On Monday, I joined Nicole Petallides on the Schwab Network (live from the NYSE) to discuss market outlook into year-end and 2024, as well as two stock picks. Thanks to Nicole, Kaitlyn Crist, Heidi Schultz and Meaghan Grealish for having me on:

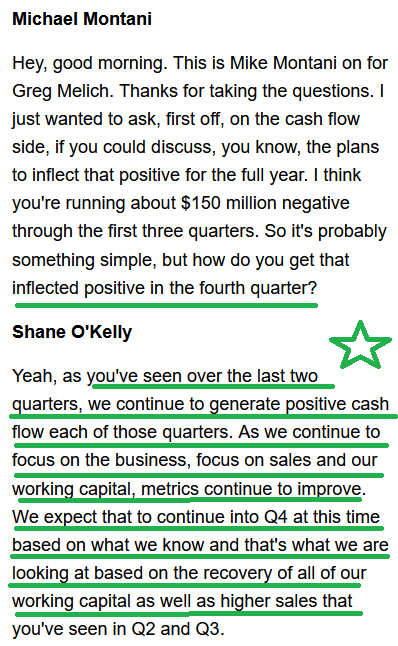

As we wind down an amazing earnings season, I’m trying to highlight the results from 1-2 companies per week that we have talked about on our weekly podcast|videocast(s). Today we’ll do a deep dive on BAX and AAP:

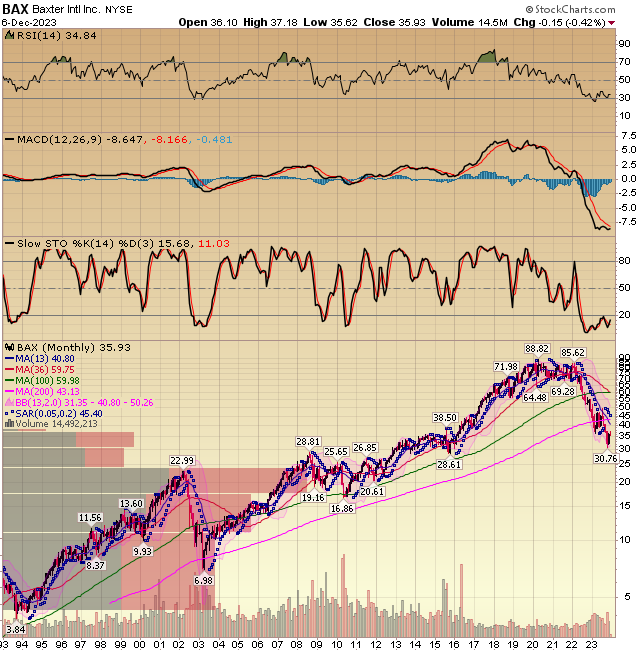

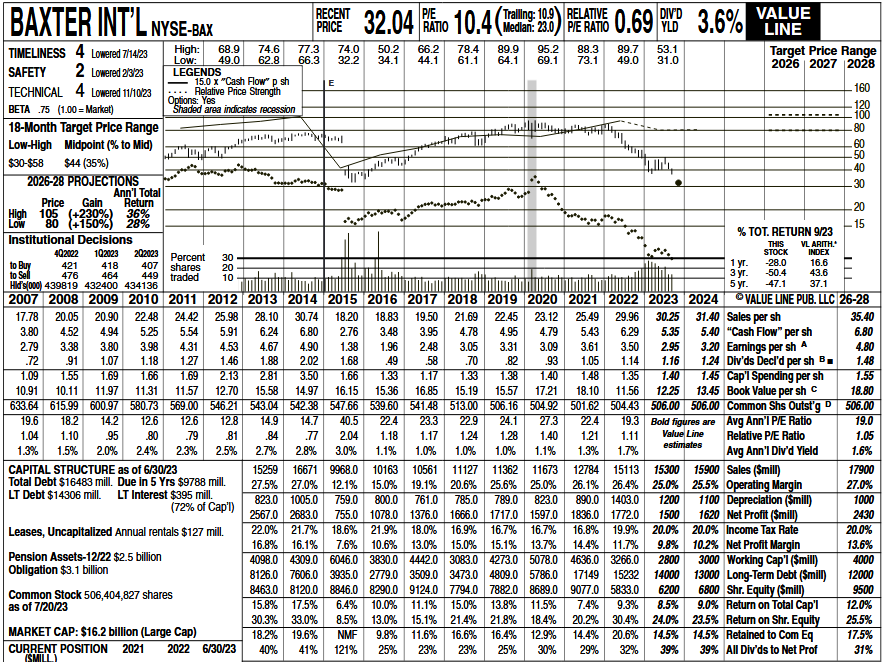

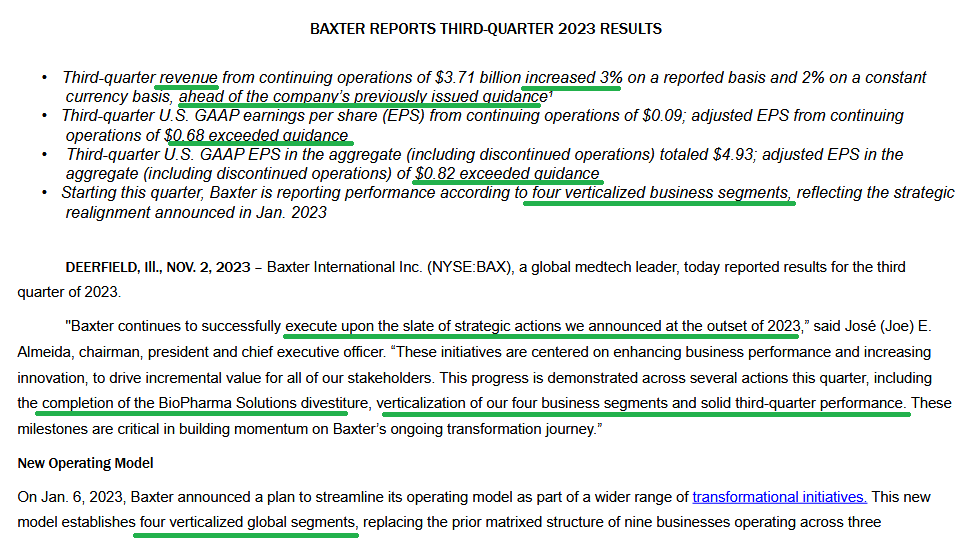

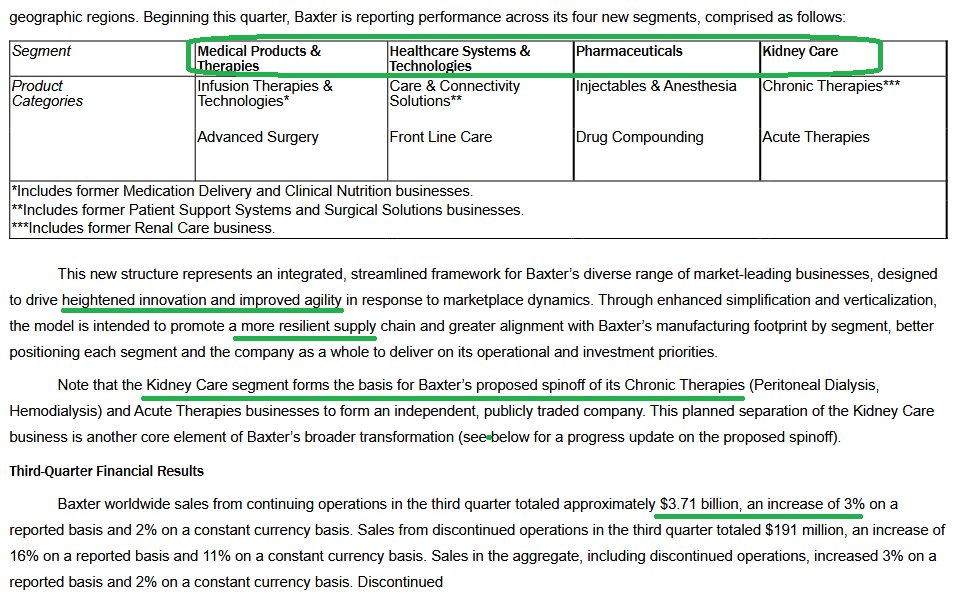

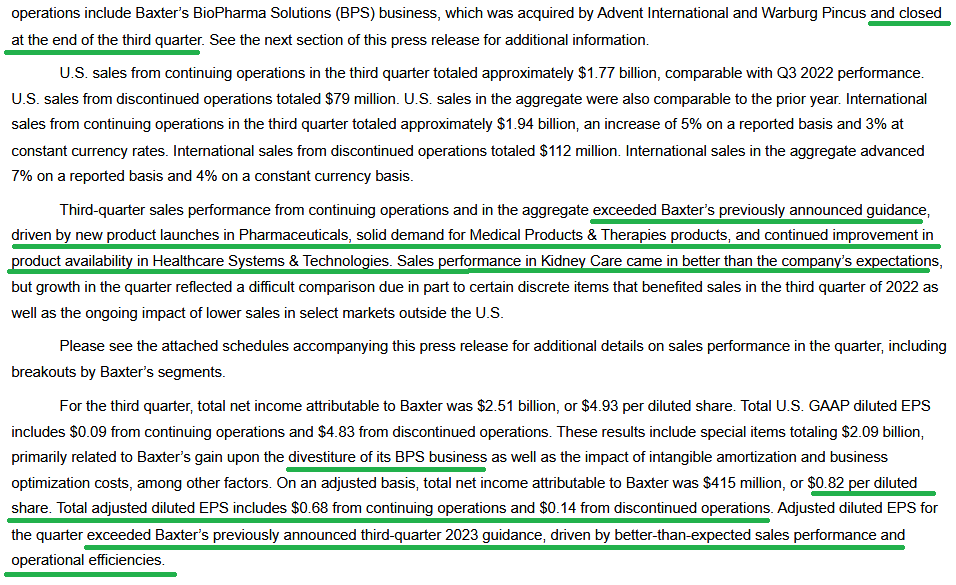

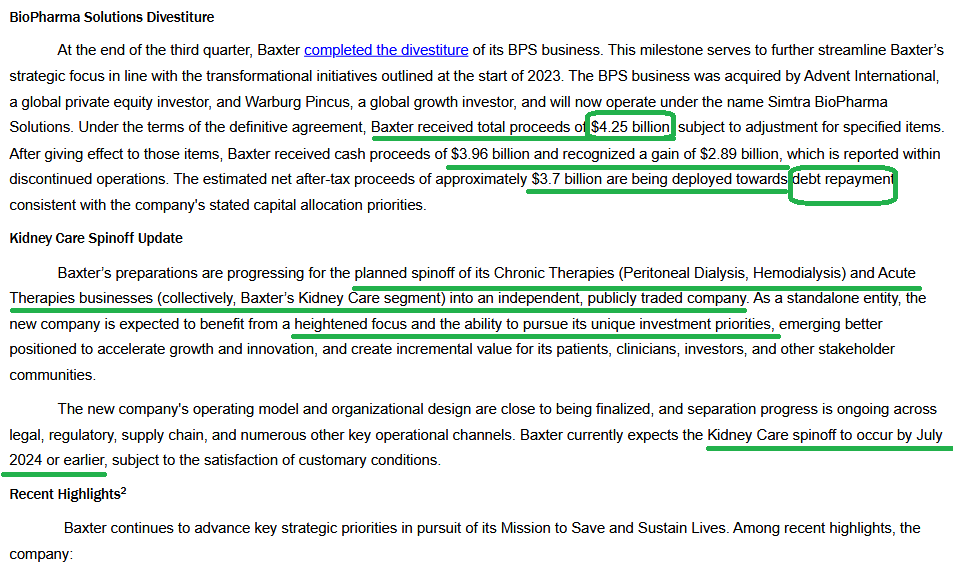

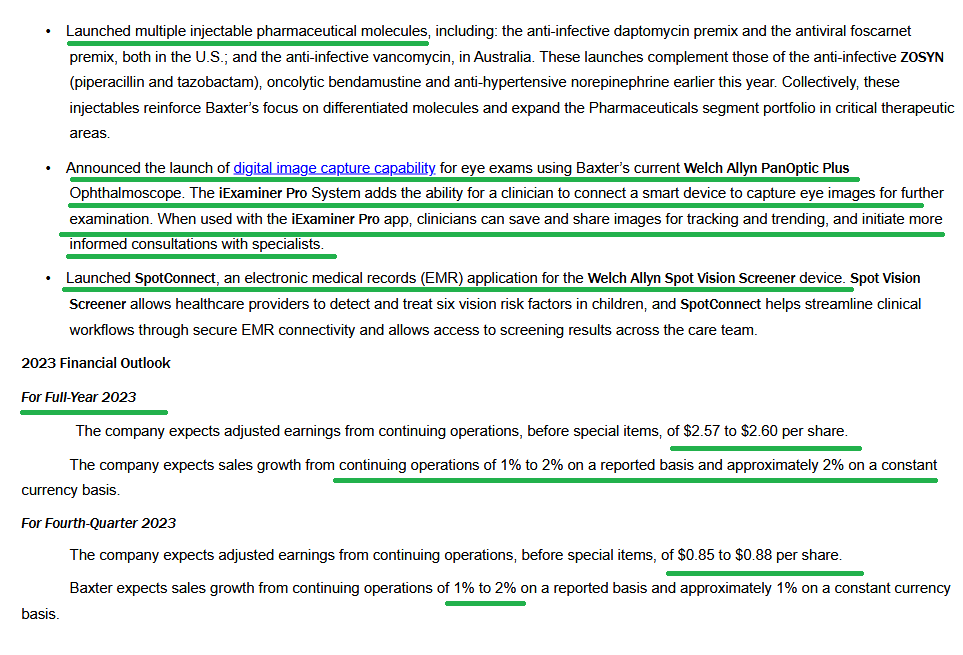

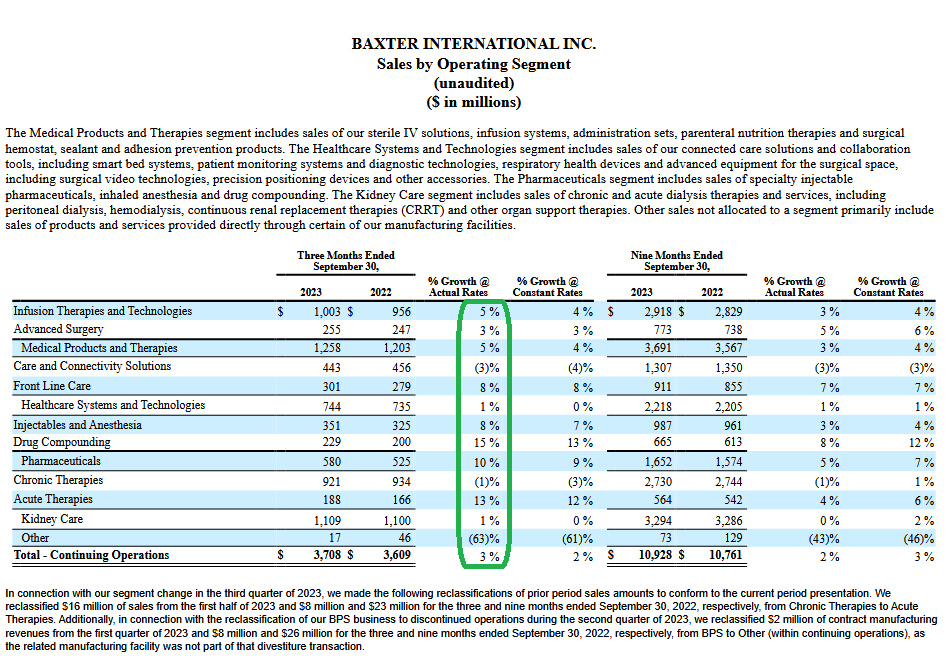

Baxter Update:

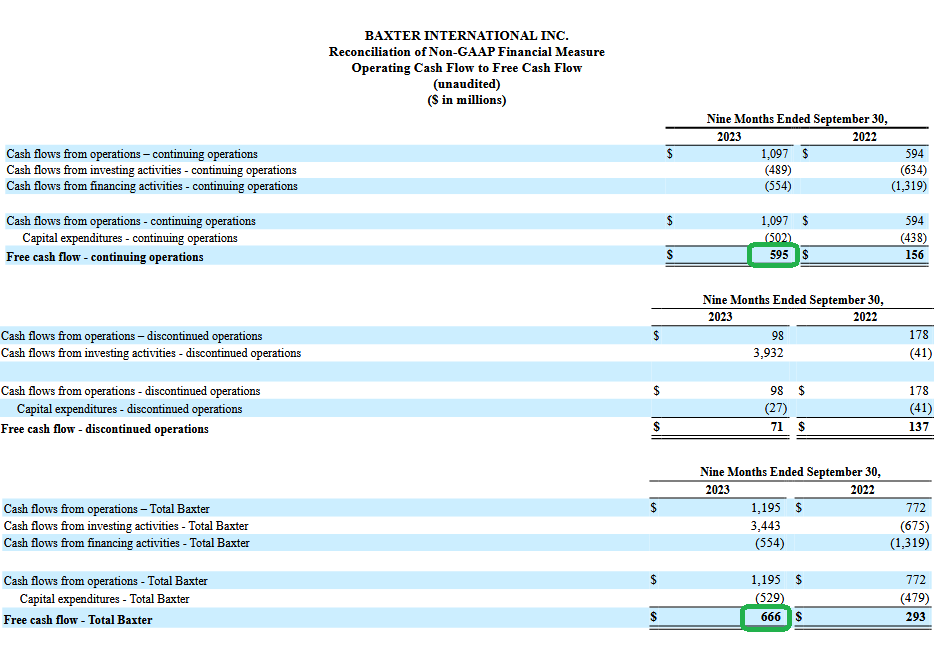

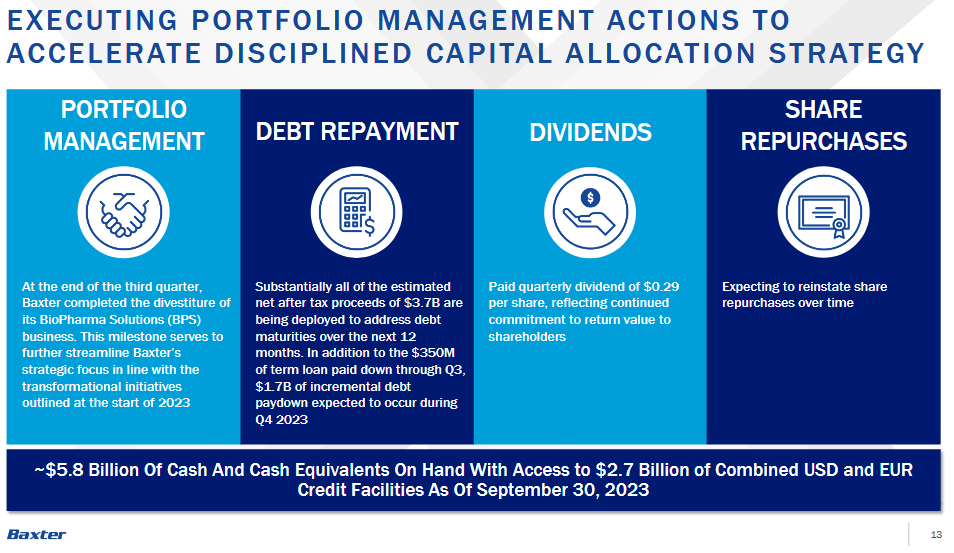

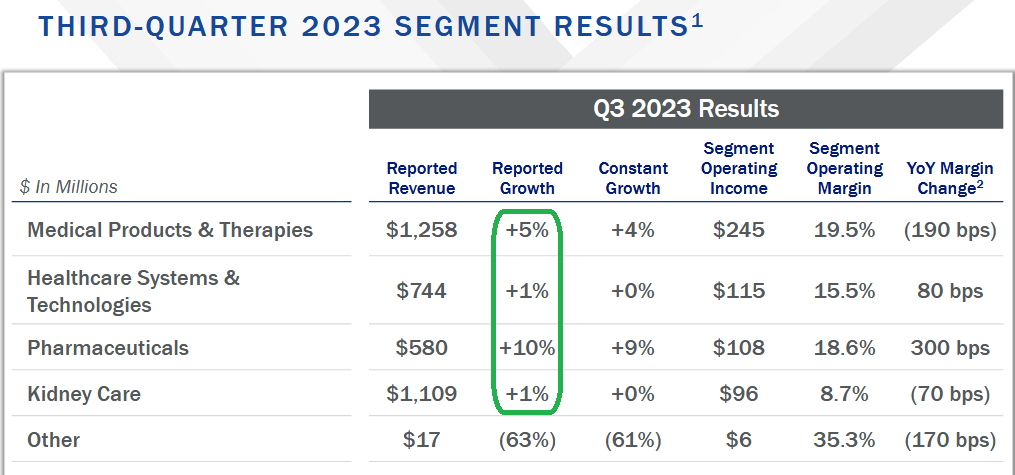

While Baxter has started to show early signs of recovery – from when we first started began about it on our weekly podcast|videocast(s) – we believe it is just getting started on a massive multi-year recovery. Here is a detailed update from the most recent earnings call, presentation and other developments:

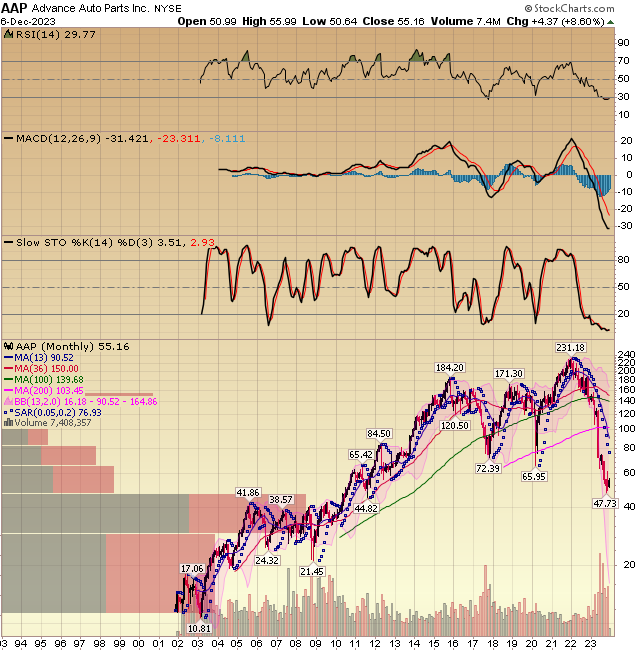

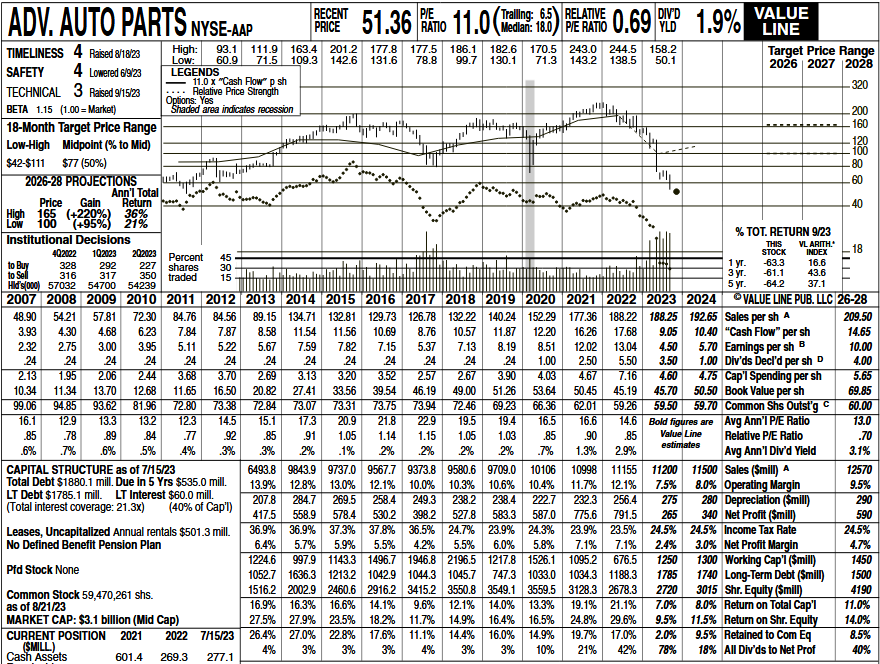

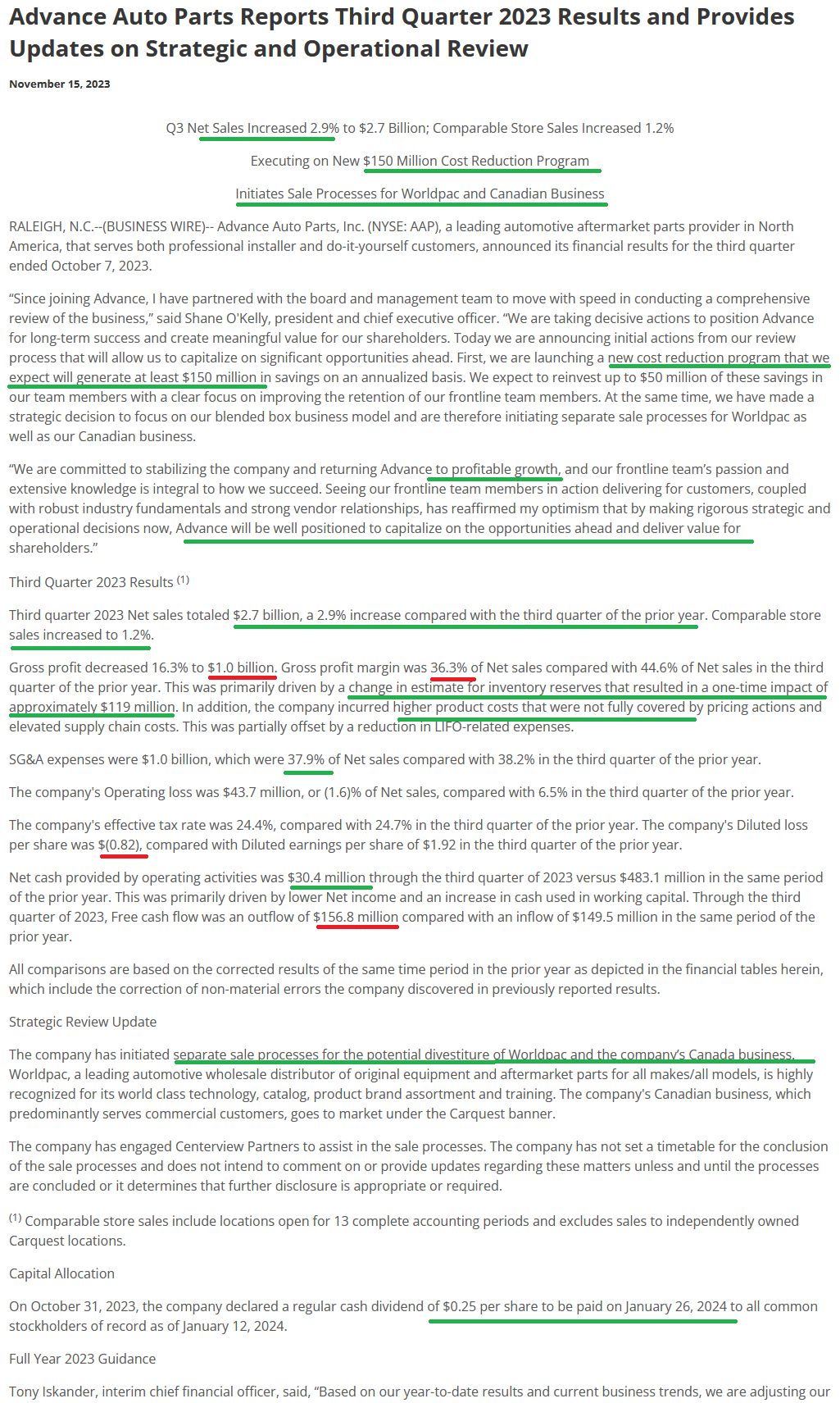

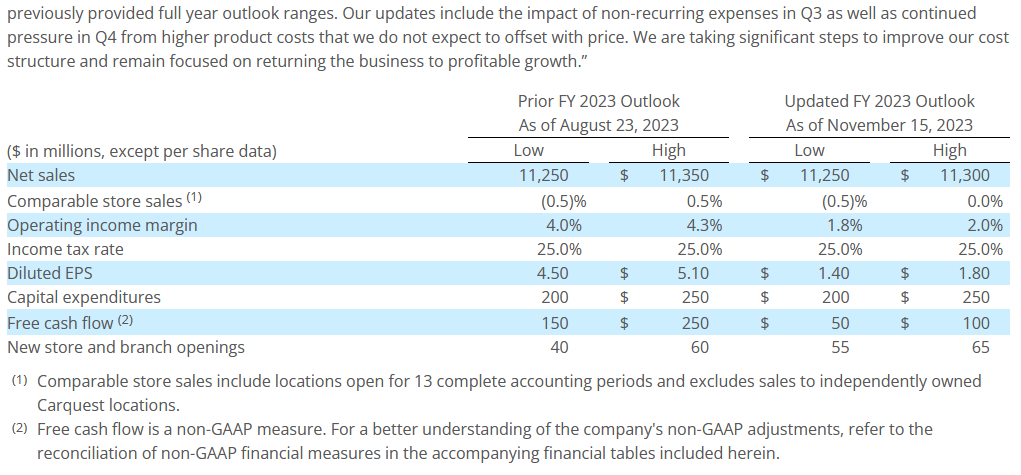

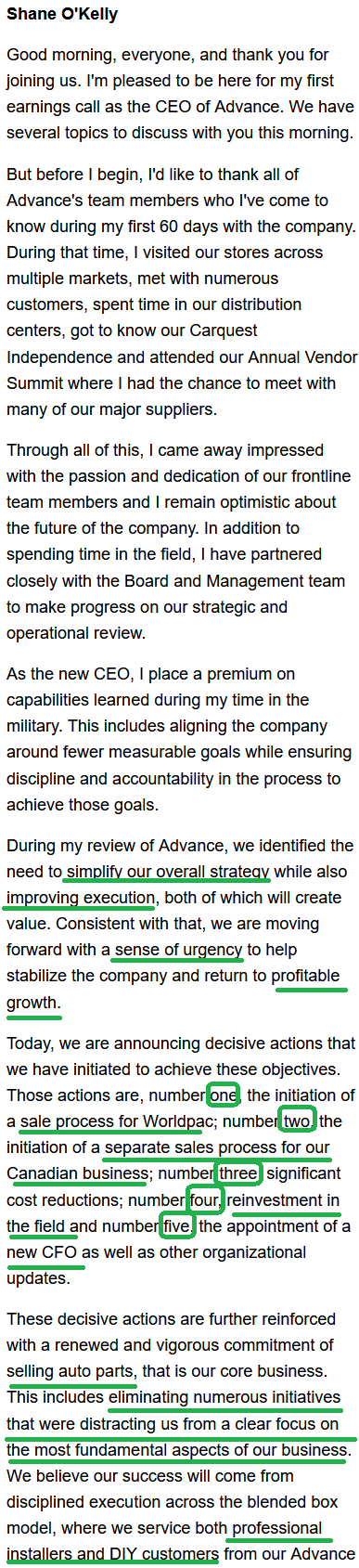

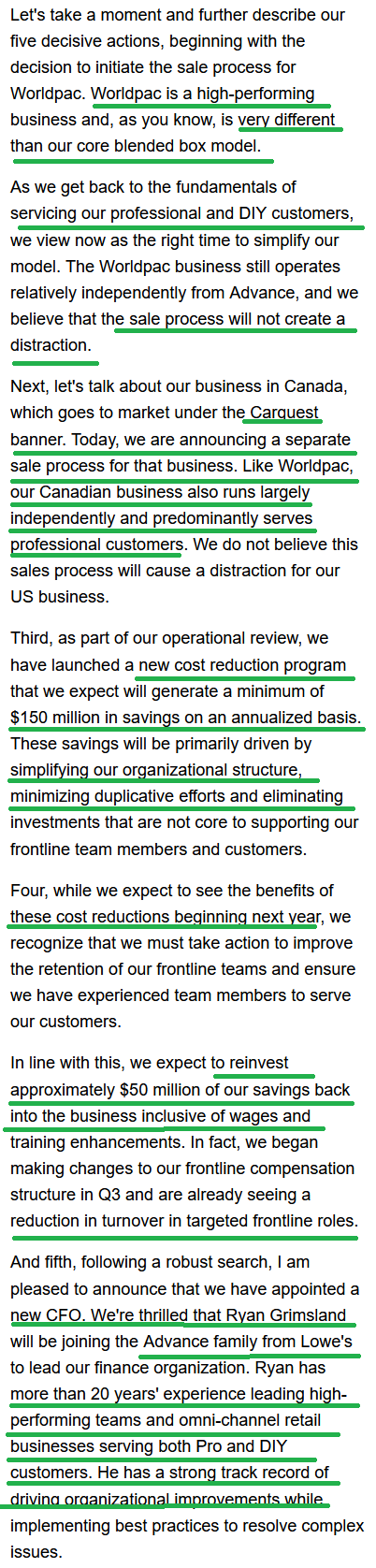

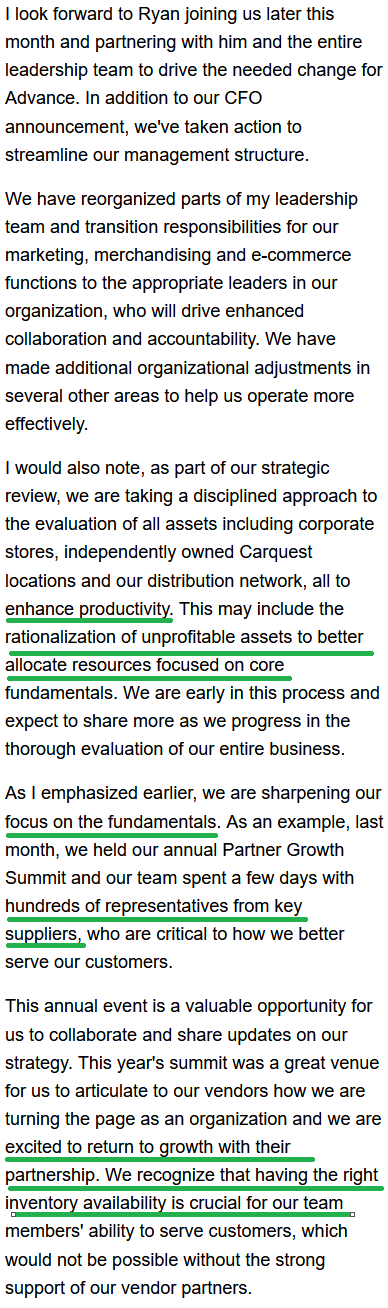

Advance Auto Parts Update

Alibaba Update

No change since last week’s commentary or the week before. The business continues to improve and generate more free cash flow (27% growth YoY, $28.1B FCF TTM, 21.8% FCF yield) and higher sales (+9% YoY). The price of the stock does not reflect that – until it does.

There are ~$60-70B of non-core assets (everything that is NOT Taobao, Tmall, AliCloud or AIDC) that we can expect will be monetized. Add the ~$60B of additional of net cash on the balance sheet + $28.1B (TTM Free Cash Flow generation growing prospectively) and they will have enough cash to buy in 100% of the float.

If you don’t know what that means, let me put it this way: If you own an apartment building with 10 partners and the cash that the asset generates is used to buy out your other 9 partners’ equity (without you having to put in more of your own cash), over time you are the only shareholder left receiving the benefits of the asset/cash flow (if you are the patient partner who refuses to sell).

There is a whole bunch of noise circulating around how the SoftBank pre-paid forward contracts are responsible for the price “being held down.” What I can tell you from being in this business for many years is this:

When price moves against someone, it is always due to mysterious “manipulation” and never due to being early or wrong. When price moves with you it’s always our “brilliance” that caused it. The only thing you can control is your PROCESS, not the timing. We have some multi-baggers hit “fair value” in months, and some take years. “Traders” say it is “wrong” or “early” – which is why there are very few of them on the Forbes 400. Good things come to those who wait (not whine). Let me state this clearly from the masters Ben Graham (and Warren Buffett):

In the SHORT TERM the market is a VOTING MACHINE based on EMOTIONS. In the long term it is a WEIGHING MACHINE based on FUNDAMENTALS. Whether it is “tax-loss selling” “Soft-Bank” “Jack Ma Selling” or “Elliot Wave” silliness causing the price to move down, it is all NONSENSE.

At the end of the day, PRICE is only what you PAY, VALUE is what you GET. Is the business generating more free cash flow today than it was last year when it traded in the $60’s-70’s and in 2015 when it traded in the $60’s-$70s? Are the Free Cash Flow and Revenues growing or contracting? Is the multiple/yield on that cashflow above your expected rate of return and is it trading above or below its historic range and that of comps? Everything else is a complete waste of time.

Will “tax-loss selling” “Soft-Bank” “Jack Ma Selling” or “Elliot Wave” or any other nonsense narrative impact the company’s ability to continue to grow? The answer is NO. It MAY impact price “at the margin” for a short period of time, but in the long term the weighing machine will kick in and slingshot price to a level appropriate to its intrinsic value (current and future ability to generate cash discounted backward by the risk free rate over the time period – adjusted for the shares remaining outstanding). Right now, the PRICE is detached from the intrinsic value, but a beach ball can only be held under water for so long…

Eventually, physics takes over. Certain laws are immutable. If you don’t “believe in” or “trust” physics and math, then you should sell the stock with the other traders. They may be right for the next few “ticks” or “candlesticks” but if you got into it for a few dollar move one way or another you are wasting your time.

There is no remedy for not doing your own homework and understanding what you own. Emotions will always beat lazy, uninformed traders sooner or later. They do not deter hardworking, informed, sensible investors who have done the work and know what they own.

Now onto the shorter term view for the General Market:

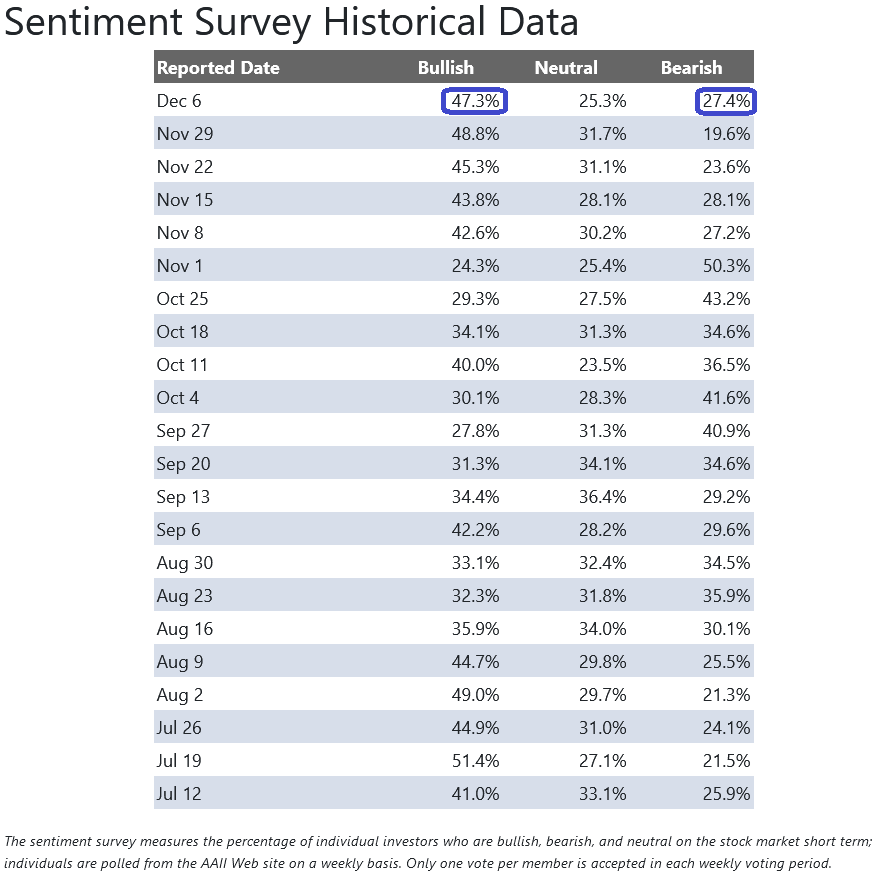

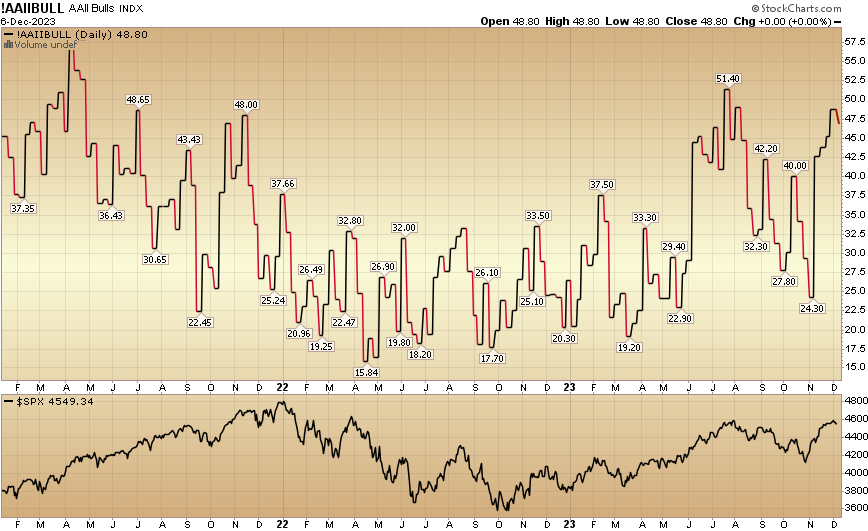

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked down to 47.3% from 48.8% the previous week. Bearish Percent rose to 27.4% from 19.6%. Retail investors are becoming giddy. This level can stay elevated during major moves (see below), but be open minded to a little give-back in markets (in the short term) to knock the certainty out of their mind before moving higher.

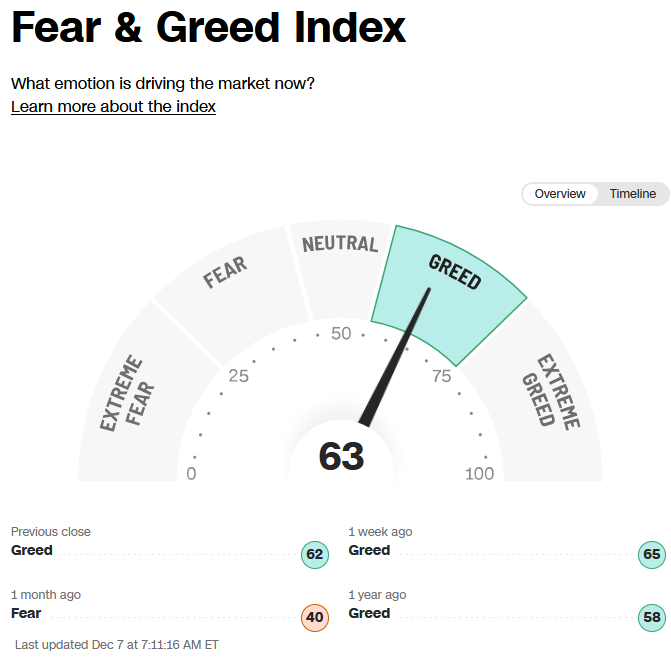

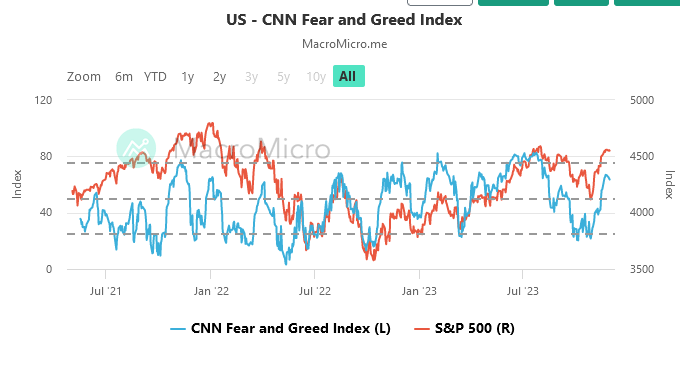

The CNN “Fear and Greed” flat-lined from 64 last week to 63 this week. By this metric, investors are a bit giddy, but not yet euphoric. You can learn how this indicator is calculated and how it works here: (Video Explanation)

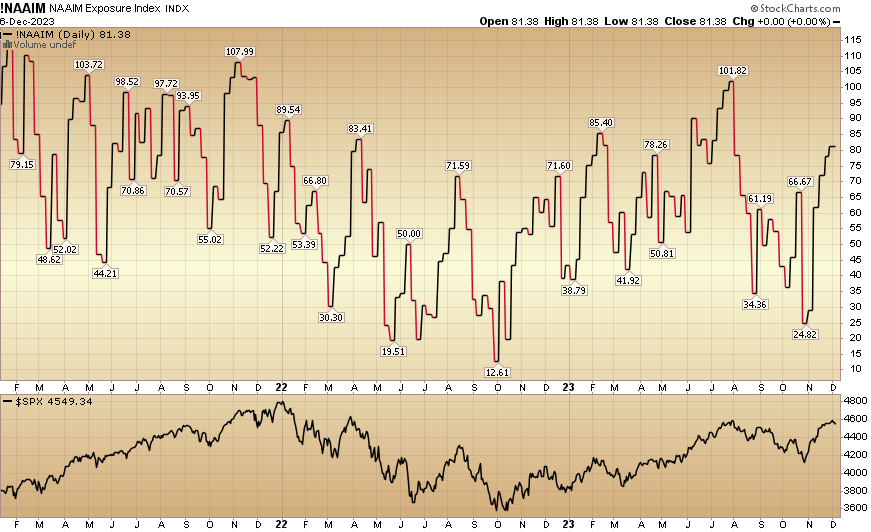

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved up to 81.38% this week from 77.95% equity exposure last week ago. The year end chase is ongoing:

Our podcast|videocast will be out late today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

More By This Author:

Tools And Tech Stock Market (And Sentiment Results)

“Earnings Results Hopping” Stock Market (And Sentiment Results)

“Weak Sisters Flushed” Stock Market

Congrats on the media coverage, that's pretty cool. You did a nice job.