(This actual Market Report was written pre-NY market opening, on Wednesday, April 10, and was updated until the NY market closed).

Here is the Market Report At the Chat, April 10, 2019.

FlyTight @flytight Apr 10, 2019 3:25 PM (GMT)

Robert P. Balan Good morning Robert. If you have time today, can you give us a heads-up on your thoughts for this EWP. We started Monday and Tuesday with two red days and it appears we will start with an up day today. Since we just finished wave-5 everywhere, what are you thoughts on this new wave count> is today a wave 2 of wave-1? That would be most helpful. have a great day!

By the way Robert, are you still anticipating a 50% retracement here?

Robert P. Balan @robert.p.balan Leader Apr 10, 2019 3:34 PM

Thanks for the note FT. I will address your queries in the market report today.

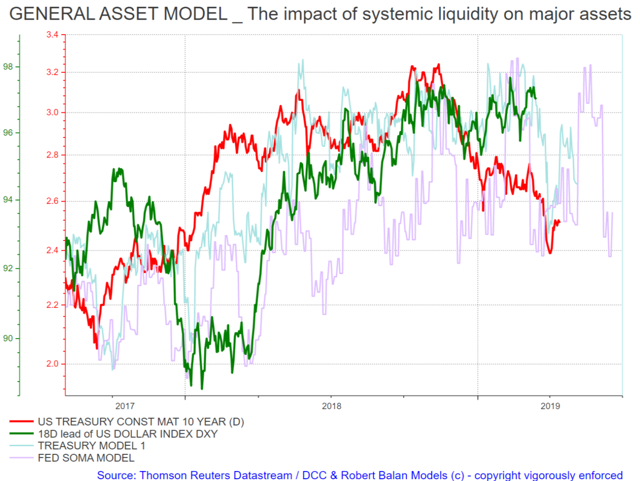

We start off with the DXY, as we are looking to sell the DXY today. Providentially, we are having a sharp uptick in DXY, which we would like to take advantage of. Last night I uploaded this chart, and it helped us allay fears that the DXY could be a safe haven if equities sell-off as much as we hoped it would.

We are seeing an uptick in DXY, and we would like to take advantage of this small rally. I will prepare a official email to document this trade. PAM will use the ETFs listed at the PAM Prospective Trades at the Tool tab.

UDN (1x Bear USD etf) UDN; ULE (2x long EUR) ULE:FXA (1x long AUD) FXA; YCL (2x long Yen ETF) YCL

PAM will buy those instruments listed above. I will do the email now.

PAM Shorts The DXY And Will Buy Bear ETFs To Implement The Trade

PAM shorts the DXY and will buy bear ETFs to implement the trade.PAM buys: UDN (1x Bear USD etf) UDN, ULE (2x long EUR)ULE, FXA (1x long AUD) FXA, YCL (2x long

Robert P. Balan @robert.p.balan Leader Apr 10, 2019 3:55 PM

PAM gets:

ULE (2x long EUR) ULE 14.29

FXA (1x long AUD) FXA 71.35

I will get back to the rest in a little while.

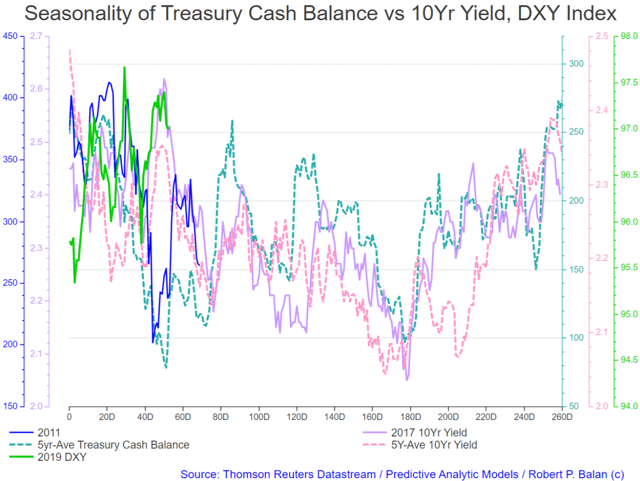

In terms of Treasury Cash Balances and Yield seasonality trends, the DXY at this time is getting in synch with the 5-year averages of the 3yr and 10yr Treasury yields.

With the TCB and the yield averages looking to bottom on trading day 73, and we are now on trading day 54 we have a good 20 trading days of probably weaker DXY.

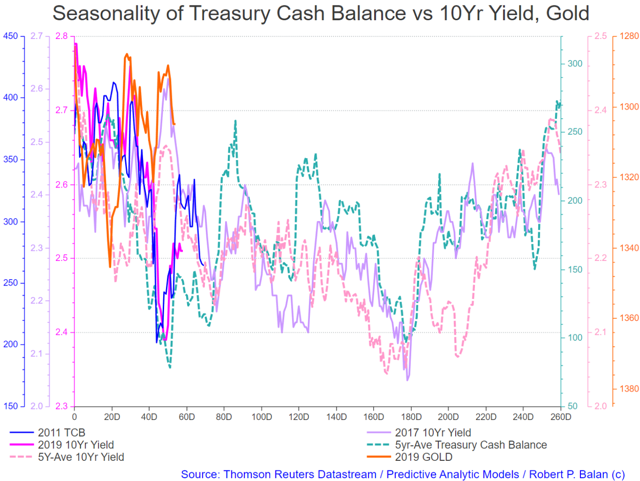

I see that Gold has risen despite a sharp uptick in the DXY, which makes me think that the DXY rally could be a fluke.

Gold is also following the TCB seasonality amd Yield averages. So we have the same analysis for DXY in the inverse -- Gold looks to top on trading day 73, and we are now on trading day 54 we have a good 20 trading days of probably strengthening Gold.

Apes says the EUR was pushed lower by ECB president Mario Draghi, but I don't expect that to have a lasting effect. It just provided better levels to sell the DXY. But we have to rush -- it won't stay at those high levels for long.

Especially so, since bond yields look to be predisposed to fall further in a corrective move that we have been describing in the past several days.

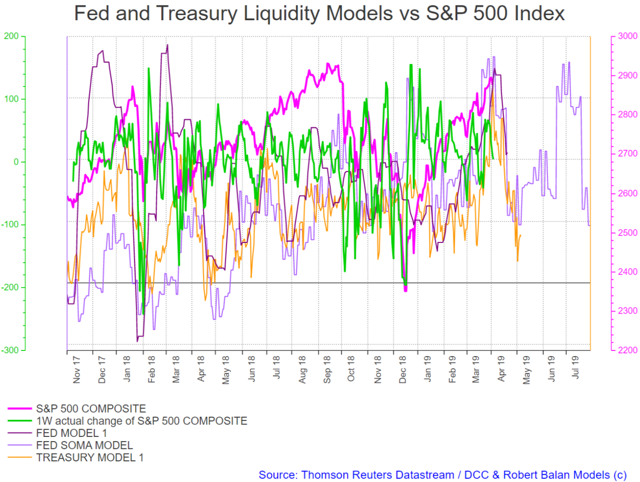

So if yields fall further, then that may have implications in the equity futures movements today.

The Dow looks weak, and is likely to complete a five-wave sequence lower later in the day. the RTY mini is almost certainly going to follow lower. The ES and NQ contracts should also do that, but these two are hanging back, will probably fall to a more limited extent.

For the first time in several weeks, we see an inflection point lower in the SPX liquidity model.

UDN (1x Bear USD etf) UDN 20.74

That is a healthy development but we need to see three lower daily closes to establish a trend down south.

PAM gets:

YCL (2x long Yen ETF) YCL 55.28

After responding to the the sell-off yesterday oil prices have risen back. Nonetheless, if equities continue to spiral lower, we should see oil prices respond lower, accordingly.

However, we have better luck with the oil ETFs -- all it takes is for the equities to fall further to get more mileage on the downside from these instruments.

No movement in the Copper Group. I guess it will take more equity movement than what we have seen so far to elicit a response from the base metals.

END OF REPORT, FOR NOW. We will continue the narratives, if/when the market moves well.

OPEN TO DISCUSSIONS.

Janaka Ahaus @Janaka.Ahaus Apr 10, 2019 4:46 PM

Oil inventory builds just came out, oil plunged.

offroadguy @offroadguy Apr 10, 2019 4:46 PM

all-OK.

Robert P. Balan @robert.p.balan Leader Apr 10, 2019 4:47 PM

Thanks JA. I have to see the details. The MMs often ignore the obvious and focus on what they like.

Janaka Ahaus @Janaka.Ahaus Apr 10, 2019 4:47 PM

Not a plunge but down Ha

10yr yield had a nice dip also, equities seem to be following the DX

Thank you for the reports Robert, it explains a lot on daily market moves.

Robert P. Balan @robert.p.balan Leader Apr 10, 2019 5:00 PM

You are very welcome, JA. I am glad you are happy with the reports.

Janaka Ahaus @Janaka.Ahaus Apr 10, 2019 5:06 PM

The equities seem to think the FOMC meeting today will be bullish. Things look kind of shakey in oil and the yields though.

Robert P. Balan @robert.p.balan Leader Apr 10, 2019 5:08 PM

Re the FOMC -- how much more dovish can the Fed get. They are grovelling in the face of Trump and totally surrendered their independence. Just a thought.

Janaka Ahaus @Janaka.Ahaus Apr 10, 2019 5:10 PM

lol. Do you think the Fed will raise rates in June?

Robert P. Balan @robert.p.balan Leader Apr 10, 2019 5:40 PM

No chance in h**l, JA.

wc.happy @wc.happy Apr 10, 2019 5:54 PM

VLO might be breaking out. fingers crossed

Robert P. Balan @robert.p.balan Leader Apr 10, 2019 5:50 PM

Yes, indeed wc.happy -- it will form a +B+ wave top of an Elliott irregular correction pattern.

Robert P. Balan @robert.p.balan Leader Apr 10, 2019 8:14 PM

@all

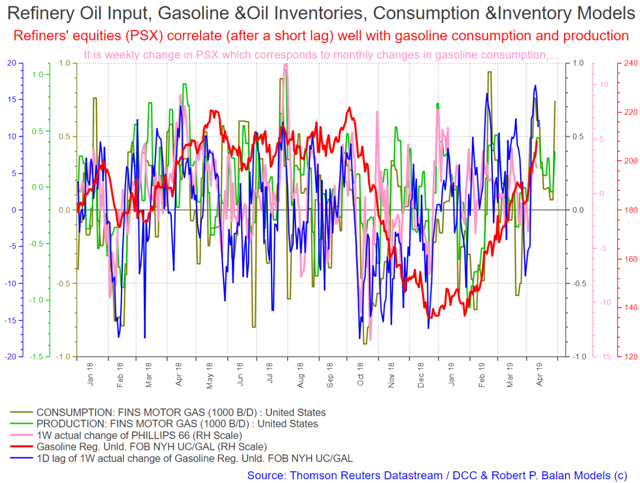

PAM is selling gasoline instruments (UGA). We believe that gasoline prices has become too higher considering the demand/consumption fundamentals. We will send the usual confirmatory email to everyone.

GASOLINE (NASDAQ:CASH)

We believe there is a time window for gasoline prices to pullback until April 26.

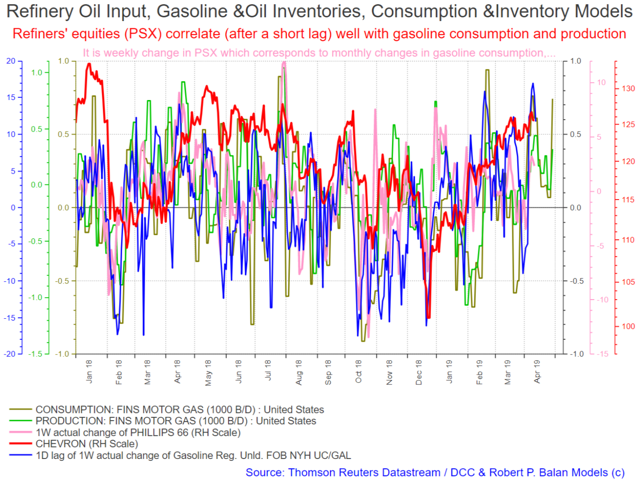

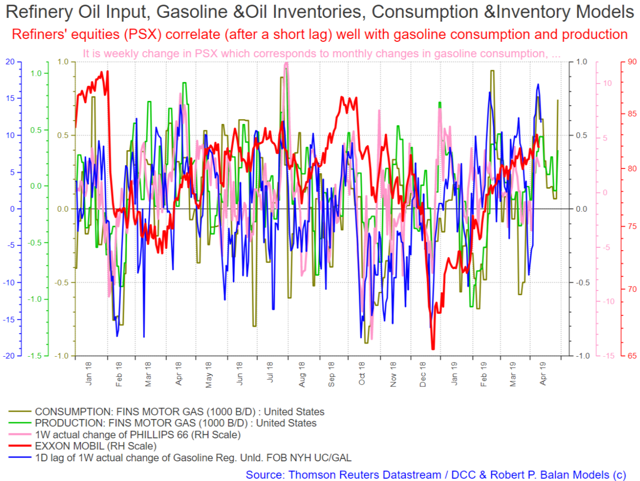

PAM is also selling CVX, and XOM

CHEVRON (NYSE:CVX)

EXXON MOBILE (NYSE:XOM)

We are also looking for a pullback until April 26 in these instruments.

PAM got in at:

UGA 32.38

CVX 125.44

XOM 81.49

Market closed.

This is very hard to follow.

Maybe you start with the primers Adam.

Link?

talkmarkets.com/.../personalblogs/