World Trade Is Slowing, Perhaps Even Shrinking. This Is A Bad Sign

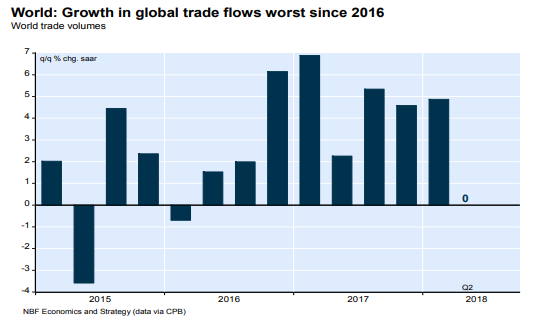

“The U.S.-led trade war is starting to hurt the world economy. Latest data from the CPB confirm global trade volumes were flat last quarter, the worst performance since 2016, as U.S. tariffs on steel and aluminum imports and retaliatory measures from affected trade partners came into effect.” (National Bank of Canada, Monthly Economic Monitor, September 2018)

While many of the world’s economies seem to be synchronized in terms of GDP and industrial production growth, this kind of synchronization is not always a positive factor.

Indeed, in the current circumstances, synchronization seems to point to slower economic growth, particularly for the advanced economies.

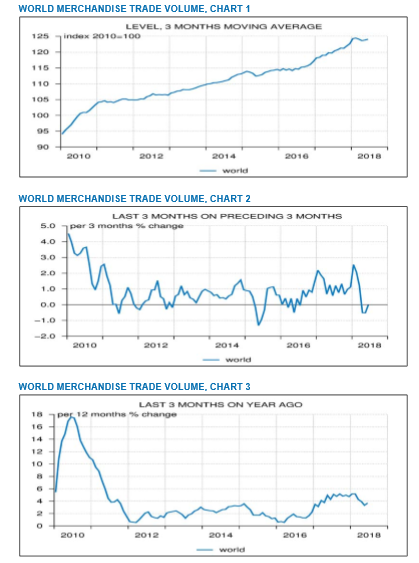

For example, in terms of international trade, recent data published by the CPB Netherlands Bureau for Economic Policy Analysis indicate that world trade volumes fell by 1.1% in May. The monthly contraction in global trade was broad-based, with both emerging and advanced economies reporting reductions in export volumes in May.

Alternative measures of world trade have also become less encouraging, as air freight traffic seems on downward trend which began in the middle of 2017. In addition, the pace at which sea container traffic is expanding has slowed from around 6.5% y/y in February to 3.5% in April.

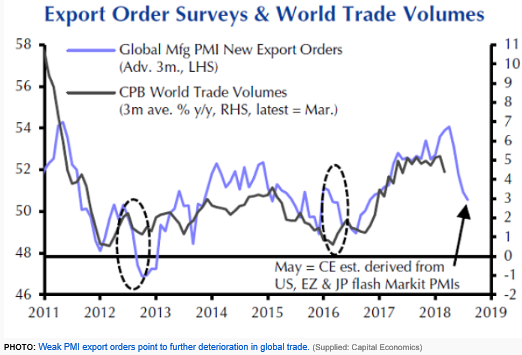

Moreover, the industrial activity indicators which are supported by purchasing managers' surveys (the PMIs) are also hinting that slower world GDP economic growth is just ahead, perhaps starting in 2020.

Finally, new export orders are a reliable indicator or global trade volumes. As the accompanying chart below indicates, new export orders have also been weakening this year.

Disclosure: None.

This is concerning despite being insulated from the effects by a stimulus package in the US with relatively no spending cuts. The main hurt is being generated in 3rd world countries that don't benefit from China outsourcing and losing manufacturing jobs to SE Asia. #TradeWars are never good and would look worse except for Europe's link up with Asian suppliers, a gradual rise in #oil prices, and the fact the US is still buying heavily from China despite the #TradeWar #tariffs.