Weakening Wednesday – Markets Down Ahead Of The Fed

Wheeee!

There’s nothing more fun than a good sell-off when you are well-hedged. Since our last review on April 16th, our paired Long-Term and Short-Term Portfolios have gained over 10% ($160,000) as our hedges are working but so are the longs where we also sold short-term calls to ride out the dip we had anticipated. As I said at the time:

“We’re certainly not worried about a 4% drop and that rising 50-day moving average means we are likely to find support at that 4,800 line so we’ll just have to see how the next few weeks play out and that means we’re going to head into earnings season with a fairly neutral stance in our portfolios.”

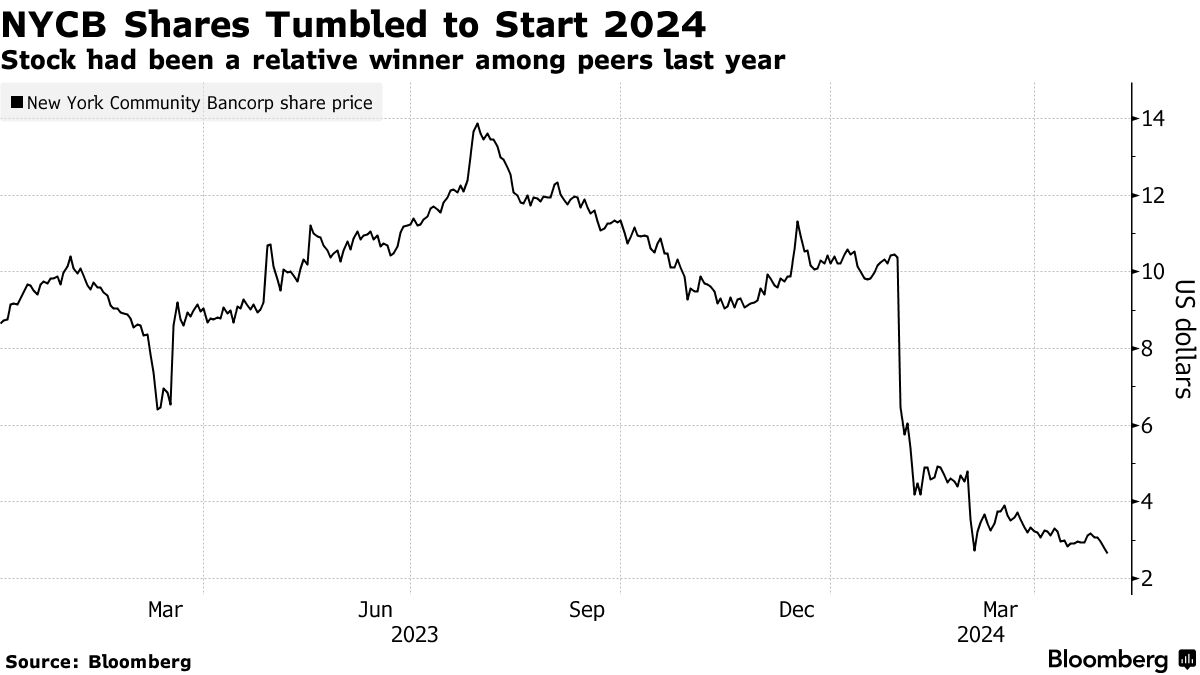

But the Short-Term Portfolio doesn’t just protect the LTP – it protects all of our long portfolios – so we have plenty of CASH!!! to spread around if we need it, which we don’t at the moment. In fact, just this morning, New York Community Bank (NYCB) which we kept doubling down on as it went lower, is popping back over $3 despite taking ANOTHER $315M in loan-loss provisions (after taking $552M last Q) but net charge-offs were only $81M – so it will take a long time to put pressure on the $867M they’ve put aside at this pace.

“Since taking on the CEO role, my focus has been on transforming New York Community Bank into a high-performing, well-diversified regional bank,” Chief Executive Officer Joseph Otting, who took over leadership of the company at the beginning of April, said in a statement. “While this year will be a transitional year for the company, we have a clear path to profitability over the following two years.”

Even our $700/Month Portfolio has an aggressive position on NYCB as we expect them to get back over $5 by next year. In our more aggressive LTP, we have 100 2026 $2 calls we bought for $2.45 ($24,500) and we sold 80 2026 $4.50 puts for $2.20 ($17,600) and 40 2026 $4 puts for $1.90 ($7,600) so our net entry on the $2 calls is a $700 credit and, at $5, we will make $30,700 (4,385%) – still good for a new trade – if you like that sort of thing…

Yesterday, in our Live Member Chat Room, we picked up a bullish spread on the Amplify Alternative Harvest ETF (MJ) as the FDA is looking to de-schedule marijuana, which will allow companies to sell across state lines (great for outdoor growing states like California and Hawaii) and, even more importantly, BANKING! Banking means access to capital and better access to capital markets and, while it’s hard to pick winners, the diversified ETF should move up nicely over time (almost $5 already!).

That’s all good trading is – paying attention and taking advantage of macro changes that are likely to affect stocks you’ve already been watching. We trade MJ last year but didn’t get back in when we began our new portfolios in May because the de-scheduling was taking longer than we thoughts but, of course, the second we heard it’s finally moving forward, we jumped right back in! MJUS ($2.50) is another ETF of US-focused stocks that should also do well. They did not have options, so we stuck with MJ.

The MJ options spread we constructed for our Members has 280% of upside potential if MJ manages to be over $5 into January (2025) expirations – that’s just 9 months away – a very nice rate of return, so you can see why we prefer the ETF with the options in this case…

But the focus today is on the Fed, who finish their meeting this afternoon and release their short little statement with perhaps 10 words changed from the last one which will, nonetheless, send the markets into their usual frenzy – fun! We’ll see what they have to say during our Live Trading Webinar at 1pm (EST).

In last week’s webinar we went over the Beige Book and we certainly didn’t see any reason for the Fed to cut rates at this meeting – or the next (July) for that matter. The market is beginning to accept the “higher for longer” rate environment but that doesn’t mean it’s not going to be painful. Just this morning the 2-year notes popped over 5% and that DEvalues existing notes (which have lower rates), as you can see from this chart.

That 101 line would be a terrible thing to cross and we’ll see if the Fed can say enough this afternoon – either in the statement or in Powell’s press conference – to hold us over that critical line. Just last month, we were half a point lower and that half a point, against $36Tn in debt, is costing our Government $180Bn – ouch! We can add that to the list of things that are draining liquidity from the system…

Look at what the Bond holders have lost in the past 4 years: 26.4% on the 10-year notes! That’s been chasing bond money into equities for the past 4 years but, as I noted in yesterday’s Morning Report, bonds are probably done falling and that means money will move back into bonds and the Fed will only hasten that process if they start to lower rates (last chance to get 5% interest backed by the US Government!) and where’s it going to come from when you can’t sell houses or CRE for a good price? Equities! Wheee indeed…

The Fed NEEDS to do something today to stop the bonds from sliding further because, if you spook bond holders – there’s $36,000,000,000,000 worth of them and the Fed’s balance sheet is “only” $7.4Tn (down from $9Tn in 2022 so good job!) so even if just 5% ($1.8Tn) worth of bonds sold off, it would double the demand for Dollars against the $1.8Tn worth of new debt the Government is trying to sell and then, guess what? Rates go flying higher!

So TODAY, while they still have the leverage, the Fed needs to make some sort of doveish pivot – either in their language or in Powell’s Q&A session. If they don’t, things can get very ugly, very fast…

As we brace for today’s FOMC announcements, the Dow teeters dangerously close to setting a new low for this correction period. This situation is mirrored across the board with mini death crosses, where the 20-day and 50-day moving averages cross in a bearish signal, now evident in every major index including the R2K and Transports.

As we dive into today’s trading, yesterday’s gloom still lingers with S&P 500 Futures down 22 points, Nasdaq 100 futures shedding 123 points, and Dow futures dipping by 82 points, all indicating a market that’s FREAKING OUT about the Fed’s decision today but I think 5,000 will hold so we can play SPY bouncy or the /ES Futures bullish at 5,050 – with tight stops below the line. We only need 20 points to make $1,000 per contract so we limit our risk against that reward and it’s a sensible way to play the Futures!

The spotlight will remain firmly on Powell’s press conference at 2:30 (EST), where every word will be dissected for hints of future policy direction (we will cover it live in our Webinar). This comes amid sticky inflation readings that threaten to derail any dovish hopes and could solidify the “higher for longer” interest rate scenario. Market participants are already reacting to a slew of earnings with notable movements from major players like Amazon, which is ticking up post-earnings (cloud services), whereas others like Starbucks and CVS face downturns as Consumers continue to slow their spending.

This complex tapestry of macroeconomic signals, earnings performances, and central bank policymaking underscores the delicate balancing act facing traders and investors alike. As we continue to ride the roller coaster, our strategic positioning in hedged portfolios allows us to exploit opportunities – even in downturns.

The broader economic indicators and Central Bank policies will dictate the overarching market direction, making today’s FOMC statement more than just a routine update – it’s a pivotal moment that could define market trajectories for the coming months.

What’s that they say about “Sell in May?”

More By This Author:

Fabulous Friday – Market Marches On

Transactional Tuesday – Retail Sales Stay Strong

Wednesday Reversal – Time For A Pullback

Click here to try Phil's Stock World free. Try PSW's ...

more