TalkMarkets Tuesday Talk: More Fireworks And WAM

Well, yesterday showed that there were still some fireworks to light as the markets returned from the 4th of July holiday weekend. The S&P 500 closed at 3,180 up 50 pts, the Nasdaq closed at 10,434 up a whopping 226 pts, while the Dow Jones Average closed at 26,287, up 460 pts. This morning US stock market futures are pointing down as COVID-19 cases continue to climb.

Bull or Bear and where to from here? TalkMarkets contributors are talking.

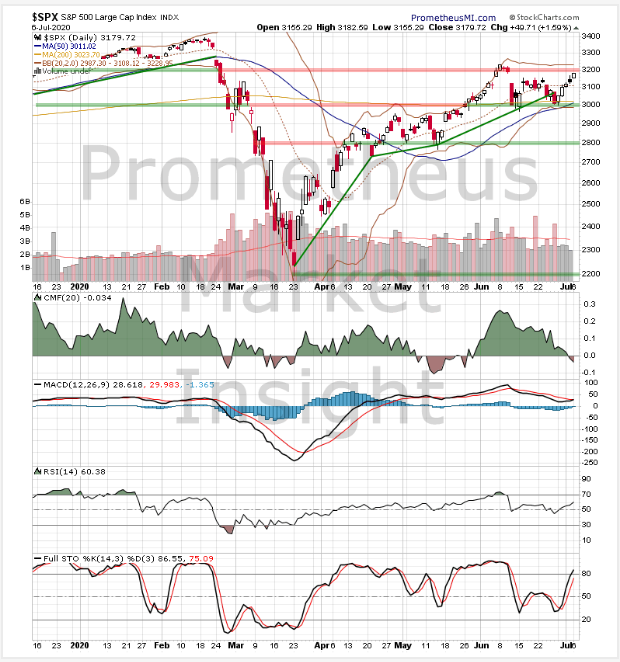

Erik McCurdy in Short-Term Forecast For Monday, July 6, provides technical analysis of the S&P 500 (SPX) index charts noting, “The index closed sharply higher today, moving up toward previous highs of the uptrend from March. Technical indicators are slightly bullish overall, tentatively favoring a continuation of the advance.”

Based on the technicals McCurdy ‘s prognosis is as follows:

“Short-term Outlook

- Bullish Scenario: A close above the previous short-term high at 3,232 would reconfirm the uptrend from March and forecast additional gains.

- Bearish Scenario: A reversal and close well below congestion support in the 3,000 area would confirm the start of a new downtrend and predict additional losses.

The bullish scenario is slightly more likely (~60 probable).”

TalkMarkets contributor Upfina.com is more cautious. Writing in Consumers Will Spend Less Without Unemployment Benefits the folks at Upfina expect that the impact of the termination of the current $600 per week stimulus for unemployed workers which is scheduled to end on July 25 will harm the recovery, but will not show up in the statistics till August. Upfina is also concerned that the continued rise in COVID-19 cases will spell further trouble to the flailing restaurant industry.

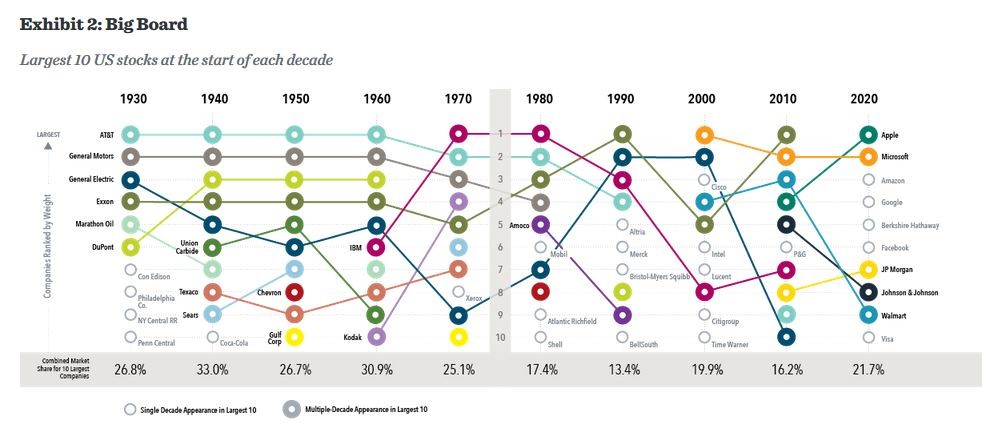

With regards to the rally in the Chinese stock market, Upfina advises to be on the lookout for a crash. Also, hinting that US technology stocks are heading into overbought territory, the article provides a historical chart of top companies over time and posits the following:

“Investors must not get caught up in the day to day news. Even if you aren’t an experienced investor, you can learn from history. That’s why we are sharing the chart below which shows the changes to the list of the top 10 U.S. stocks by market cap. We are in an interesting period because 2020 has the newest companies on the list (5), yet investors are extremely confident these top businesses will be titans forever.”

This is as good a piece as any to understand where we are as we go into the unknown of Q3 2020. Upfina concludes thusly, “Euphoric sentiment never lasts. It’s amazing how confident investors are in the top 10 U.S. companies, specifically the internet names, when there has recently been so much flux in the U.S. market cap leader board. Do you believe Facebook, Apple, Microsoft, Amazon, and Google will all be amongst the top 10 biggest companies in 2030?”

Norman Mogil in his TalkMarkets exclusive, The Savings Rate Is The Key To An Economic Recovery discusses how the COVID-19 pandemic has seen an upsurge in personal savings rates in many economies and how this growth in savings, partially aided by government stimulus efforts, can stymie recovery efforts, given that consumer spending is seen as one of the keys to renewed economic growth. While maybe not a contrarian view, Mogil notes that “Those anticipating a V-shaped spending bounce have yet to make a convincing argument that overcomes the impact on growth of these high rates of savings.”

Mogil mentions, too, that ECB President Christine Lagarde has “made the case that the rise in personal bank deposits are a clear indication that the pace of the economic recovery will be “sequential and restrained”. This is central bank jargon for a long hard slog ahead.”

A quick and worthwhile read.

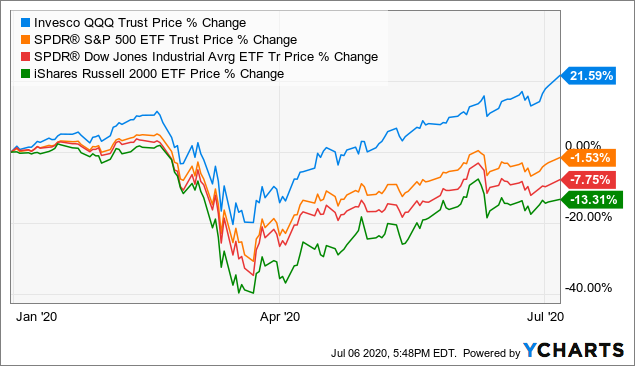

Tech Is In La-La Land according to TalkMarkets contributor Erich Reimer. Don’t get him wrong, Reimer is a strong advocate for the Nasdaq, he just believes it has run a bit too far ahead and he goes back into recent history to remind us of how things can go bust.

“I think the tech rally has reached some of its last legs for the moment because its valuations have soared far beyond what is justified based on current business and economic projections. Times are good for tech but it has gotten a bit ahead of itself, trading on hopes far further down the line and with a premium due to a lack of other safe sectors, and I believe soon enough its current rate of growth will slow and perhaps even reverse for a time.”

Here’s the good chart for 2020:

And here’s the 2000 dot-com bubble and burst chart:

Another cautionary tale in pictures.

To round out today’s column Michael Kahn in another exclusive for TalkMarkets, Everybody Is Wrong tells us why the economists, the politicians and the market analysts, both technical and fundamental have got it all wrong. His article is a bit tongue-in-cheek, but he makes the case that a lot of the current mess, has to do with how people in all sectors of the economy and government have reacted or in many cases over-reacted to the COVID-19 pandemic. He does take care not to lambaste the medical profession.

“For the May jobs report, the experts were looking for 7.5 million jobs to be lost but there were actually 2.5 million jobs gained. This just goes to show that economists are non-essential workers. In June, there were 4.8 million jobs gained; more than a million over the estimate. This was touted as the largest monthly gain in history…”

Kahn goes on to skewer the others mentioned above as well. The article will bring out the inner-cynic in you, but only for a bit. He concludes with the following:

“Educate yourself on this virus. Believe the emergency room workers when they tell you this is a serious disease. But we are passed the stage where the only answer is self-isolation and an Amazon account.”

Economies do need to be re-opened and they need to be re-opened safely. Each one of us can do our part. It starts with WAM, Wear A Mask.

Once again, I will mention that I do believe that frequent disclaimer we see, "Past performance is no guarantee of future performance." Certainly the pushers of sunshine want us to believe that that the past does prove the future. But the real value of the past is learning from the mistakes about what choices are not going to work next time, either. It is indeed quite handy to not make the same mistake repeatedly. Besides being unprofitable, repeating a mistake damages one's credibility a bit.

Thanks @[David Marshall](user:121103), great roundup.