April Was Brutal — But Investors Can Still Find Winners

April was a brutal month for the stock market. And if you’re like many investors, you may be rethinking your decision to invest.

Over the past week, I’ve fielded calls, text messages and even in-person questions from worried friends.

It seems that everyone is nervous their stock market positions.

But the truth is, investing doesn’t have to be this tough! Especially if you take a balanced long-term approach to the market.

The problem is, too many people have been heavily invested in the most dangerous areas of the market. Meanwhile, safer stocks are holding up just fine (with plenty of room for future gains).

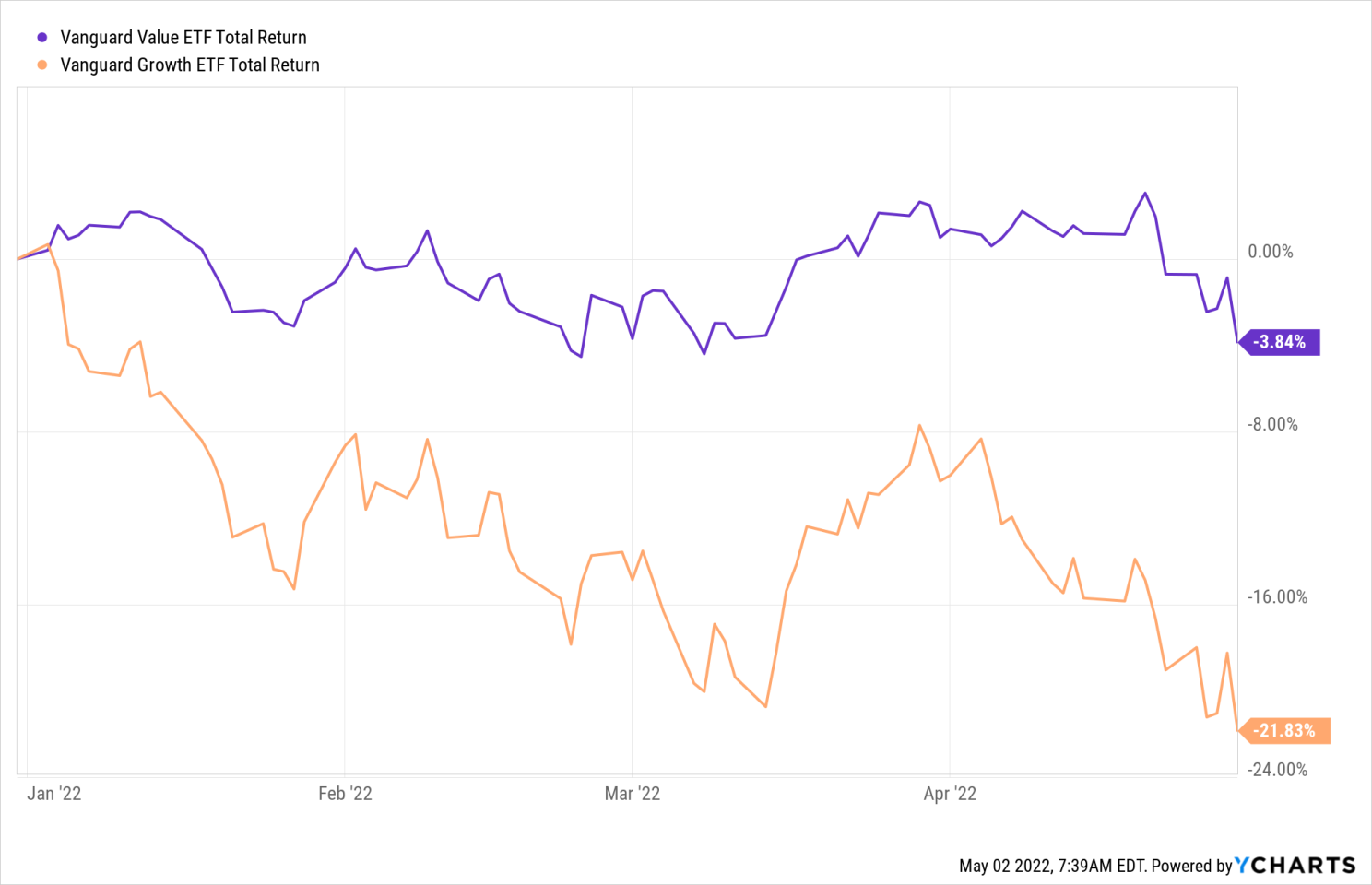

Value Stocks Outperform

With all of the negative media attention, you might think the entire stock market has been pummeled this year.

But that’s just not the case!

Sure, the more popular growth stocks have been under severe pressure. But that makes perfect sense!

Many of these stocks book losses every year. (And even the profitable ones often book meager gains each quarter.) But with so much investor excitement over the last two years, these stocks got pushed up to unreasonable levels.

Once the Fed started raising interest rates, investors took a second look — and started selling. This drove many stocks closer to a reasonable price. Which of course means growth stocks have taken it on the chin.

Meanwhile, value stocks have held up just fine!

(Value stocks are simply stocks that trade at a reasonable price compared to earnings. So if you’re “buying profits” with your investment dollars, you’re getting a value with these stocks.)

Take a look at the difference between these two markets:

The Value Trend Has Room…

Clearly, investors are moving capital out of growth stocks and into value stocks. This makes sense as risk for the overall economy picks up and investors look for safe places to park capital

But how long could this trend last?

Over the weekend, Bespoke Investment Group shared a chart showing how long value stocks have been underperforming. (Nearly 15 years!)

That’s quite a long time. And since growth stocks have been pushed higher for more than a decade, it leaves plenty of room for value stocks to outperform for many years to come!

If you’re worried about the overall stock market and protecting your investment returns, value stocks could be a great place to invest over the next 10+ years.

Value Doesn’t Have to be Boring

One of the biggest complaints I hear about value stocks is that they’re “boring” with minimal returns.

Of course, modest positive returns are much better than “exciting” negative returns. And growth stocks could be on the bad side of this equation for a long time to come.

But value stocks could also offer exciting positive returns. Just look at the sharp ramp in value stocks as the dot-com bubble burst in 2000.

Another option for traders who want more excitement is to buy call option contracts on value stocks.

This way, even if the stocks themselves only trade higher by a few percentage points, option contracts could accelerate those returns if your timing is right.

For instance, Chevron Corp. (CVX) and Deere & Co. (DE) both fall into the value stock category. CVX trades for just 9.5 times this year’s expected profits. And DE currently trades for about 14 times 2023 projections.

My Speculative Trading Program recently bought in-the-money call contracts on both of these stocks.

If these stocks move up, returns on these two option positions could be much higher (in percentage terms). Of course any capital you invest in option contracts is at risk… So only invest capital you can afford to lose.

While the overall market has been under pressure, there are plenty of profitable areas. Value stocks could be “hot” for many years to come!

Here’s to growing and protecting your wealth.