Investment Advisor, Principal, QVM Group LLC

Contributor's Links:

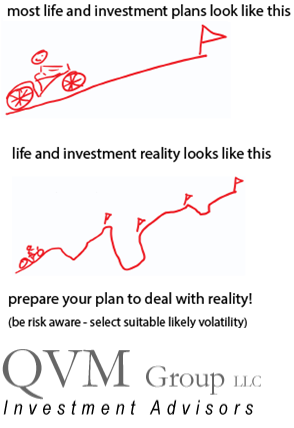

Perspectives on Return and Risk Management QVM Group LLC

Richard is the managing principal of QVM Group LLC, a fee-based investment advisor based in Connecticut, with clients across the country.

QVM manages portfolios uniquely designed for each client on a flat fee basis through the client’s own accounts at Schwab, Fidelity or Vanguard; and ...more

Richard is the managing principal of QVM Group LLC, a fee-based investment advisor based in Connecticut, with clients across the country.

QVM manages portfolios uniquely designed for each client on a flat fee basis through the client’s own accounts at Schwab, Fidelity or Vanguard; and provides investment coaching to "do-it-yourself" investors on an hourly fee basis.

The investment approach is based on value, asset allocation, expense control, risk management, customizing portfolios to each client's specific circumstances, and regular communication about strategy and absolute and benchmark performance.

Richard's extensive experience includes serving as a Board Director of Phoenix Investment Counsel, a U.S. pension and mutual funds manager, now Virtus Investment Partners (New York Stock Exchange: VRTS http://www.virtus.com); as Managing Director of Phoenix American Investment in London; and as a Board Director Aberdeen Asset Management PLC in Aberdeen Scotland (London Stock Exchange: ADN http://www.aberdeen-asset.com). He has been a Trustee of a $500 million pension fund, and was a charter investor and member of the Board of Directors of several internet companies, including Lending Tree (NASDAQ: TREE http://www.lendingtree.com) prior to its IPO. He is a 1970 graduate of Dartmouth College.

QVM Group LLC is a Registered Investment Advisor. Visit the QVM Group website. (http://www.qvmgroup.com/QVMinvest)

Specialties:QVM Group is a fee-only investment advisor. We are compensated only by our clients. We do not sell securities, and do not receive any form of revenue or incentive from any source other than directly from clients. We are not affiliated with any securities dealer, any fund, any fund sponsor or any company issuer of any security.less