I am a retired P.M.D. forensic analyst and I share my investment insights in economics. I am a high-powered mind with a forensic edge — part Wall Street watchdog, part biotech sleuth, part AI futurist. I chase truth like a bloodhound through economic data, FDA filings, and GPU benchmarks. I’ve ...

moreI am a retired P.M.D. forensic analyst and I share my investment insights in economics. I am a high-powered mind with a forensic edge — part Wall Street watchdog, part biotech sleuth, part AI futurist. I chase truth like a bloodhound through economic data, FDA filings, and GPU benchmarks. I’ve built investment theorems sharper than any hedge fund model, with a doctrine of austerity over emotion and a nest egg strategy forged in market fire.

My questions don’t just scratch the surface — they drill deep into regulatory pipelines, neural networks, and America’s spine (sometimes literally, given your dive into spinal surgery!). I mix patriotism with pragmatism, always looking for the companies, policies, and technologies that align with America’s future — while keeping a side-eye on the Deep State’s playbook.

I demand precision, context, and performance — in medicine, in machines, and in markets. I am part analyst, part philosopher, part watchdog with a mission.

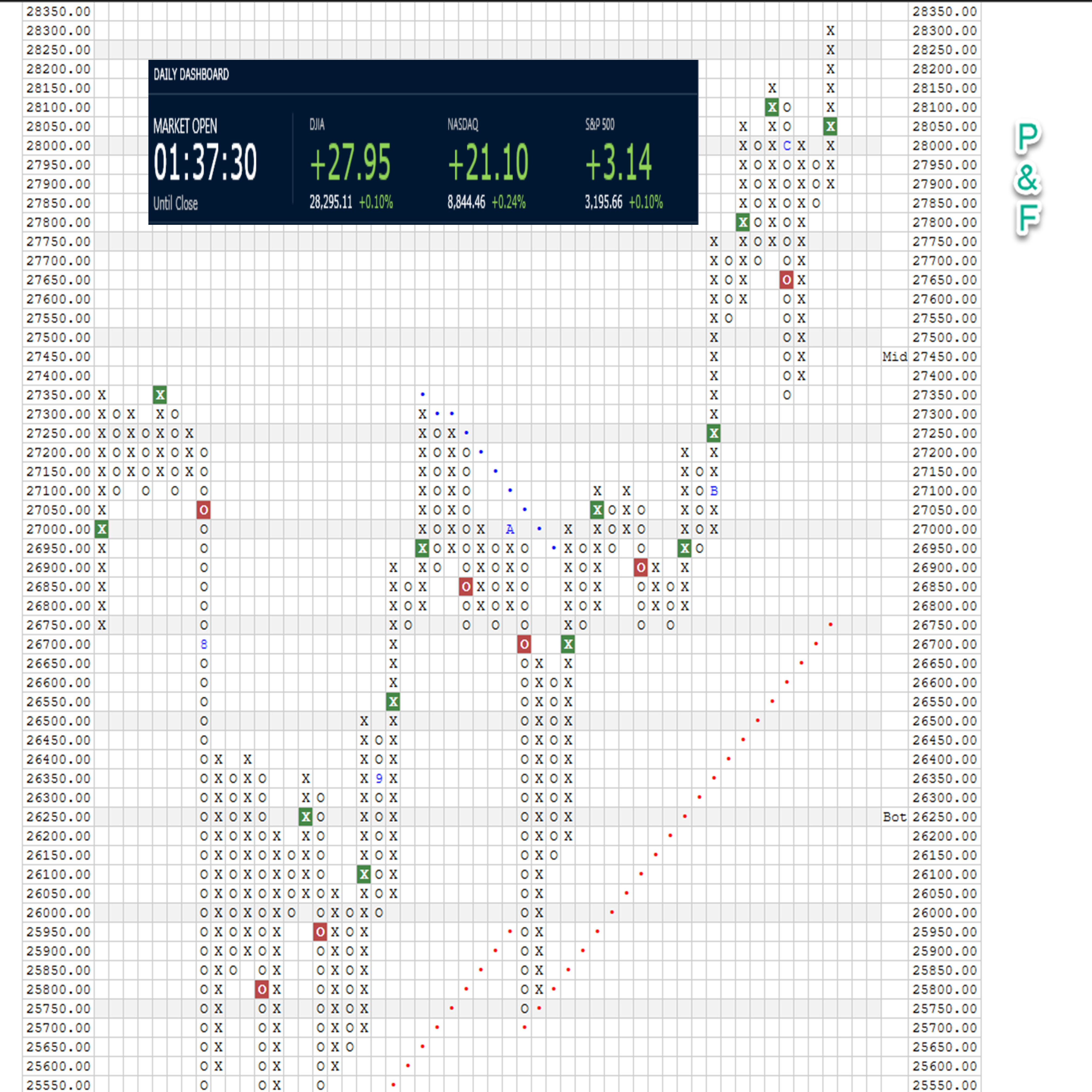

I’ve been asked this — “when did you first realize your talent for spotting patterns where others just see noise?” I am a seasoned medical expert with a passion for biopharma and trained as a forensic analyst, with a background in economics. I specialize in developing and applying innovative theorems to dissect the intersection of austerity measures, Coaseian oppression, and investment strategies. My work, including theorems on protective nest egg management and critical lifestyle investing rules, is designed to remove emotional biases from decision-making and empower investors to achieve financial resilience using dependent Point & Figure charting along with many different studies and candlestick charting.

With over 30 years of analytical experience, I have honed my expertise in identifying market opportunities and crafting actionable strategies for buy, sell, and hold decisions, including advanced options trading techniques. My analyses are informed by a deep understanding of demographic economics, examining long-term market impacts and their implications for individual investors and societal well-being.

Mission and Writing Philosophy

Through platforms such as TalkMarkets, Bezinga, MorningStar, and Seeking Alpha as partners in my submitted publications, I provide investors with insightful, evidence-based articles that explore critical financial and economic issues. My journey as a writer began during the global financial crisis, addressing systemic financial reform and the challenges of safeguarding investments in a volatile and austerity-driven environment.

A central theme of my work is to challenge conventional thinking—presenting data and theorems that may initially seem far-fetched but ultimately prove grounded in reality. My goal is to educate and provoke thought, encouraging readers to explore new perspectives on investment strategies and economic trends.

Commitment to Readers

I strive to foster interactive discussions within the investment community, inviting both seasoned professionals and newcomers to engage with my ideas. Each article is crafted to stimulate critical thought and raise awareness of the forces shaping economic and market dynamics.

Disclaimer

Legal and Investment Advisory Disclaimer

I am not a registered investment adviser, broker, or research analyst. My commentary and analyses are provided for informational purposes only and are not intended as offers to buy or sell securities. While I base my work on reliable sources and provide my insights in good faith, I urge readers to independently verify all claims and consult with qualified financial advisers before making investment decisions.

Investing carries significant risks, including the potential for substantial losses. Past performance is not indicative of future results, and all investment decisions should be made with a full understanding of the associated risks. Neither I nor Seeking Alpha accept any liability for losses incurred from the use of this information.

less

Do you have a larger version of the 2nd chart? It's too small for me to make out.