No GDP Downturn Forecasted: SPF

In contrast to the July WSJ survey, the just-released Survey of Professional Forecasters mean forecast shows no negative GDP growth.

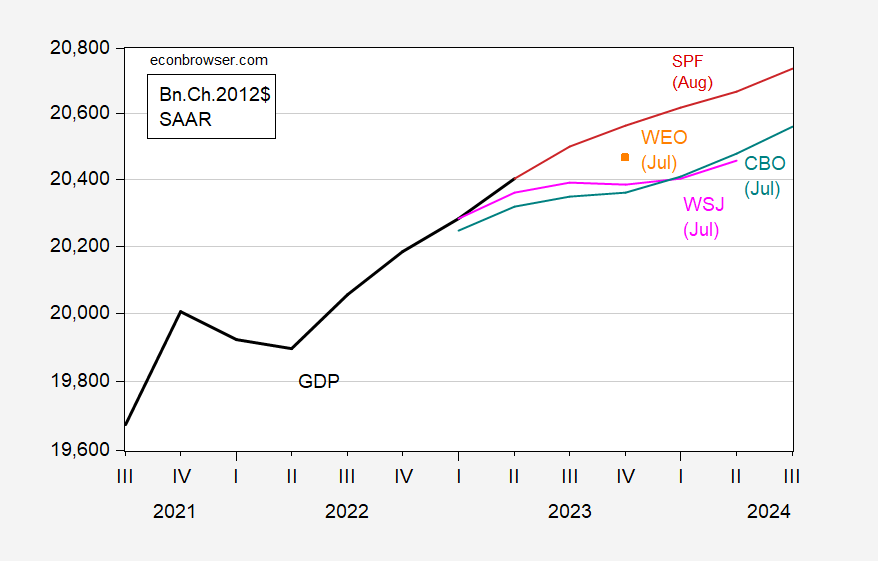

Figure 1: GDP (bold black), August SPF (red), July WSJ survey (pink), CBO projection (teal), World Economic Outlook (orange square), all in bn. Ch.2012$ SAAR. Source: BEA, Philadelphia Fed, WSJ survey, July CBO Economic Outlook Update, IMF World Economic Outlook July Update, and author’s calculations.

The SPF forecast is substantially above the WSJ, partly because it incorporates the actual Q2 advance estimate. Respondents to the July WSJ survey, as well as the CBO and IMF staff, did not have the Q2 advance estimate at time of forecasting.

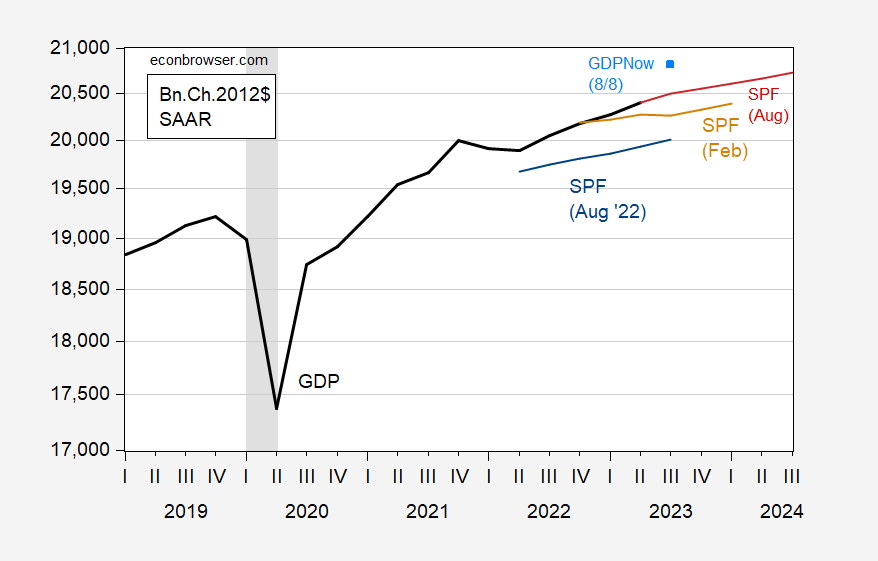

The August SPF indicates both faster growth, and higher level of output, than the February SPF, which was again above the August SPF (albeit with slower growth).

Figure 2: GDP (bold black), August SPF (red), February SPF (tan), August SPF (blue), GDPNow of 8/8 (sky blue square), all in bn. Ch.2012$ SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, Philadelphia Fed, Atlanta Fed, NBER, and author’s calculations.

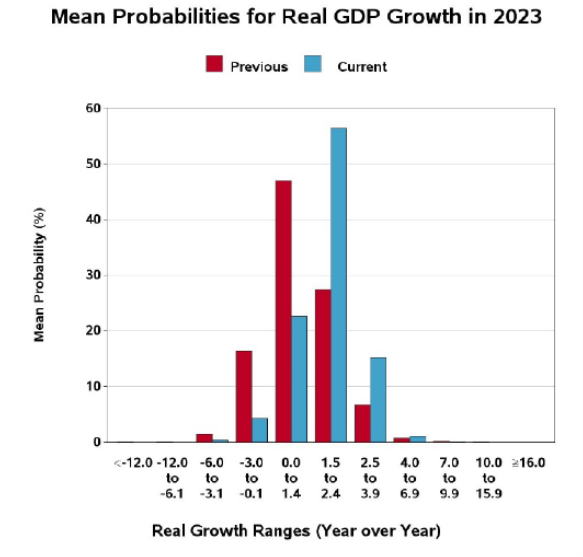

The y/y growth rate distribution has noticeably shifted up since the May survey.

Source: SPF (August, 2023).

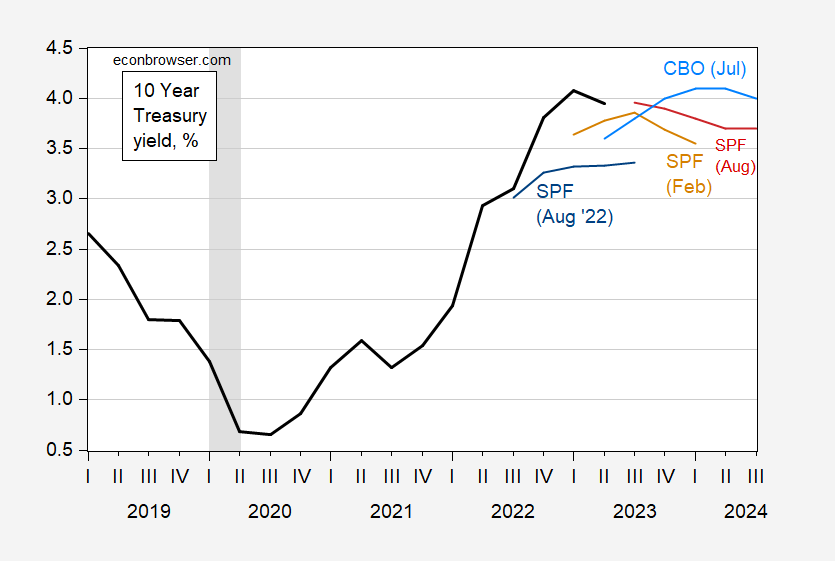

Note that even as growth has proven resilient, the forecasted ten year yield has moved up (although still below CBO projection in 2024).

Figure 3: Ten year Treasury yield (bold black), August SPF (red), February SPF (tan), August SPF (blue), CBO (sky blue), all in %. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, Philadelphia Fed, CBO Economic Outlook July Update, NBER, and author’s calculations.

More By This Author:

Chinese Growth In Question (Again) - UpdatedBetter To Light One Candle Than Curse The Darkness*: Real Wage Edition

Inflation In July: Central Tendency Down