Tuesday Talk: Market Stays Steady

With turmoil in the Kremlin and no movement towards a ceasefire in the Middle East the market maintained a steady course on Monday, ahead of data dumps later in the week.

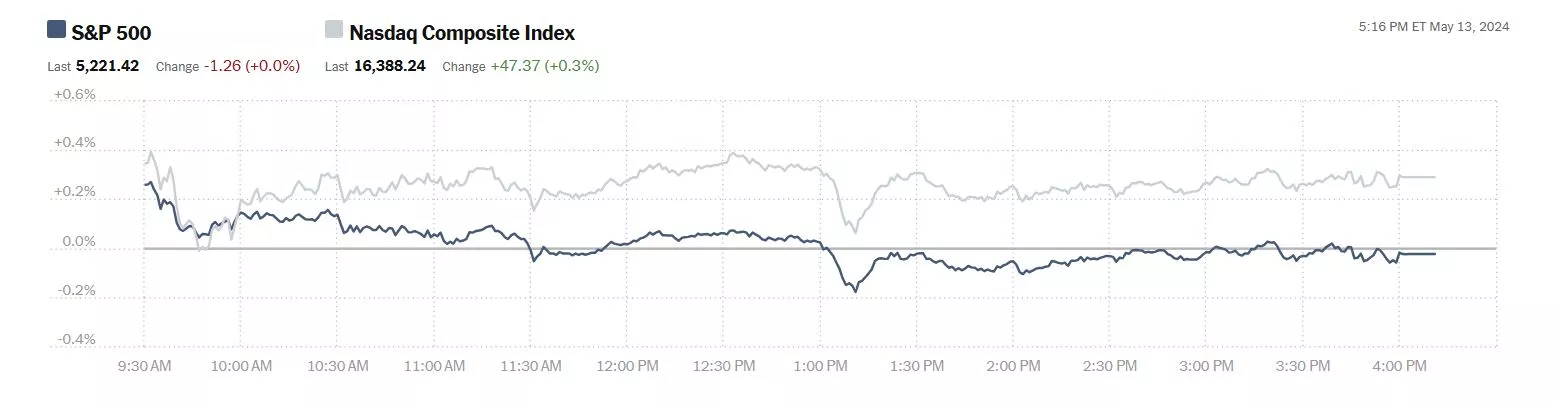

On Monday the S&P 500 closed at 5,221, down 1.26 points, the Dow closed at 39,432, down 81points and the Nasdaq Composite closed up 47 points at 16,388.

Chart: The New York Times

Most actives were led by Uber (UBER), down 5.7%, followed by Tesla (TSLA), down 1.7% and Intel (INTC), down 2.2%.

Chart: The New York Times

In early morning futures trading S&P 500 market futures are up 1 point, Dow market futures are up 10 points and Nasdaq 100 market futures are up 2 points.

TalkMarkets contributors Lance Roberts and Michael Lebowitz in a TalkMarkets Editor's Choice column write that The Correction Is Over As Stocks Bounce Back.

"This past week, the market broke above the 50-DMA with a solid confirmation of the MACD “buy signal.” Currently, the market is decently overbought after the advance, so a pullback to retest the 50-DMA would be welcome. Such a pullback would turn the 50-DMA from previous resistance into support and reduce some overbought conditions.

Notably, the breakout above key resistance and the reversal of the volatility index suggest that the recent correction is over. However, while the April correction may be over, as noted above, there is still a decent probability of another correction before the Presidential election in November. As shown below, such tends to be a statistical normality during Presidential election years.

Of course, that is just the “average,” meaning that Presidential election years have been better and worse. As such, we must continue monitoring and reacting to the market as the macro and micro environments evolve.

However, there are reasons to expect that the current bull market may have some room to run, at least over the next few months...

While buybacks and earnings will support higher asset prices over the next two months, things become less certain once we enter the year’s second half.

Currently, analysts are rapidly upgrading economic growth estimates.

(On the other hand) There is an essential caveat to all the positive earnings data. It is all based on the cumulative total of all equities in the S&P 500 index. However, there is a story beneath the surface that investors should pay close attention to – all earnings growth is not equal.

The S&P 500 index’s earnings growth centers on just six (6) companies. If you strip out the earnings of those six companies, earnings growth is negative. In other words, economic growth is likely weaker than headlines suggest...

As we stated last week, the important lesson for investors is to pay less attention to “media headlines.” While “doom and gloom” will get “clicks and views,” it is not the best way to manage your portfolio.

The correction we discussed in March is likely complete and could provide another few months of tepid gains heading into the two months before the election. As we have discussed before, given the very contentious nature of this particular match-up this year, a bit of derisking in the markets ahead of voting day would be unsurprising. However, we will focus more on that later in the summer.

With earnings season behind us and buybacks returning in force, the only risk to the market currently is a surge in inflationary pressures and/or a reversal by the Federal Reserve to a more “hawkish” stance. Given the current economic data, neither of those events is likely to happen between now and the next FOMC meeting.

We have rebalanced our portfolios and used the recent correction to add to our Equity and Dividend Equity models.

However, as is always the case, continue to manage risk accordingly.

These are only excerpts from a very long article full of forward looking observations. Worth a look.

Contributor Andrew Rocco looks at Embracing Market Dynamics As Inflation Data Looms.

"Last week, watching U.S. equities was akin to watching paint dry – very dull and without drama. The price ranges in the major indices were tiny, the volume was minuscule, and there was little in the way of news items or action. However, this week appears to be precisely the opposite. “Meme” stocks like GameStop (GME - Free Report) and AMC (AMC - Free Report) exploded after the popular internet personality “Roaring Kitty” emerged from the darkness and tweeted. Meanwhile, the hated and underfollowed bull market in Chinese equities continues with ADRs like Alibaba (BABA - Free Report) and Futu Holdings (FUTU - Free Report) each gaining more than 5% on heavy turnover (BABA will report EPS in the morning)...

Short-Term Market Outlook

Stubborn inflation has been the proverbial “pebble in the shoe” for Jerome Powell and the Fed. As a result, investors should expect a spike in volatility later this week. With the S&P 500 Index ETF (SPY - Free Report) up seven straight sessions, a short-term pullback is not out of the question and would not be abnormal. Furthermore, according to data from Jeffrey Hirsch (Almanac Trader), the S&P 500 Index has been lower 11 of the last 15 May monthly options expiration weeks (which we are in now).

Intermediate/Long-Term Outlook

Understanding that time frames can give conflicting data is paramount to investing success when analyzing the market. The intermediate to long-term view paints a much more bullish picture.

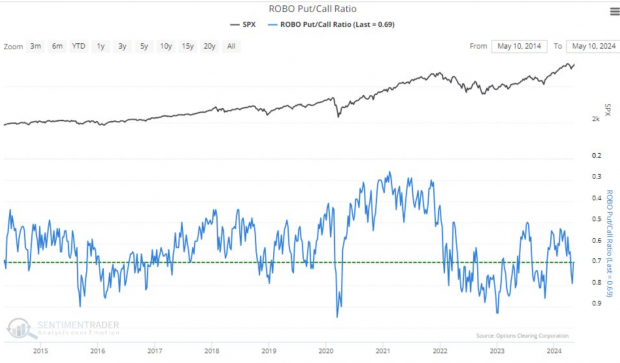

Put/Call Ratio

The put/call ratio is a great metric for understanding market froth and retail sentiment. Though there were some breathtaking moves in individual names today, the put/call ratio is hovering near normal levels and is not showing any signs of overheating.

Image Source: Sentimentrader

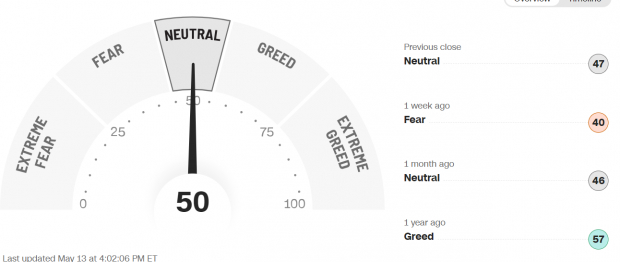

Fear & Greed

The CNN Fear and Greed Index paints a similar picture to the put/call ratio. Though the major indices are a hair-off all-time highs, the CNN Fear and Greed Index is showing a “Neutral” sentiment.

Image Source: CNN"

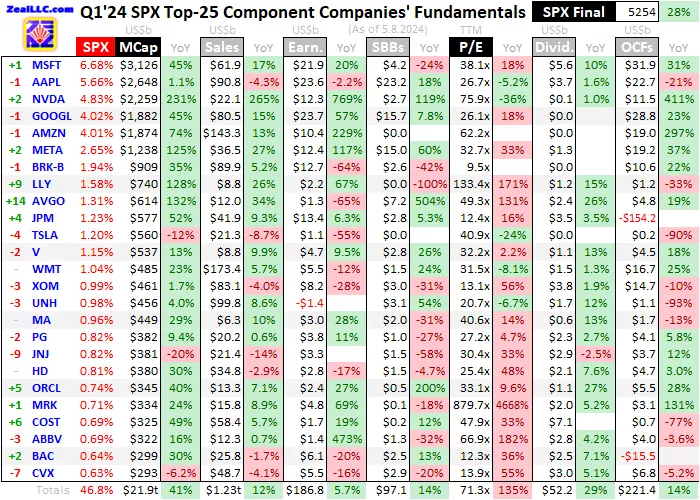

Contributor Adam Hamilton looks at Big U.S. Stocks’ Q1’24 Fundamentals.

"The big US stocks dominating markets and investors’ portfolios continue to thrive. They are finishing up another earnings season covering a record-breaking quarter, reporting some fantastic results. Still, these fat underlying profits are growing far slower than major companies’ soaring stock prices. That has forced valuations deeper into dangerous bubble territory, fueling mounting risks for awakening a new bear market...

As always big US stocks’ latest Q1’24 results are important for gaming stock markets’ likely direction in coming months. For 27 quarters in a row now, I’ve analyzed how the 25 largest US companies that dominate the SPX fared in their latest earnings seasons. Exiting Q1, these behemoths commanded a stunning record 46.8% of the SPX’s total market cap! Their latest reported key results are detailed in this table...

The US stock markets have grown increasingly top-heavy, which is a serious risk. Exiting Q1, the SPX’s 25 largest component stocks again represented 46.8% of its entire weighting! Dramatically soaring since the 34.8% in Q3’17 when I launched this deep quarterly research thread, that extreme concentration is troubling. The fewer stocks any bull market depends on to drive it, the more fragile and precarious it is.

These US stock markets are heavily reliant on the beloved Magnificent 7 mega-cap technology stocks. Together mighty Microsoft, Apple, NVIDIA, Alphabet, Amazon, Meta Platforms, and Tesla now account for a staggering 29.1% of the SPX’s total market cap! The Mag7’s gargantuan total $13,587b exceeded the total of the SPX’s bottom 403 components. These market darlings essentially are the US stock markets.

Their outperformance remains dramatic, with the Mag7’s market cap skyrocketing 50.6% over the year ending Q1’24! That almost doubled the entire S&P 500’s 27.9% gain, which means the vast majority of its other 493 stocks seriously underperformed. While these mega-cap-tech giants are fantastic American companies with amazing fundamentals, their stocks are still exceedingly overvalued as we will soon discuss.

So another dynamic is fueling their outsized gains, and disturbingly it is peer pressure. Since the lion’s share of US-stock-market gains have come from the Mag7, professional fund managers have no choice but to way overweight their allocations. Without heavy Mag7 exposure, their funds’ performances will lag well behind their peers’. Underperforming too long in the money-management business is the kiss of death...

The bottom line is big US stocks just reported another great quarter. Led by the beloved mega-cap techs, revenues and earnings utterly soared. But despite that, valuations still remain deep in dangerous bubble territory. The US stock markets are wildly overpriced compared to underlying corporate earnings, which portends a serious bear looming. It will maul markets, forcing stock prices lower until profits catch up..."

So, some "bad news" to digest. The author is a gold believer.

Contributors from the Staff of ING Economics note on their FX Daily: Slow Disinflation, Low Volatility.

"Today’s PPI and tomorrow’s CPI figures will tell us whether the US has made further steps in the disinflation process, or if prices remain too sticky for the Federal Reserve to cut. The latter seems more likely, and a consensus call too – which could leave FX markets without much sense of direction and volatility still depressed...

The CPI report will have a larger market impact, although we have seen the dollar moving on tier-two data lately, so today’s PPI figures for April can be a big event for markets too. Expectations are for a 0.2% month-on-month core PPI print, which would match the March figure – when core CPI printed a hot 0.4% MoM. It’s also worth noting that inflation expectations have been on the rise, with yesterday’s New York Fed survey showing one-year expectations at a five-month high (3.3%) after the University of Michigan also reported a similar development.

While markets have taken stock of the seemingly cooling US jobs market, data this week may indicate that the inflation picture remains more uncertain and still too hot for the Fed to revamp strong dovish communication. On the Fedspeak space, Chair Jerome Powell will participate in an event this afternoon, but major deviations from the recent policy tone does not seem too likely before inflation figures are published. On the data side, there is also the NFIB Small Business Optimism index to watch today, which has grown in relevance as a leading indicator recently.

The dollar has shown some tendency to asymmetrically bearish reactions to US data after the latest CPI print, so risks could look a bit skewed to the downside if one believes there are equal chances of an upside or downside surprise in inflation this week. In practice, inflation has mostly surprised on the upside recently and we suspect there are smaller chances of a lower print.

Consensus prints today and tomorrow may simply put off the whole inflation discussion by a few more weeks and leave a market that has largely digested the “divergence” narrative (Fed vs. Europe) directionless for longer. "

Leaving you with an outlandish headline TalkMarkets contributor Stefan Gleason asks Will The United States Become The Next Argentina?

"

Let’s give credit where credit is due.

Facing a record-high budget deficit and an entrenched inflation problem, the government is finally embracing fiscal responsibility in a significant way.

Thanks to sweeping spending cuts enacted this year, the government has posted three consecutive monthly budget surpluses – leading to a reduction in money supply growth and a marked lessening of inflation pressures.

This hopeful state of affairs doesn’t apply to the government of the United States, of course. It describes what the government of Argentina is achieving under its new president, Javier Milei.

The free-market economist turned politician had campaigned with a chainsaw in hand, vowing to cut government bureaucracy and bring down Argentina’s triple-digit inflation rate.

The media dismissed him as an eccentric protest candidate. Then when he shocked everyone by winning the election decisively, the media said he couldn’t or wouldn’t actually follow through on his bold campaign promises.

Rare is the politician who does.

But after just a few months in office, Milei has actually abolished dozens of agencies and fired thousands of state bureaucrats. He has slashed government bureaucracy by as much as 50%.

Milei has declared there will simply be no more deficit spending in Argentina: "Zero deficit isn't just a marketing slogan for this government, it is a commandment."

Conquering inflation remains a work in progress. After decades of rule by socialist politicians who promised endless streams of benefits that were never fully paid for, Argentina’s economy was careening toward ruinous hyperinflation.

Last month, the monthly inflation rate in Argentina fell below 10% for the first time in years.

The official inflation rate in the United States has never reached Argentinean proportions. But its spiraling debt is starting to draw comparisons to countries that have seen their currencies and economies collapse due to reckless fiscal and monetary policy.

Washington, D.C. has been warned over and over again that it needs to change its spending habits. U.S. government debt has been downgraded twice by major credit ratings agencies. Its own central bank has called its fiscal path “unsustainable”...

the International Monetary Fund is warning that unsustainable growth in U.S. government debt – which is projected to soar from $34 trillion to $46 trillion within a decade – poses a threat to the global financial system.

Meanwhile, Congress has just refused to even consider the recommendations of a bipartisan commission on tackling the debt.

Legislators have decided that they don’t want to be told they are spending too much money they don’t have and are promising too many people too many benefits that cannot be paid.

It seems clear at this point that politicians will not act to avert a crisis. They will only act in response to one when they have no other alternative.

For a brief period in the late 1990s, it appeared as though federal finances were on a sustainable path. Republicans in Congress pushed hard to balance the budget. And President Bill Clinton famously declared, “The era of big government is over.”

The era of big government wasn’t over, of course. It continued to grow year after year regardless of which party controlled the levers of power in any given year. And despite former President Donald Trump’s vows to “drain the swamp,” the D.C. swamp is now bigger and murkier than ever.

Nobody in Washington even talks seriously about balancing the budget anymore...

Will the United States become the next Argentina? It’s looking like the U.S. will have to experience a much worse inflation problem before the government feels compelled to change course. Things will likely have to get worse before they get better."

That's a wrap for this Tuesday morning.

Have a good one.

Peace.

More By This Author:

Thoughts For Thursday: New Highs Expected While Market Slows

Tuesday Talk: Still Flying

Thoughts For Thursday: Lingering Inflation