Why Friends Don’t Let Friends Calculate 18 Month Not-Seasonally Adjusted Growth Rates

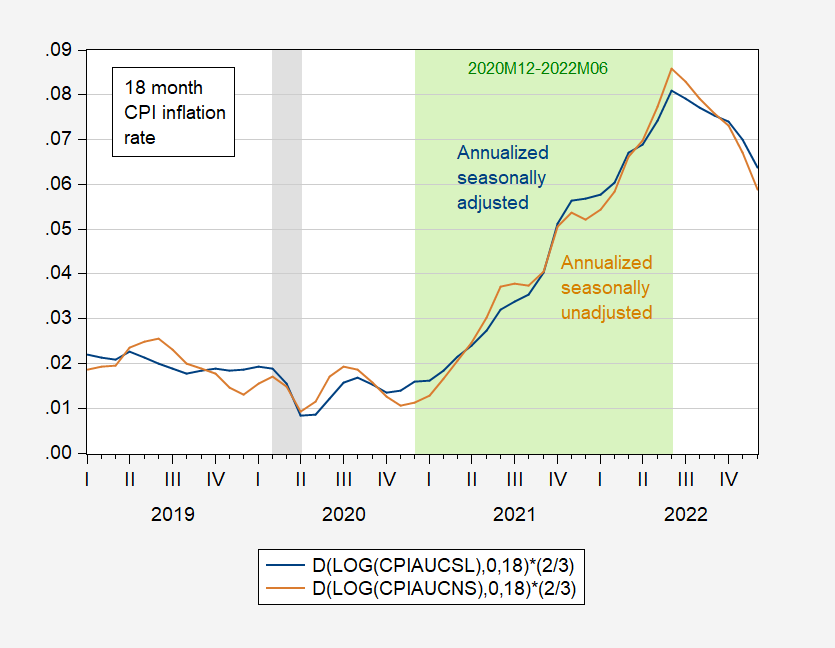

Bruce Hall seems to think calculating 18 month inflation rates (either annualized or not) is just fine. It is just fine. As long as you don’t do it using not-seasonally-adjusted data. If you do that, you really should be clear. Illustrative example for CPI below.

Figure 1: 18 month annualized inflation for seasonally adjusted CPI-urban all consumers (blue), and for not-seasonally-adjusted CPI-urban all consumers (tan), calculated using log differenes. NBER defined peak-to-trough recession dates shaded gray. Source: BLS via FRED, NBER, and author’s calculations.

My vision last time I recall the numbers is 20-400 (rather than 20-20) uncorrected, but even I can see the two series differ substantially at different times.

In case reader CoRev is going to accuse me of manipulating the data, let me note that I use FRED series CPIAUCSL for seasonally adjusted CPI, and CPIAUCNS for seasonally unadjusted. All other calculations are pretty straightforward looking at the formulas in the legend box — unless one is unacquainted with the use of natural logs, or distrusts them. (Here is Jim Hamilton’s post on the use of logs and log-differences, if you don’t trust Menzie Chinn either because of his name or worldviews.)

I must say, 18 months is kinda odd choice. 1 month, 3 month, 12 month, 2 years, 5 years, ok. 1.5 years, well, one should have a reason.

More By This Author:

"Beneath The Stock Market's Surface ... "

Business Cycle Indicators As Of Mid-January 2023

Demographic Variations In Inflation Expectations

Disclosure: None.