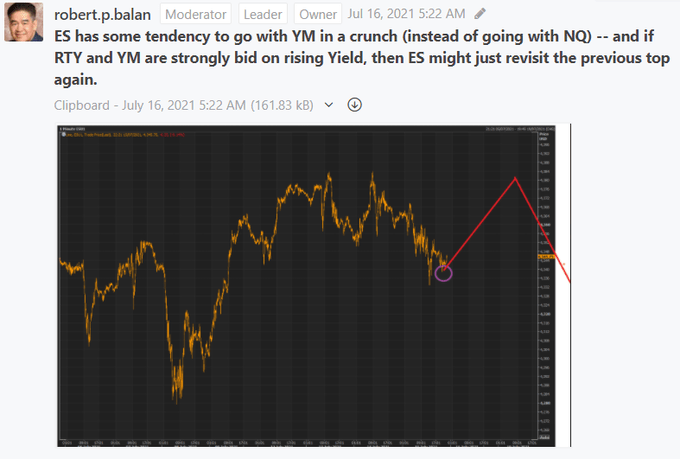

4X This may also mean a brief sojourn of the RTY under the sun and some needed uplifting. But RTY will probably trail the YM. 5/x ES has some tendency to go with YM in a crunch (instead of going with NQ) -- and if RTY and YM are strongly bid on rising Yield, then ES might just revisit the previous top again.

5/x ES has some tendency to go with YM in a crunch (instead of going with NQ) -- and if RTY and YM are strongly bid on rising Yield, then ES might just revisit the previous top again. 6/X I don't expect NQ to rise as much as the other three indexes, But when the Yield goes lower per expectations, it should outperform the field. And the lower the Yield goes, the better it will be for NQ,

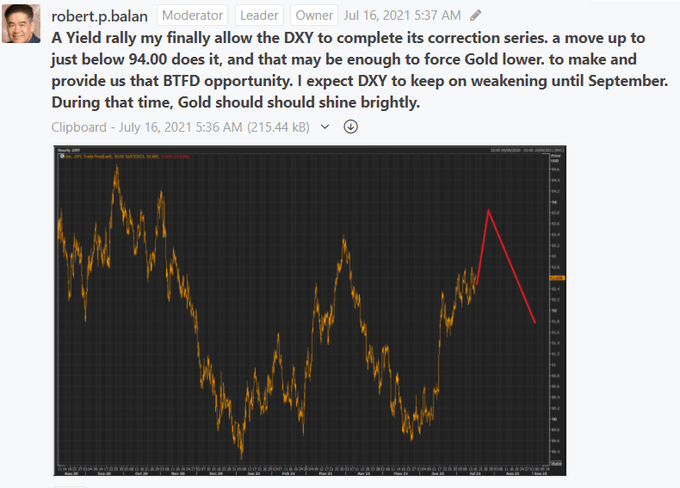

6/X I don't expect NQ to rise as much as the other three indexes, But when the Yield goes lower per expectations, it should outperform the field. And the lower the Yield goes, the better it will be for NQ, 7/X Gold may pullback on rising Yields -- it has not done so in the previous run-up, but it could do it this time. And if i does, this may be he BTFD opportunity that I was speaking about. I just have no idea how low a correction will go, or if one occurs at all.

7/X Gold may pullback on rising Yields -- it has not done so in the previous run-up, but it could do it this time. And if i does, this may be he BTFD opportunity that I was speaking about. I just have no idea how low a correction will go, or if one occurs at all. 8/8 A Yield rally my finally allow DXY to complete its correction series, move up to below 94.00, and that may force Gold lower. That provides us that BTFD opportunity. I expect DXY to keep on weakening until September. During that time, Gold should should shine brightly.

8/8 A Yield rally my finally allow DXY to complete its correction series, move up to below 94.00, and that may force Gold lower. That provides us that BTFD opportunity. I expect DXY to keep on weakening until September. During that time, Gold should should shine brightly.

9/9 Hi, Robert, any thought on crypto (GTBC)? You said a few days ago if no bounce, you would bail out. Is this time to bail out, or not yet? Thanks. wayne_2020 Looking at this price action wayne -- it may get slightly worse before it gets better. ------------------------------------------------------------------------------------

------------------------------------------------------------------------------------

This is the latest performance of PAM's One-Contract Portfolio, with a margin capital of $100,000, making the same trades as the flagship Swing Fund, but doing consistent, one contract-trades.

----------------------------------------------------------------------------------------

Here is the current status of the PAM flagship Swing Fund, which includes open and closed trades.

During the first six months of 2021, PAM delivered phenomenal real-dollar Hedge Fund trading performance, the best at Seeking Alpha:

PAM's flagship Swing Portfolio, year-to-date (June 30, 2021) delivered $115,395,668.48 net profit on $11,172,813 margin capital.

Year-to-date performance: 995.25%.

........