"Beneath The Stock Market's Surface ... "

From Lu Wang, “There’s an upbeat signal…” Bloomberg (Jan 18, 2023):

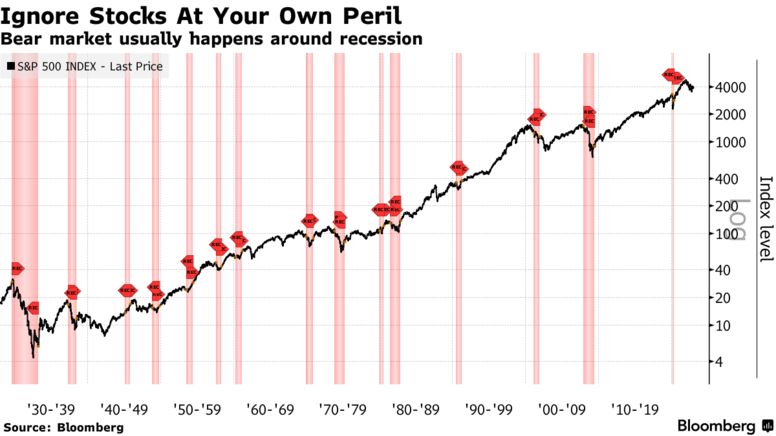

It’s as close to a sure-thing bet as markets ever offer. When the S&P 500 falls 20% or more, a recession is close behind. But economists whose dour calls for 2023 are being informed by this signal should look deeper into last year’s rout before betting the farm on it.

…

New analysis from researchers at Banque de France and University of Wisconsin-Madison shows treating the market as a whole when assessing its economic signals is less effective in part because benchmarks such as the S&P 500 can be skewed by richly priced companies or those deriving revenues from overseas. The performance of industrial and value stocks works as a better predictor for future growth, according to the study that covers a period from 1973 to 2021.

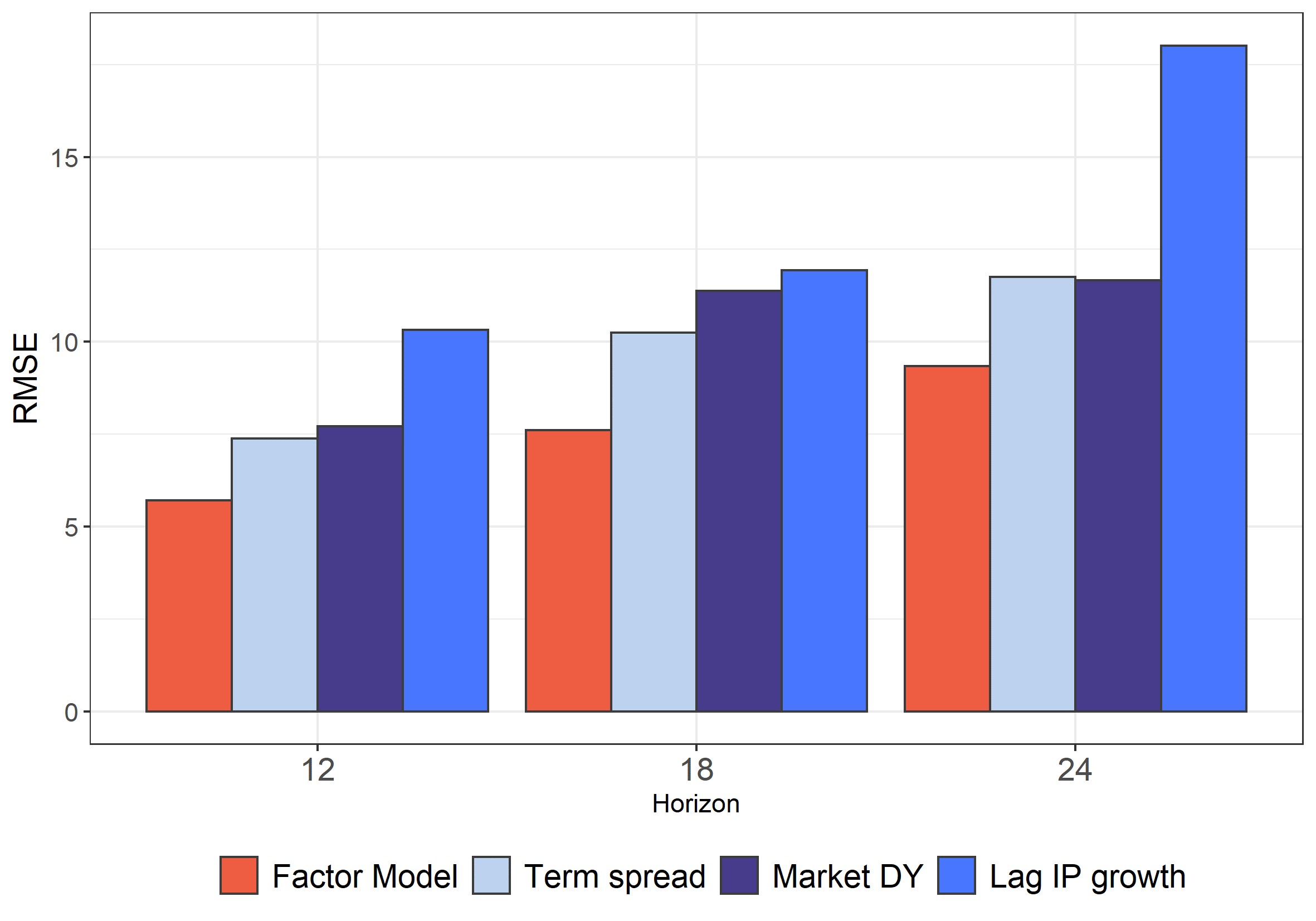

The paper in question is Chatelais, Stalla-Bourdillon and Chinn, “Forecasting real activity using cross-sectoral stock market information,” Journal of International Money and Finance (March 2023), discussed in this guest post. The forecasting power of a factor based on disaggregated stock indices outperformed the 10yr-3mo term spread and an aggregate stock index.

Figure 2: Out-of-Sample RMSE from the different estimated models

Note: On the graph are represented the Out-of-Sample RMSE of different models (the factor model or univariate regressions relying either on the aggregate DY, on the lagged IP growth or on the term spread). The predicted variable is the IP growth over 12, 18 and 24 months.

The article concludes:

Barclays Plc strategists including Venu Krishna have kept a model that tracks stock leadership and business cycles and by comparing them over time, seeks to offer a look into the market’s assessment of the state of the economy. Right now, the verdict is clear: no recession.

Unfortunately, as of July 2022, our model predicted a 2.2% decline in industrial production, in contrast to positive forecasts from the term spread and aggregate dividend yield somewhat at variance with the sunny conclusion from Barclay’s Plc. As of December, US IP is down 0.5 ppts relative to June 2022.

More By This Author:

Business Cycle Indicators As Of Mid-January 2023Demographic Variations In Inflation Expectations

More On An Inflation Regime Switch

Disclosure: None.