The Stock Market Is A Different Kind Of Overbought With Breadth So Strong

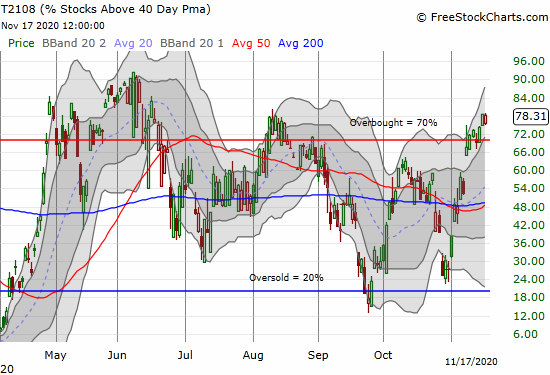

I like to think of the stock market in cyclical terms. AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), provides a handy way to measure the extremes in the stock market represented by oversold (below 20%) and overbought (above 70%). At market extremes, risk/reward starts to favor counter-trend trades. Even though the S&P 500 (SPY) pulled back slightly from its all-time high, the stock market remained comfortably in overbought territory with AT40 closing at 78.3%. In fact, AT40 (Above The 40DMA), closed flush with its previous close.

AT40 (T2108) is in overbought territory.

When the stock market flips into overbought trading territory with AT40 reaching above 70%, I go on alert for the looming (short-term) end to the existing rally. Even though the stock market can continue to rally through extended periods of overbought conditions, the end of those overbought conditions often precedes a tradeable pullback.

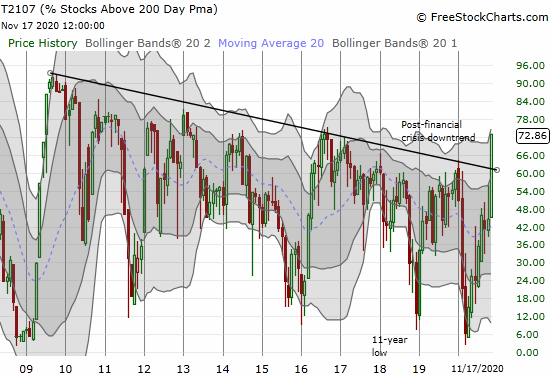

When the stock market flipped overbought last week, I noted another technical indicator makes THIS overbought period much different from so many others. AT200 (T2107), the percentage of stocks trading above their respective 200DMAs, broke out from a very important downtrend. When the stock market started its long recovery from the financial crisis, AT200 shot upward for 6 straight months until topping out above 90%. This indicator of longer-term breadth in the stock market has not come close to such elevated levels ever since. More importantly, that peak started a downtrend that lasted for over 11 years. Last week's entry into overbought conditions accompanied the end of that downtrend.

AT200 (T2107) ended an 11 1/2 year downtrend.

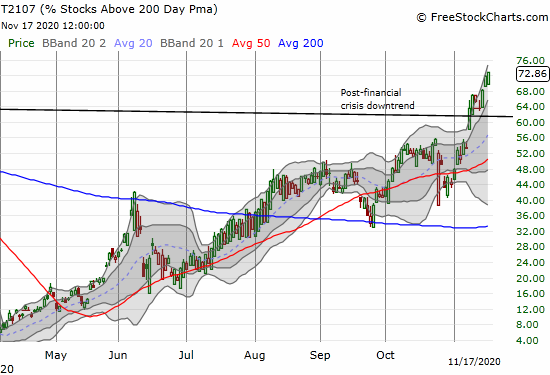

An on-going expansion in longer-term breadth is an important characteristic of the current market. "Reopen trades" have come to life in the wake of news of two coronavirus vaccines which promise at least 90% effectiveness. Finally, investors see more hope over the horizon. They are willing to overlook the dire financials of companies dependent on a reopened economy of traveling, dining, and entertainment. The underlying breadth in the stock market made me reconsider my rationale for flipping from bullish to neutral on the stock market earlier this month in preparation for an end to the current rally.

After weeks of small gains, AT200 (T2107), soared through the downtrend defined by a decade long decline in stock market breadth.

My cyclical trading rules dictate going bearish once the stock market ends its overbought trading conditions; ALL overbought periods eventually end. However, given the stock market's impressive breadth, I expect the next bearish period for the stock market to be a short one. In other words, I expect the next dip to represent more of a buying opportunity than a setup for shorting the general stock market. I will still look for bearish trading opportunities, but I will likely hold such positions like hot potatoes. Of course, if the stock market's breadth breaks down, all bets are off. Still, until proven guilty, the base case for the stock market is a broadening benefit from the buying interest of traders and investors.

Certainly there is a cyclic nature to the stock market, and from that many have amassed fortunes, if they perceive correctly. But there is also a large random noise element that is much harder to predict accurately. Thus the real world sounds like a mixture of signals and noise. On most occasions it is difficult to know just what one is hearing.

Definitely. And to this point, buying oversold has a much better risk/reward than selling overbought because of the longer-term uptrend in the stock market. It took me a while, but I stopped automatically selling overbought markets and instead waited for additional signals....like dropping out of overbought conditions.

Undoubtedly true. Automation works best in very predictable situations, it is great for production lines, much less applicable in stock trading.