Short-Term Forecast For Monday, July 6

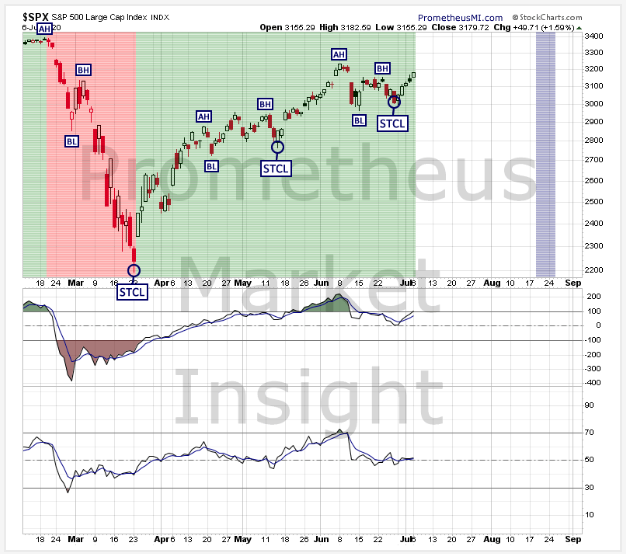

We are 5 sessions into the alpha phase rally of the short-term cycle that began on June 27.

(Click on image to enlarge)

An extended alpha phase rally that moves up to new highs would reconfirm the current bullish short-term trend and forecast additional gains. Alternatively, a quick reversal followed by an extended alpha phase decline that moves well below the last short-term cycle low (STCL) at 3,009 would signal the likely transition to a bearish short-term trend.

S&P 500 Index Daily Chart Analyses

The following technical and cycle analyses provide short-term forecasts for the S&P 500 index.

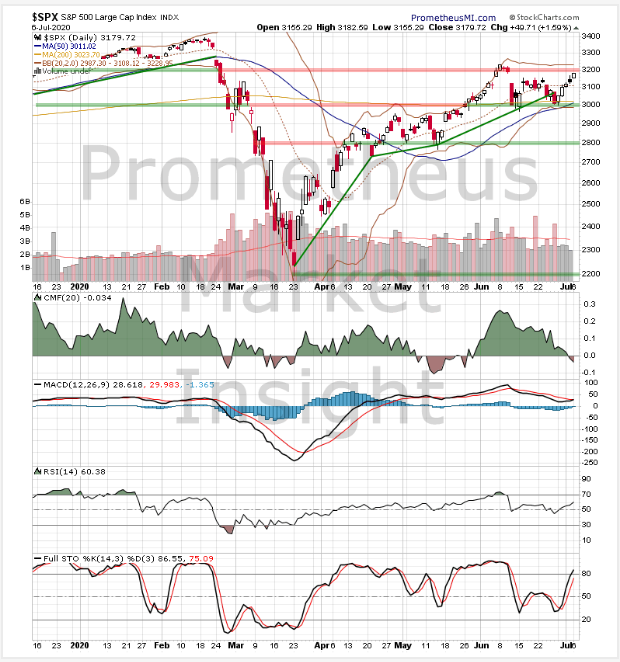

Technical Analysis

The index closed sharply higher today, moving up toward previous highs of the uptrend from March. Technical indicators are slightly bullish overall, tentatively favoring a continuation of the advance.

(Click on image to enlarge)

Cycle Analysis

We are 5 sessions into the alpha phase rally of the cycle following the short-term cycle low (STCL) on June 26. An extended alpha phase rally that moves up to new highs would reconfirm the current bullish short-term trend and forecast additional gains. Alternatively, a quick reversal followed by an extended alpha phase decline that moves well below the last short-term cycle low (STCL) at 3,009 would signal the likely transition to a bearish translation. The window during which the next STCL is likely to occur is from August 7 to August 27, with our best estimate being in the August 19 to August 25 range.

- Last STCL: June 26, 2020

- Cycle Duration: 5 sessions

- Cycle Translation: Bullish

- Next STCL Window: August 7 to August 27; best estimate in the August 19 to August 25 range.

- Setup Status: No active setups.

- Trigger Status: No pending triggers.

- Signal Status: No active signals.

- Stop Level: None active.

(Click on image to enlarge)

Short-term Outlook

- Bullish Scenario: A close above the previous short-term high at 3,232 would reconfirm the uptrend from March and forecast additional gains.

- Bearish Scenario: A reversal and close well below congestion support in the 3,000 area would confirm the start of a new downtrend and predict additional losses.

The bullish scenario is slightly more likely (~60 probable).