Investment Advisor, Principal, QVM Group LLC

Contributor's Links:

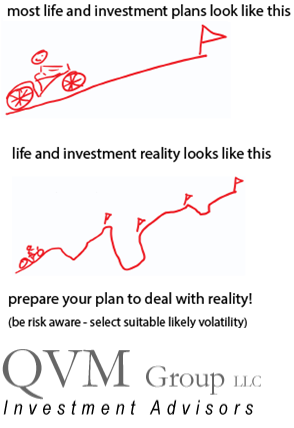

Perspectives on Return and Risk Management QVM Group LLC

Richard is the managing principal of QVM Group LLC, a fee-based investment advisor based in Connecticut, with clients across the country.

QVM manages portfolios uniquely designed for each client on a flat fee basis through the client’s own accounts at Schwab, Fidelity or Vanguard; and ...more

Richard is the managing principal of QVM Group LLC, a fee-based investment advisor based in Connecticut, with clients across the country.

QVM manages portfolios uniquely designed for each client on a flat fee basis through the client’s own accounts at Schwab, Fidelity or Vanguard; and provides investment coaching to "do-it-yourself" investors on an hourly fee basis.

The investment approach is based on value, asset allocation, expense control, risk management, customizing portfolios to each client's specific circumstances, and regular communication about strategy and absolute and benchmark performance.

Richard's extensive experience includes serving as a Board Director of Phoenix Investment Counsel, a U.S. pension and mutual funds manager, now Virtus Investment Partners (New York Stock Exchange: VRTS http://www.virtus.com); as Managing Director of Phoenix American Investment in London; and as a Board Director Aberdeen Asset Management PLC in Aberdeen Scotland (London Stock Exchange: ADN http://www.aberdeen-asset.com). He has been a Trustee of a $500 million pension fund, and was a charter investor and member of the Board of Directors of several internet companies, including Lending Tree (NASDAQ: TREE http://www.lendingtree.com) prior to its IPO. He is a 1970 graduate of Dartmouth College.

QVM Group LLC is a Registered Investment Advisor. Visit the QVM Group website. (http://www.qvmgroup.com/QVMinvest)

Specialties:QVM Group is a fee-only investment advisor. We are compensated only by our clients. We do not sell securities, and do not receive any form of revenue or incentive from any source other than directly from clients. We are not affiliated with any securities dealer, any fund, any fund sponsor or any company issuer of any security.less

Latest Comments

USD Reserve Currency Status Eroding Slowly But Surely

Thank you

S&P 500 Technical Charts

Thank you Dick.

Equity Reallocation Between US, Developed And Emerging Markets

Very kind. Thank you.

When Someone Asks, 'Should I Own Bitcoin?'

Just lucky timing, but logic supports the call at some time. Wouldn't be surprised to see a strong bounce back, but can't see a long-term future for an unregulated "currency" technically supported by open source software running on a volunteer network of private computers, with most holders not being known to government taxing agencies; and with extremely limited transaction volume and speed capacity (miniscule by comparison to daily banking and credit card volumes and very long by comparison to banking and credit card transaction time)

When Someone Asks, 'Should I Own Bitcoin?'

I believe that is because their is no name or origin location attached to the transaction record. I am no expert on that, but that I my understanding.

How To Prepare A Portfolio For War With North Korea

Thanks Bill... at a more extreme level (and related to other hostile players), it could make sense to have asset at more than one dealer or bank in cased North Korea (or other adversaries) decide to and effectively hack a dealer or bank and disable the backup and scramble the accounts data. Even if it would eventually be straightened out, the wait might be too long.

I personally have my assets at three different dealers partly for that reason (but for other reasons too). --- I also believe that keeping PDF and/or paper versions of statements is essential in case proof of holdings ever became necessary...

... sounds silly but I have already learned the hard way. it is not just theory.

I was vested in a pension at the Travelers Ins Co many years ago. When I turned 65 I called to claim my pension, and they said they had no record of me and that I had to prove to them I ever worked there by producing copies of W2 statement (from 40 years earlier).

The SS admin doesn't store data that far back. They get data from the IRS and they don't store data that far back.

I called the ERISA people in Washington DC and they said I could file a law suit (gee thanks, with what evidence?) So I have no money from the time I spend at Travelers.

Fortunately not a big loss, but there is a specific example of electronic records being wiped (in this case by negligence of the parties who bought and sold the Travelers) that put the burden on the individual to maintain records to prove a holding or a right. Keep records on the dealers letter head.

When Someone Asks, 'Should I Own Bitcoin?'

I said, "hundreds of other cryptocurrencies". Should have been more specific. The 10 listed are the 10 most popular or most developed. They are referred to at AltCoins. Don't know if the other hundreds are called AltCoins as well. I will ask editors to add note that the 10 are the leading alternative digital currencies

When Someone Asks, 'Should I Own Bitcoin?'

Good idea -- yes, this is your generation's bubble -- it may be difficult to short with such a volatile asset because it is difficult to know quite when the time has come -- the whipsaw risk is extremely high -- futures are your only option at the moment, a liquid fund available to short may become available in the future -- GBTC is "hard to borrow" and cannot be used to short at this time

The Idiot's Guide To High Frequency Trading

Mark,

I we assume that HFT as you define it continues, and if we think of it as just one more structural cost of investing, what do you think that cost is?

Richard