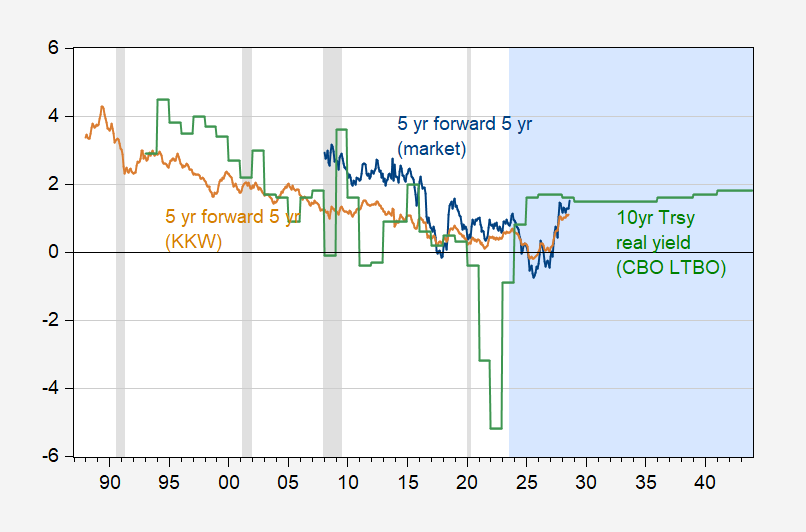

Two Graphs Of Real Rates

Long term real rates predicted, and r*.

From the market, and from the CBO. Both are predicting real rates will rise (although the market indicators seem to have been way off in the past few years).

Figure 1: 10 year real Treasury yield from CBO Long Term Budget Outlook (green), and 5 year 5 year forward real rate from market (blue), adjusted from KKW (tan). Light blue shading denotes projection period. NBER defined peak-to-trough recession dates shaded light gray. Source: CBO, Treasury via FRED, KKW, NBER, and author’s calculations.

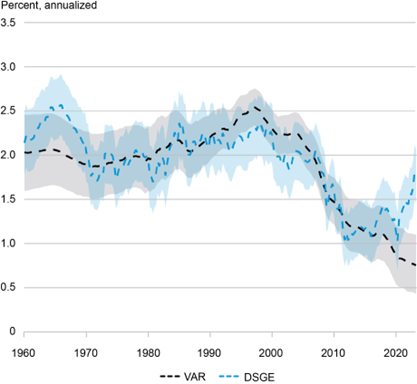

What about r*, the rate that sets output at potential output? And here are two estimates of r*, from Baker et al. at the NY Fed.

Figure 2:r* estimates from VAR and from DSGE, as described in Baker et al. (2023).

Clearly, as discussed in the article, there is some disagreement. The DSGE approach indicates a move back toward pre-2000 levels, while the VAR indicates that the drop could be persistent.

More By This Author:

Russian GDP And GDP Ex-Military SpendingUncertainty In China

No GDP Downturn Forecasted: SPF