BTC Rallies As Fed Signals Rate Cuts: NVDA, COIN, SQ To Gain

The price of Bitcoin (BTC) scaled upward recently after the Federal Reserve’s Chair Jerome Powell said at the Jackson Hole Symposium that “time has come” to trim interest rates soon.

Rate cuts, by the way, are bullish for cryptocurrencies like BTC, and stocks such as NVIDIA Corporation (NVDA) , Coinbase Global, Inc. (COIN) and Block, Inc. (SQ) are well-poised to gain from the digital coins’ present upsurge.

BTC Bull Run is Here

Despite a rollercoaster ride, BTC has been able to lure investors repeatedly since its inception in 2009. It witnessed modest gains in 2012 but surged substantially in 2017, and the momentum carried into 2021.

BTC’s meteoric rise, however, was disrupted in 2022, yet the flagship cryptocurrency bounced back in 2023 to end at $42,258. In 2024, the approval of spot Bitcoin ETFs fueled another rally, with BTC’s price climbing above $70,000 by March.

BTC’s price, nevertheless, has been struggling to hold above its key support level of $58,000 in recent times as investors remained cautious ahead of the Fed’s monetary policy decision.

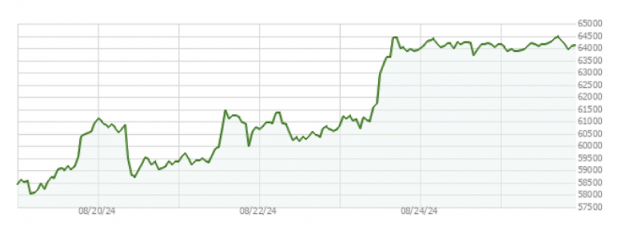

Things improved as BTC’s price scaled upward in the last couple of trading sessions to trade around $64,000 following the Fed’s assurance that the time has come for an interest rate cut soon. BTC’s price has jumped 9.2% in the last seven trading days raising speculation of a forthcoming upswing.

Bitcoin Price Chart – Percentage Change (7d)

Image Source: Zacks Investment Research

What’s Propelling BTC Price Higher?

Powell recently said that time has arrived to cut interest rates as inflationary pressures have begun to subside. The minutes from the Fed’s latest policy meeting also indicated that an interest rate cut in September is highly likely.

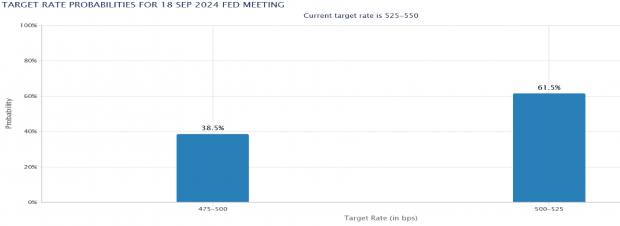

Per the CME FedWatch Tool, 61.5% of market participants expect the Fed to trim interest rates by a quarter-point in the September meeting, with many estimating at least two rate cuts this year.

Image Source: CME Group

Liquidity increases amid a lower interest rate scenario. Thus, spending on riskier assets such as cryptocurrencies and stocks typically rises. At the same time, a significant downward selling pressure on BTC has waned. After all, the German government has concluded BTC liquidations and Bitcoin whales have started to acquire additional BTC.

3 Stocks to Make the Most of BTC’s Upward Trajectory

With the price of BTC set to scale northward, things are hunky dory for NVIDIA, Coinbase Global and Block, which can take advantage of the world’s numero uno cryptocurrency’s bullish momentum. These stocks currently have a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

NVIDIA

NVIDIA has entered the cryptocurrency space by developing graphic processing units for mining cryptos like BTC.

Nvidia’s expected earnings growth rate for the current and next year is 106.9% and 26.1%, respectively. Its estimated revenue growth rate for the current and next year is 93.9% and 30.9%, respectively (read more: The Better AI Stock to Buy Now: NVDA or SMCI).

Coinbase Global

Coinbase Global is one of the biggest cryptocurrency exchanges in the United States. BTC is traded in its crypto-trading platform.

Coinbase Global’s expected earnings growth rate for the current quarter and year is 6,000% and 1,435.1%, respectively. Its estimated revenue growth rate for the current quarter and year is 93.1% and 84.8%, respectively.

Block

Digital payment company Block generates revenues from products such as Cash App, where BTC is traded.

Block’s expected earnings growth rate for the current and next year is 98.9% and 27%, respectively. Its estimated revenue growth rate for the current and next year is 11.9% and 9.6%, respectively.

Shares of NVIDIA, Coinbase Global and Block have gained 176.2%, 186.8% and 17%, respectively, over the past year.

Image Source: Zacks Investment Research

More By This Author:

Time To Buy The Post Earnings Rally In Cava Group's Stock?4 Integrated Energy Stocks To Watch Amid Industry Turbulence

2 Small Caps Recently Upgraded To Outperform

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more