Tuesday Talk: Edgy Enthusiasm

The market is still edgy as ever, but a late afternoon recovery after European markets closed was enough to propel U.S. markets out of the red zone and into the green.

At the close of trading on Monday, the S&P 500 was up 23 points, to close at 4,155, the Dow was up 84 points, to close at 33,061 and the Nasdaq Composite jumped 201 points, to close at 12,536. Higher than Friday, but still a bit lower than the year's S&P and Nasdaq lows of March 14. In morning trading, S&P 500 market futures are up 3 points, Dow market futures are up 10 points and Nasdaq 100 market futures are up 5 points.

In today's column TalkMarkets contributors assess what the poet T.S. Eliot called the cruelest month.

"April is the cruelest month, breeding

Lilacs out of the dead land, mixing

Memory and desire, stirring

Dull roots with spring rain."

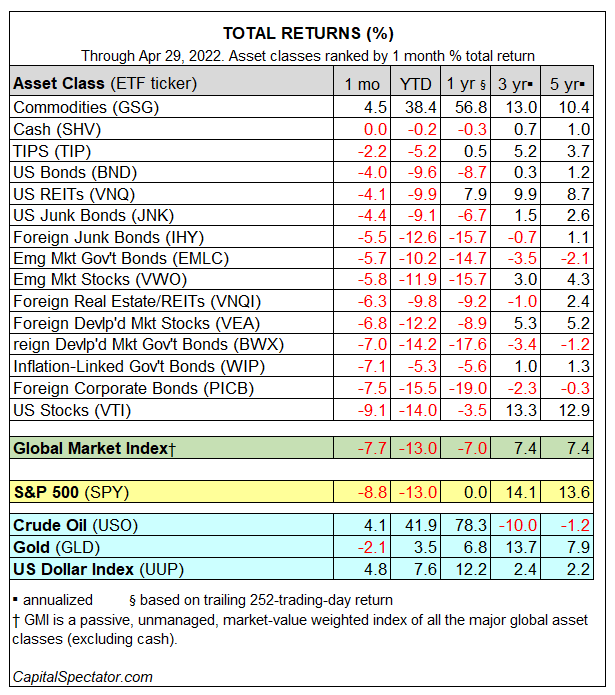

Contributor James Picerno who tracks sector ETFs racks and stacks the carnage in April 2022 Performance Review - Major Asset Classes.

"Red ink spilled across nearly every slice of the major asset classes in April. Commodities were the exception, posting a solid gain. Otherwise, losses prevailed, based on a set of ETF proxies.

Notably, it’s the same story for year-to-date results in the wake of last month’s losses. Everything except commodities is down so far in 2022, with double-digit slides representing half of the declines."

Go to the article for Picerno's April world economic strength rating via his proprietary "Global Market Index" barometer.

TM contributor David Moenning says part of the trouble is that a Record Trade Deficit Contracts Economy.

"The equity market struggled again last week as the S&P 500 saw its fourth consecutive weekly loss. The Nasdaq underperformed, ending the month lower by more than 10%. It was the worst month for technology shares since 2008. Disappointing earnings reports from tech giants such as Amazon (AMZN) and the prospect of a more aggressive tightening by the Fed pushed equities lower.

The energy sector outperformed on the back of higher oil prices. The WTI crude rose for the week as tensions rose between Russia and the European Union over energy.

The Commerce Department reported that the U.S. economy contracted by 1.4% in the first quarter, way below expectations. A record trade deficit was mainly to blame as consumer spending remained strong."

"Other economic data such as capital goods orders and personal spending showed continued expansion. The 10-year U.S. Treasury yield ended the week unchanged at 2.94%, but there was underlying volatility as the yield reached the low of 2.72% earlier in the week before rising."

Stephen Innes in a "TalkMarkets Exclusive" market round-up heading into this week's FOMC meeting, asks Are 75 Bp Increments On The Table?

"MARKET

U.S. stocks closed solidly higher on Monday, rallying 2% into the close after being down 1.7 %, with large-cap tech shares staging a late rally to close out a volatile session even as traders anticipate the Federal Reserve's most significant rate hike in more than two decades later this week.

With a 50bp hike to the target range all but certain, the press conference will provide important colour around the prospects of a soft landing, the neutral fed funds rate and balance sheet normalization. One question on everyone's mind: Are 75bp increments on the table?

OIL

Crude prices are up after comments from Germany's economy minister, which noted that the E.U. plans to ban Russian oil imports either immediately or in a few months.

In addition, oil prices found support from surging refined products markets, offsetting threats to China's fuel demand outlook stemming from its stringent measures to curb Covid-19...

GOLD

Gold is coming under pressure as markets anticipate Fed tightening, and downward pressure is likely to linger until we clear the Fed meeting...

FOREX

...In the meantime, the US dollar enjoys broad-based strength amid waning confidence in the euro area and signs of China’s Covid lockdowns weighing on the local economy."

In all things crypto this today, contributor Simon Peters asks, A Make Or Break Scenario For Cryptoassets This Week?

"Both bitcoin and ether battled investor fear last week, both finishing well down week on week. This week appears to be posing something of a make-or-break scenario for cryptoassets as investors around the world take a deep breath ahead of the US Federal Reserve’s latest monetary policy announcement.

Bitcoin began last week trading just clear of $40,000, but this collapsed on Tuesday as it fell precipitously below $37,500. The cryptoasset recovered somewhat to above $39,500 later in the week but is now trading back around $38,000.

Ether meanwhile began last week above $2,950 but fell to below $2,700 by the weekend on the eToro platform. It is currently back above $2,800.

The turbulence of the cryptoasset market more broadly seems to be moving in lockstep with other assets as investors move away from riskier areas of the market such as tech stocks. Volatility is also high at the moment, as the price swings described above illustrate.

Stock investors are said to now be holding their breath ahead of the Fed decision tomorrow - and this would broadly hold true for the crypto community too."

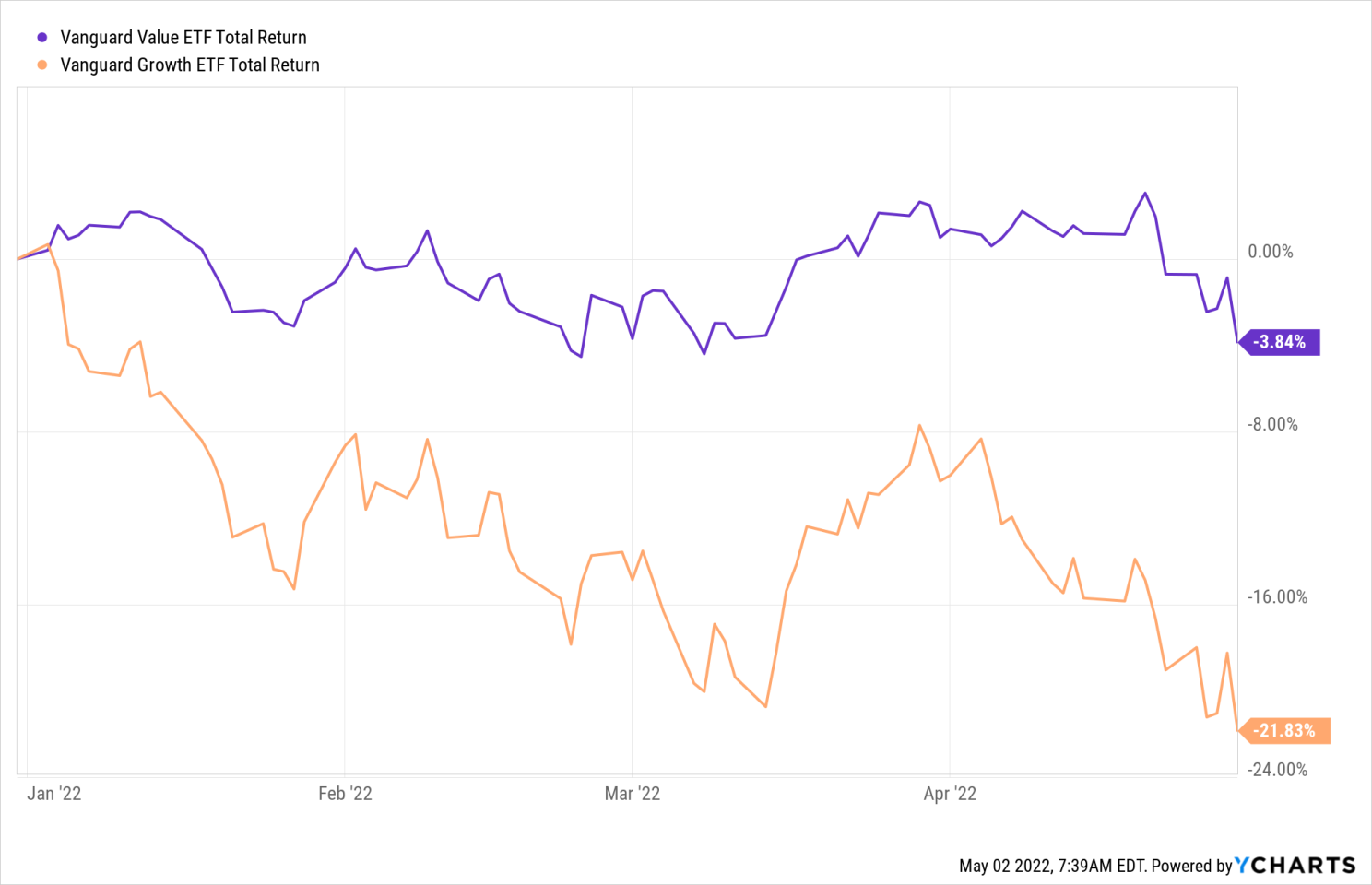

Contributor Zachary Scheidt looking for the light writes April Was Brutal — But Investors Can Still Find Winners.

"April was a brutal month for the stock market. And if you’re like many investors, you may be rethinking your decision to invest...The problem is, too many people have been heavily invested in the most dangerous areas of the market. Meanwhile, safer stocks are holding up just fine (with plenty of room for future gains)."

"Many of these (high price-growth) stocks book losses every year. (And even the profitable ones often book meager gains each quarter.) But with so much investor excitement over the last two years, these stocks got pushed up to unreasonable levels.

Once the Fed started raising interest rates, investors took a second look — and started selling. This drove many stocks closer to a reasonable price. Which of course means growth stocks have taken it on the chin.

Meanwhile, value stocks have held up just fine!"

"Clearly, investors are moving capital out of growth stocks and into value stocks. This makes sense as risk for the overall economy picks up and investors look for safe places to park capital

But how long could this trend last?..."

Scheidt throws up a chart that shows value stocks have been underperforming (relative to growth stocks) for more than fifteen years and he says:

"That’s quite a long time. And since growth stocks have been pushed higher for more than a decade, it leaves plenty of room for value stocks to outperform for many years to come!

If you’re worried about the overall stock market and protecting your investment returns, value stocks could be a great place to invest over the next 10+ years."

That's all for the "Take the good news from where you can get it department".

As always, Caveat Emptor.

Have a good one!

Good review.