Tuesday Talk: Perils Of Telegramming

The arrest of Telegram CEO Pavel Durov has been seen by many as an assault on free speech, but the French authorities are holding Durov for things quite serious and most likely criminal, in the name of free speech. Many Russian and Ukranian citizens are upset as they use it as a primary source of information about the war, air raid alerts, and telling stories from the front lines. Russian soldiers also use the application to supplement their command and control systems. But Telegram has been suspected of using or facilitating its service to spread illicit material, terrorist activity, drug dealing and illegal weapons sales, to name a few. The arrest of Durov highlights the intersection of societal norms with technology and comes on the heels of Brazil banning Elon Musk's Twitter (X) application. The issues posed by the power of communications (and now AI) technologies are not new, but Durov's arrest gives plenty of food for thought to investors, the person in the street, governments, and markets around the world.

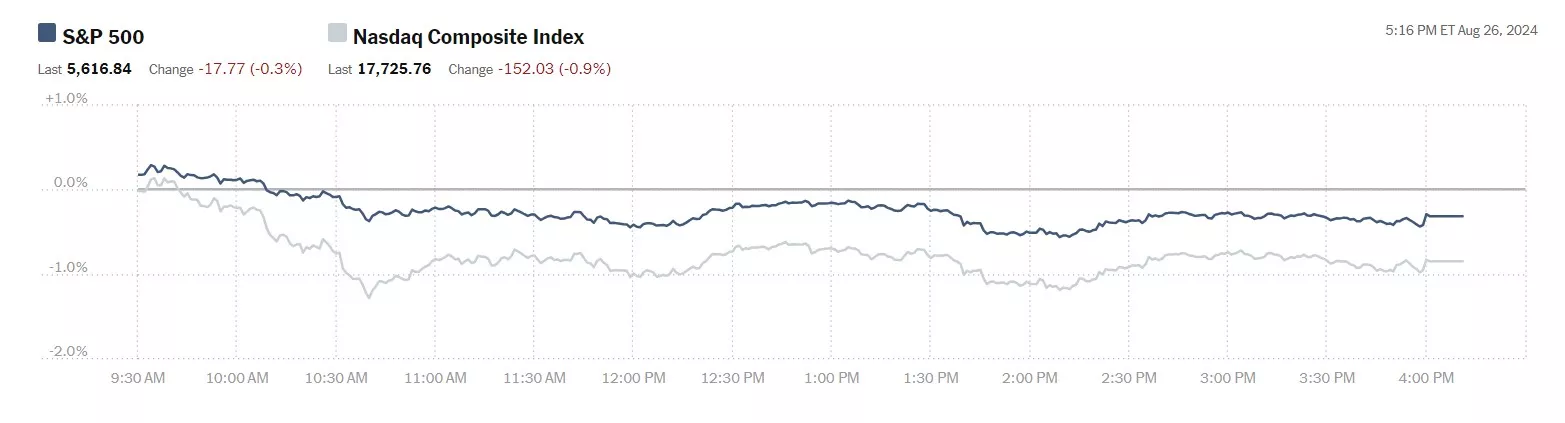

On Monday the stock market had a mixed day. The S&P 500 closed at 5,817, down 18 points, the Dow closed at 41,241, up 65 points and the Nasdaq Composite closed at 17,726, down 152 points.

Chart: The New York Times

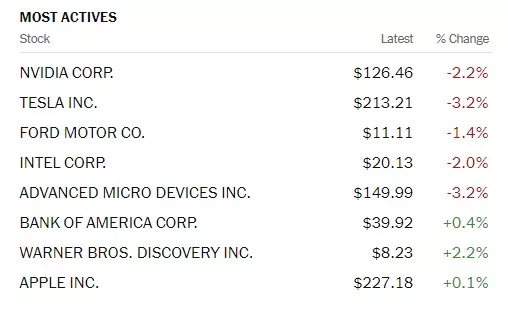

Most actives were led by Nvidia (NVDA), down 2.2%, followed by Tesla (TSLA), down 3.2%, and Ford Motor Co. (F), down 1.4%.

Chart: The New York Times

Index futures are also, trading down this morning. S&P 500 market futures are up 4 points, Dow market futures are down 3 points and Nasdaq 100 market futures are up 51 points.

TalkMarkets contributor Monica Kingsley looks at what the market is up to in Games, Traps And Nvidia.

"S&P 500 rose to new highs, and then another intraday rug pull came – just like the prior low volume week. Are NVDA earnings as important fundamentally as Jackson Hole? The risk-off sectoral view says so, and very technical intraday trading with false breakouts and breakdowns is the result.

Tech weakness before Wednesday‘s close, the NVDA uncertainty, is practically the most surefire variable at the moment. So, how will it end? I think with NVDA beat and relief over not too bad guidance – those heavy capex spending where largest players have to keep up with the Joneses no matter what, is the indicator. It has the power to turn the shaky ground looking SMH chart.

This environment though also gets Russell 2000 (IWM) – moving in fits and starts, the same traps, but continued resilience now when rate cuts have been quite officially confirmed, causing way less indigestion in precious metals together with crude oil relief. Little did change since Saturday‘s extensive analysis..."

Contributor James Picerno in a TalkMarkets Editor's piece column US Recession Risk Is Still Low Via Q3 GDP Nowcasts says the US economy is still expanding.

"If a recession in the US has started, or is imminent, the threat has yet to show up in the latest run of nowcasts for third-quarter GDP. That’s no guarantee that the economy will continue expanding, but it’s an encouraging sign...

“The solid growth picture in August points to robust GDP growth in excess of 2% annualized in the third quarter, which should help allay near-term recession fears,” advises Chris Williamson, chief business economist at S&P Global Market Intelligence.

A similarly upbeat Q3 profile has also been reflected in the weekly updates of The US Business Cycle Risk Report, a sister publication of CapitalSpectator.com. More than a week ago I wrote: “The main business-cycle index for the newsletter – Composite Recession Probability Index (CRPI) — continued to reflect a probability of less than 10% that the economy was contracting (as of Aug. 10).” In this week’s edition of the newsletter, a similar reading prevails...

“The underpinnings of the economy look good. Broadly speaking, things look pretty solid,” says Karen Dynan, an economics professor at Harvard University. “When we enter the typical recession, there is usually some underlying weakness. It just doesn’t feel that way now.”

Low risk isn’t zero risk, however. UBS Global Wealth Management, for instance, advises that US recession risk, while still low, appears to be inching up..."

Contributor Sramana Mitra writes Astera Labs Benefits From The AI Boom.

"According to a recent market report, the global Artificial Intelligence market is expected to grow 37% annually over the next few years to reach $2.75 trillion by 2032 from $177 billion in 2023. This is also propelling the growth of AI infrastructure companies. One such player is Astera Labs (ALAB) that listed recently and has seen its stock soar...

Astera offers two key products: the Intelligent Connectivity Platform that comprises of semiconductor-based, high-speed, mixed-signal connectivity products that integrate a matrix of microcontrollers and sensors; and COSMOS, its software suite which is embedded in the connectivity products and integrated into its customers’ systems. The Intelligent Connectivity Platform provides its customers with the ability to deploy and operate high-performance cloud and AI infrastructure at scale. Its connectivity products are available in various form factors including ICs, boards, and modules. Astera estimates the total addressable market for its connectivity platform to be $17.2 billion. It anticipates this market to grow to $27.4 billion by 2027...

Earlier this year, Astera became one of the few small technology firms to list. It raised $712.8 million by selling 19.8 million shares priced at $36 each, valuing it at $5.2 billion. The stock has had a strong run since. It is currently trading at $43 with a market capitalization of $6.7 billion. It touched a high of $95.21 soon after trading but dropped to $36.22 amid the market turbulence earlier this month.

Astera should continue to benefit from the AI boom. There are many players in its space as well, with names like Cyan, Credo, Lattice Semiconductor offering similar technologies. But the market right now is big enough to accommodate these players."

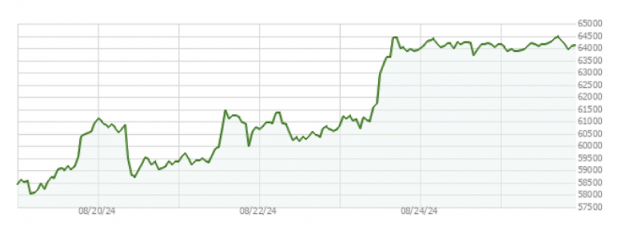

TM contributor Tirthankar Chakraborty writes BTC Rallies As Fed Signals Rate Cuts: NVDA, COIN, SQ To Gain.

"Despite a rollercoaster ride, Bitcoin (BITCOMP) has been able to lure investors repeatedly since its inception in 2009. It witnessed modest gains in 2012 but surged substantially in 2017, and the momentum carried into 2021...

Bitcoin 7 Day Price Chart

Liquidity increases amid a lower interest rate scenario. Thus, spending on riskier assets such as cryptocurrencies and stocks typically rises. At the same time, a significant downward selling pressure on BTC has waned. After all, the German government has concluded BTC liquidations and Bitcoin whales have started to acquire additional BTC...

With the price of BTC set to scale northward, things are hunky dory for NVIDIA, Coinbase Global and Block, which can take advantage of the world’s numero uno cryptocurrency’s bullish momentum. These stocks currently have a Zacks Rank #3 (Hold)..."

See the full article for additional particulars.

Contributor Ironman weighs in with some good housing market news, reporting that US New Home Market Cap Spikes With Mortgage Rate Drop.

"The market capitalization of new homes sold in July 2024 reached a record high, breaking the previous nominal record from August 2005 during the height of the housing bubble.

After months of hovering near or above a seven percent threshold, interest rates on a 30-year fixed rate conventional mortgage dropped below it in July 2024. While the amount of the change was small, new home buyers appear to have leapt upon the lower rates, racing to buy new homes during the month.

Consequently, July 2024 was the best month for new home sales since March 2022, when the U.S. Federal Reserve first started hiking interest rates in the United States to combat inflation...

That increase in sales was accompanied by a month-over-month increase in the average sale price of new homes sold in the U.S. The initial estimate of the average sale price of a new home sold in July 2024 is $514,800, which is up from a revised estimate of $501,700 for June 2024. For reference, the finalized estimate of the average sale price for a new home sold in March 2022 is $511,800.

The combination of the surge in new homes sold with average new home sale prices that remain well elevated has resulted in a spike in the U.S.' new home market cap...

July 2024's initial estimated trailing twelve month average new home market cap of $31.30 billion surpasses the $31.05 billion recorded in August 2005 in nominal (non-inflation adjusted) terms. Taking inflation into account, the size of the new home market in July 2024 is over 37% smaller in real terms than it was in August 2005.

Since mortgage rates have continued falling in August 2024, how that change will impact this month's sales has yet to be determined, in part because July 2024's elevated number of sales shrank the supply of new homes.

Lower mortgage rates provide that stimulus because they improve the affordability of new homes by reducing the monthly mortgage payments for equivalently priced homes..."

The full article contains additional charts and particulars.

That's a wrap.

Have a good one.

Peace.

![]()

More By This Author:

Thoughts For Thursday: Waltzing With Walz

Tuesday Talk: Jackson Hole And Digging Holes

Thoughts For Thursday: Won't You Please Come To Chicago