Tuesday Talk: Halloween Treats

It's only Tuesday, so there is plenty of time for market tricks before month end, but for now it seems investors are being showered with treats. Yesterday both the Dow and the S&P 500 reached new highs and the Nasdaq closed with a triple digit gain.

The S&P 500 closed at 4,566, up 21 points, the Dow Jones Industrial Average closed at 35,741, up 64 points and the Nasdaq Composite closed at 15,227, up 137 points. Currently market futures are in the green, S&P 500 futures are up 17 points, Dow futures are up 88 points and Nasdaq 100 futures are up 98 points.

Staying in the treats department TalkMarkets contributor Forrest Crist-Ruiz has these thoughts on Why Is Consumer Staples Outperforming The Season?.

"Major indices are sitting at or near new highs with XLP lagging not far behind. While this is not signaling a direct market downturn, it is showing that investors are keeping XLP on watch in case the market begins to look weak. Furthermore, XLP is likely rising due to worries of inflation and the well-known shipping problems the U.S continues to face. With that said, seasonally, XLP performs poorly in October, but as seen in the below monthly chart, XLP has outperformed the past 6 years of trading thus far (XLP). This is an interesting trend if XLP continues to push higher along with the general market."

"Looking at XLP from a daily perspective, it has just made a second close over its 50-Day moving average at $71.16. This confirms a bullish phase change and potential new support area if XLP holds its major moving average. If consumer goods continue to have pressure from increasing demand and waning supplies, we can expect this to have a positive effect on price. On the other hand, if XLP breaks down, this could be showing that prices of general goods and potentially inflation are beginning to ease."

Bitcoin (BITCOMP) can definitely be called both a trick or treat and contributor Frank Holmes keeps readers up to date with 5 Bitcoin Developments You Need To Know About. See the full article for all the details, but here are the highlights:

"1. The first Bitcoin ETF was also the fastest to $1 billion in assets

The ProShares Bitcoin Strategy ETF (BITO), which tracks the performance of Bitcoin futures contracts, was first out of the gate last Monday...The ETF attracted over $1 billion in as little as two days after its debut, making it the fastest ever to reach that milestone...BITO may be the first, but it will hardly be the last. A second Bitcoin futures fund, the actively managed Valkyrie Bitcoin Strategy ETF (BTF), became available for trading on Friday.

Having said that, not everyone is jumping to buy a Bitcoin futures contract. Of the nearly 700 people who took a recent HIVE poll, more than three-quarters said they were either “probably” or “absolutely” not interested in an ETF that tracks the futures market. Presumably, they are holding out for a Bitcoin spot ETF, or they would prefer to own the crypto outright.

2. Bitcoin’s all-time high price has reignited speculations of $100,000

The price of Bitcoin topped $66,000 for the first time ever last Wednesday, pushing its market cap above an incredible $1.3 trillion. The surge was driven largely by the debut of BITO as well as the undeniable power of FOMO, or fear of missing out. This has reawakened speculation that the crypto is headed for $100,000, perhaps as early as year’s end...

3. A public U.S. pension fund bought Bitcoin and Ether

...For the first time ever, a U.S. pension fund has invested in the space. On Thursday, the $5.5 billion Houston Firefighters’ Relief and Retirement Fund announced that it had purchased $25 million in Bitcoin and Ether, representing a “watershed moment for Bitcoin and its place in public pensions,” according to Nate Conrad, Global Head of Asset Management at New York Digital Investment Group (NYDIG), which facilitated the purchase...

4. Walmart now has Bitcoin ATMs, with plans for thousands more

...Last week, it was being reported that Walmart quietly began installing special Coinstar machines at select locations that give customers the option to buy Bitcoin. Some 200 kiosks are currently available at the giant retailer, but according to Bloomberg, there are plans to install as many as 8,000 of them over time...

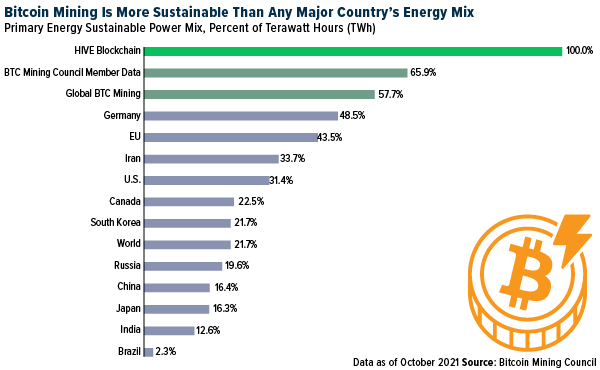

5. The global Bitcoin network uses less energy than holiday lights

...Bitcoin mining uses a negligible amount of energy globally when stacked against any major country and even any major industry, gold mining included...See chart below:

Caveat Emptor, Remember the tulips!

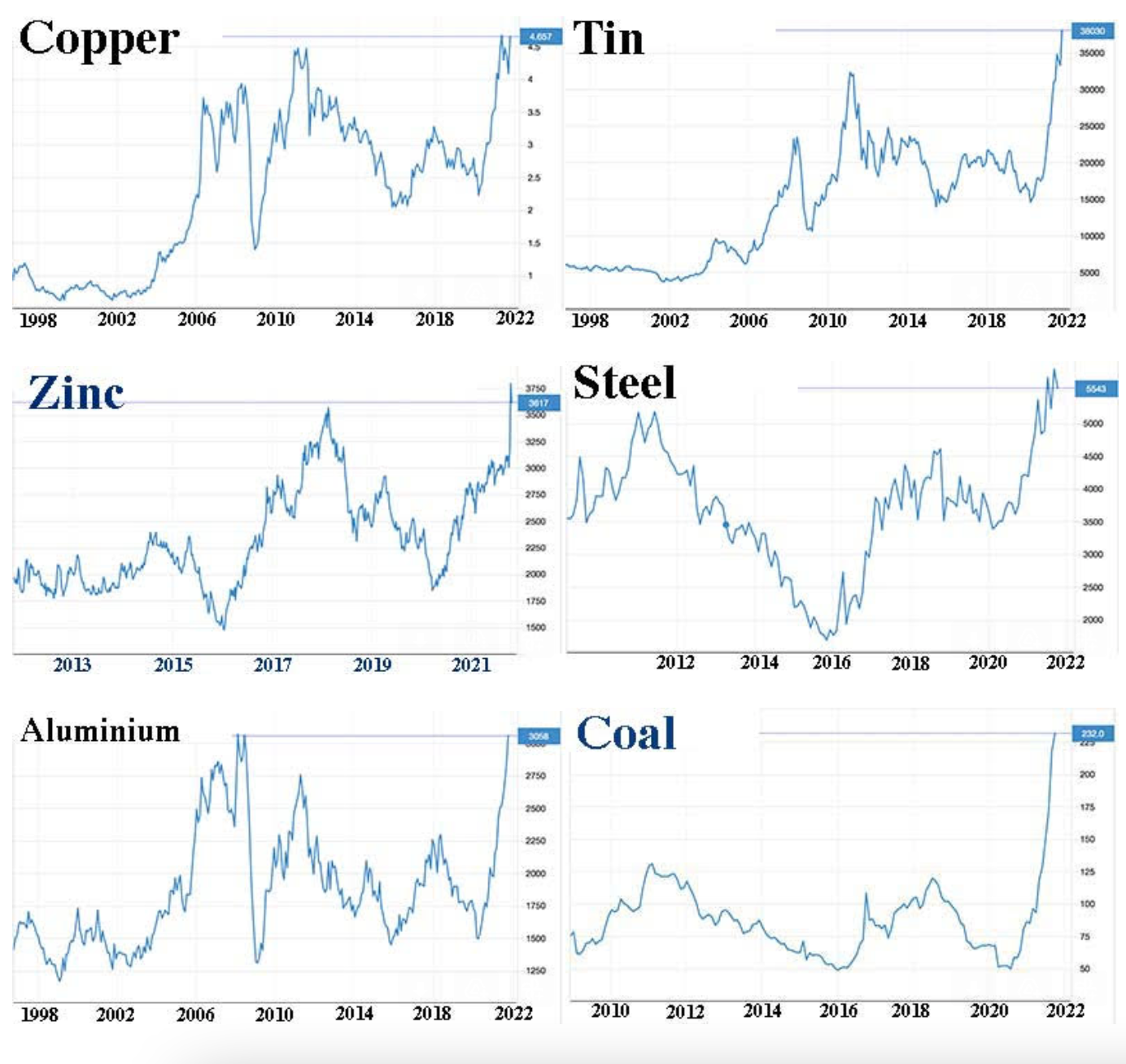

Commodities have been rising in 2021 and contributor Cyrille Jubert writing in Energy Crisis: Metals At Historic Highs finds some explanations for why prices keep rising.

"...China is currently experiencing a major energy crisis due to a coal shortage. As a result, the price of it, which fluctuated between 600 and 1 000 per tonne on futures (January Zhengzhou) for two years, soared abruptly in September and listed 2 226 on October 15. This price hysteria is reflected in the price of coal on the London market...India, the world's second-largest producer of coal, is experiencing a similar energy crisis and must limit the distribution of electricity. India's 135 coal-fired power plants as of October 15 had only 8 days of fuel and half of them only had 2 days of operation...China produces 80% of the world's magnesium. But since its production processes require a lot of energy, companies in this field have just been drastically limited. As a result, magnesium sheets, which make it possible to meet the weight saving requirements in the automotive sector, will become a scarce commodity from the beginning of next year, which will put the automotive industry in slow motion...

...70% of silver (SLV) comes from the refining of copper, tin or zinc. If the prices of these metals skyrocket, so must that of silver in the very near future...There are major inventory problems today (for copper, JJC) . Between the price of paper, that is to say futures, and the demand for delivery, there is a widening gap. Manufacturers must pay a premium to obtain delivery of copper. This is a historic first."

Read the full article for more details.

In a TalkMarkets Editor's Choice column When Tools Stop Working, contributor John Mauldin bemoans many of the methods the Fed uses to stimulate the economy and is concerned about the drop in Q3 GDP but also, notes that there are a lot of positive things going on. It's a long piece touching on issues ranging from the logjam in container shipping to housing, treasury yields, the strength of the dollar and inflation, to name a few. Here is some of what he has to say:

"The economy is performing well in many ways. Plenty of jobs are available, new businesses are being launched, companies are profitable (third-quarter earnings season has started off with a bang!) and stock prices are strong. We could do much worse. But we could also do better, and the missed opportunities are frustrating."

"We face a swirling mess of different problems, interacting in ways we don’t fully understand. We do have some clues, though. It now looks more and more like August/September marked some kind of turning point. Economic data has weakened considerably since then...It’s probably important that the Atlanta Fed’s third-quarter GDPNow estimate crumbled from 6.1% as of August 23 to 0.5% on October 18. That’s a whale of a change in less than two months..."

"Clearly something changed in the last 60–90 days. Here are some possible factors, in no particular order.

-

Increasing supply chain snarls

-

Jumping energy prices

-

COVID-19 Delta variant case surge

-

Evergrande and China housing crackdown

-

A hasty US Afghanistan withdrawal

-

End of enhanced US unemployment benefits

-

Difficulties for pending infrastructure bills

-

Oh, yes, the return of 5%-plus inflation which deducts from Nominal GDP to get Real GDP.

We can’t pin it on any one of these. They all had some influence, along with others not listed, adding up to the lower growth estimates. And let’s note, “lower growth” isn’t the end of the world. If Q3 real GDP growth is 0.5%, it won’t be what we hoped but it won’t be recession, either."

"..consumption growth...is partly a consumption shift. Thanks to COVID, Americans have reduced spending on services (restaurants, concerts, hotels, airlines, etc.) and spent more on goods. It’s pretty clear in the inflation data."

"...recent comments by Fed officials suggest the Fed is trying to gently convince their adoring public that inflation may actually turn out to be “a little stronger than they forecast for a little longer than they forecast.” Sigh...this is a vast problem with many moving parts. It has other elements (I haven’t mentioned today) for instance, low interest rates and quantitative easing which can’t solve supply chain issues, microchip shortages, and changes in the labor market...Together, the federal government and the Federal Reserve have put us all in a jam with no good alternatives."

To close out today's round-up I want to draw your attention to an in-depth TM Editor's Choice Op-Ed from contributor Seth Levine entitled Chinese Investment Markets Reveal Their Fatter Tails. While fiercely championing free market views, Levine also, details impending pitfalls for investors in China and Chinese companies due to recent sweeping changes in Chinese government regulations and policy.

Levine kicks off here:

"Throughout the year, the Chinese Communist Party (CCP) progressively restricted freedoms of its citizens, plummeting share prices for some of the largest companies in the world. While this not-so-naked power struggle between economic and political factions is as old as modern societies, it’s nonetheless tragic. This rings especially true for the Chinese population. Their progressively increasing living standards and political freedoms now seem poised to reverse. Unfortunately for investors, the CCP’s consolidation of power reveals that the country remains far more centralized than believed. Hence, it’s more dangerous—and expensive—which bodes poorly for portfolios and global growth."

And ends with this:

"The opportunities in China’s investment markets remain uncertain. Luckily, one need not be a policy expert to evaluate a country’s economic direction... China’s current centralizing course is tragic. It’s playing out in real-time for all to see. Hopefully, other countries will take note and reverse their own onto more decentralized and free-market paths."

It's an interesting read.

I'll be back with another look on Thursday. In the meantime keep an 👁 out for goblins.

Interestig and educationl reading here! And looking at the economy, a good point that a small bit of growth is not a recession! GREED is such a nasty disease! Indeed, keep in mind the Tulip bubble, that could indeed happen with Bitcoin and all of that imaginary wealth.

And watch out for China! Those Generals in the background might not be quite as smart as they think they are, OR there may be a very well hidden agenda to take over the world, but not for the benefit of those common Chinese workers. Once again, keep in mind that CHINA IS DIFFERENT!!! In so many aspects.

Also, our very own Federal Reserve Bankers sort of admit, slightly, that inflation is a bit more than they had intended. Such spin doctoring. While our infltion is not as damaging as the virus pandemic, it is certainly much less selective on who is being damaged by it, with the greatest misery, naturally, being inflicted on those least able to deal with it.