The Savings Rate Is The Key To An Economic Recovery

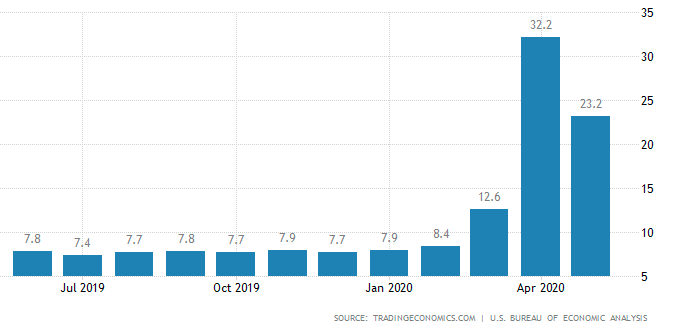

As the coronavirus plays havoc with the world economies, households have responded with a huge surge in domestic savings. To central bankers, the dramatic increase in household savings further complicates their task to stimulate growth through consumption.US household savings, prior to the economic lockdown was averaging around 8%. Once the lockdown was introduced in March the rate shot up to 13% and then surged to over 32%, and now has retreated slightly to 23%, still far and above any recent historical experience.

US Household Savings Rate (%)

(Click on image to enlarge)

Two interpretations are often put forth on how the savings rate will impact future economic growth. Optimistic analysts contend that money stashed away in bank deposits or other very liquid assets, represents pent-up consumer demand that will be launched once the lockdowns are lifted. This view argues these funds have been involuntarily put aside, since there were so few opportunities to spend, especially in entertainment, restaurants, travel, and other non-essential services. While this may have been the case so far, it does not follow that consumption will just take off as restrictions are lifted and the consumer will return to historic spending patterns. Alternatively, household savings are one way to insure against uncertain times ahead. The shock of losing jobs or considerable personal income, on top of investment losses, has left the consumer in a state of shock. Given that there are 20 million out of work in the US, it is highly unlikely that those individuals experience “pent up demand”. Many are nowhere near returning to their former jobs and millions will not likely have their former jobs available as the economy re-structures in response to a long-term struggle against the pandemic.

Households across the world have been saving up since the coronavirus pandemic hit the global economy. Canada’s savings in March was nearly double that of last December. The UK savings increased its savings rate from 5.4% to 8.6% in the first quarter. Eurozone household savings rate rose to 17% in the first three months of the year, compared to 13% in the last quarter of 2019, the highest on record. Christine Lagarde, president of the European Central Bank, made the case that the rise in personal bank deposits are a clear indication that the pace of the economic recovery will be “sequential and restrained”. This is central bank jargon for a long hard slog ahead. Early indications are that household bank deposits in the eurozone are rising in the second quarter. Even Japan, historically a nation of savers, experienced an increase in the national savings from 17% to 26% in respond to the pandemic.

Governments have come to aid of the workforce and provided direct cash contributions, making savings somewhat easier. Although households in advanced economies have suffered declines in earnings during the pandemic, their incomes have been partly buttressed by these transfer payments. While the full extent of job losses is not known and may not be for several more months, households can be expected to continue to save as the pandemic rages, especially in the US. Re-enforcing the need for savings, is the expected surge in personal bankruptcies later this year. Those anticipating a V-shaped spending bounce have yet to make a convincing argument that overcomes the impact on growth of these high rates of savings. Moreover, central bankers are contending with deflationary forces which further encourages savings. Central bankers have made it abundantly clear that interest rates are going to remain zero-bound, a sign that the price level will remain or drop from current levels.

Indeed, savings will be needed to make the recovery work, if there ever is a true recovery. And while savings may be the solution, the Fed is working against savings by throwing fuel on the inflation fire.. Increasing the supply of money is the way to keep some folks portfolios healthy, but it is also the way to reduce the value of all savings.

Do I object to this attack on my savings? Certainly I do. Will I remember who did it when the time for paybacks eventually arrives? Certainly I will. Will the response be sweet and gentle? No Way in Hell will the payback be "sweet and gentle"!! There are institutions that are guilty, and to prevent the same things from happening again and again those institutions need to be ground into dust beneath the heel of change.

Perhaps that sounds a bit harsh, Warnings do need to be as intense as the problems they address, at least some times.