TalkMarkets Tuesday Talk: A Very COVID Christmas

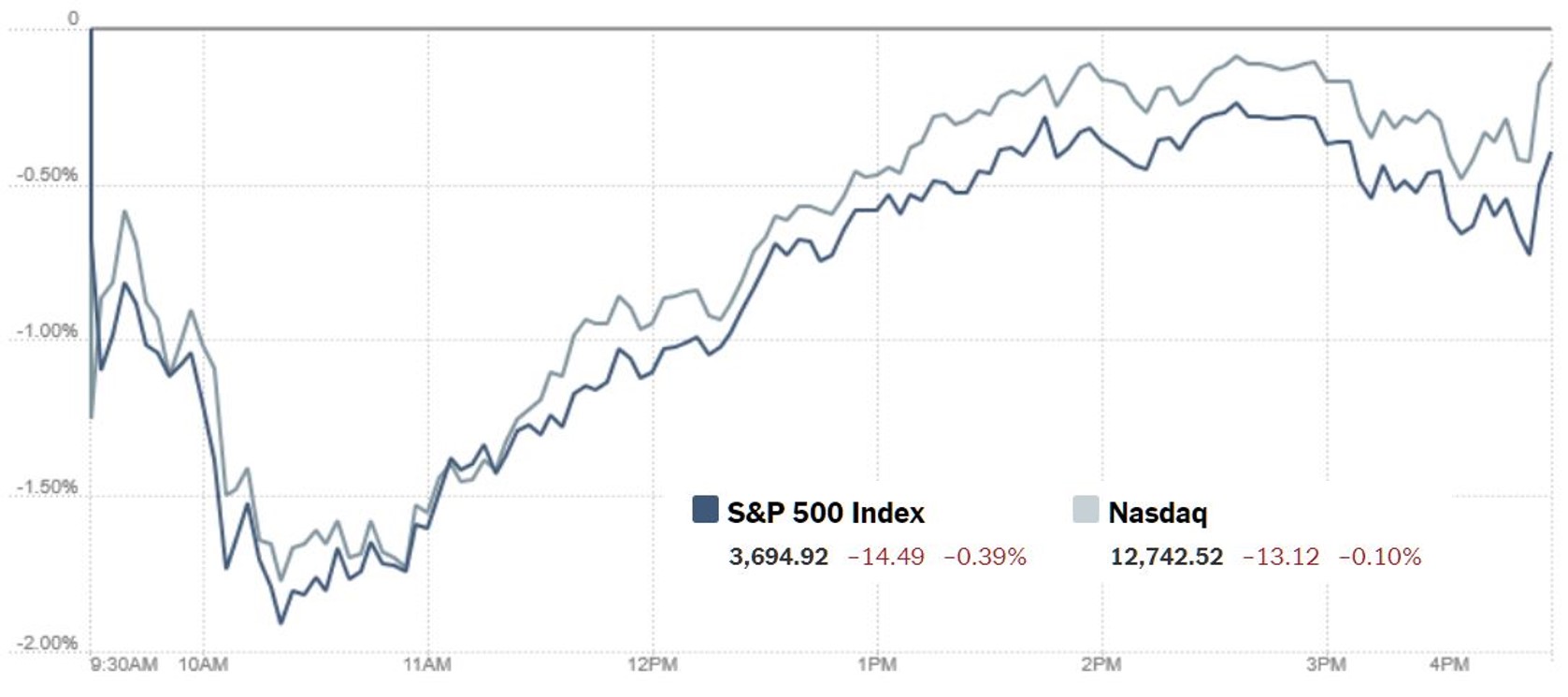

Source: The New York Times

News of a mutant COVID-19 strain coming out of England has shutdown skies worldwide and vaccines aside, has put an even further damper on an already dark holiday season. After a choppy morning, US markets rebounded and closed mostly unchanged Monday. The Nikkei 225, Hang Seng and Shanghai Composite indices closed down in Tuesday trading, while European markets are higher in morning trading. Currently S&P 500 futures are trading flat at 3,695, Dow Jones futures are trading at 30,127, up 14 points and Nasdaq 100 futures are trading at 12,754 up 71 points from Monday's 12,683 close.

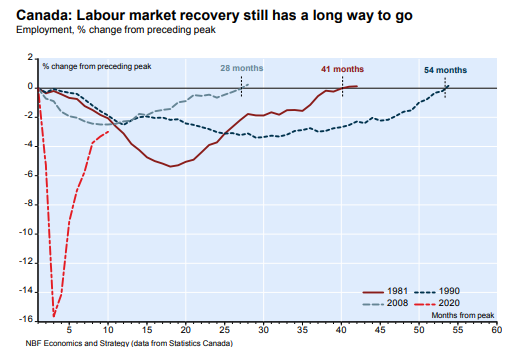

TalkMarkets Exclusive contributor Arthur Donner in The Canadian Economy Has A Long Road Ahead To Recover The Jobs Lost In The Pandemic checks in with our neighbor to the North.

"The Canadian job market recovery continued to slow in November, adding only 62,000 net new jobs compared with 84,000 which were created in October. The unemployment rate in November fell to 8.5% from 8.9% in October. The employment increases in November left Canada 574,999 jobs short of restoring the 3 million jobs which were lost in March and April."

Despite continued hemorrhaging in the retail and hospitality industries, Donner says, "Canada’s total economic response to the pandemic recession is much more V like than the extended U shape I thought was possible." Donner includes the below chart which shows how the Canadian labor market is recovering from the current recession vs recessions in prior years.

A V-shaped (labor market) recovery indeed, but still well below the peak.

TM contributor Travis Tim in his article 3 Pieces Of Good News, has found some ways to cheer readers on.

1. "First, the Moderna (MRNA) vaccine was approved and will start to be used on Monday. This is another MRNA vaccine like the one from Pfizer (PFE), but it doesn’t require the same especially cold freezers, and it can be shipped in smaller volumes, making it a more accessible vaccine, particularly for smaller and more rural hospitals.

2. The second piece of good news was that Congress FINALLY agreed to a stimulus bill. The $900 billion deal provides relief to small businesses, airlines, increases unemployment benefits and provides a $600 payment to individuals that qualify.

3. The third piece of good news is that the Federal Reserve is going to allow banks to buy back stock again next year, after finding that they have more than enough capital to easily survive a dramatic stress test, far worse than what we are seeing now for the economy. This is absolutely huge, as the stocks are really cheap so these buybacks are enormously accretive, depending on the bank, but certainly the ones we own. This should help earnings per share growth and in many cases book value per share growth, which are the key metrics that guide valuations and stock prices for these companies."

Things many of us have been waiting for.

The housing sector in the U.S. has been strong despite the pandemic and Sweta Jaiswal, FRM from Zack's Investment Research, finds some ways for investors to benefit in an article entitled ETFs To Gain On Positive US Housing Starts In November. Jaiswal gives an overview of positive developments in the U.S. housing industry and then provides the four following ETF picks for consideration.

"iShares U.S. Home Construction ETF (ITB)

This fund provides exposure to U.S. companies that manufacture residential homes by tracking the Dow Jones U.S. Select Home Construction Index. With AUM of $2 billion, it holds a basket of 46 stocks, heavily focused on the top two firms. The product charges 42 basis points (bps) in annual fees.

SPDR S&P Homebuilders ETF (XHB)

A popular choice in the homebuilding space, XHB, follows the S&P Homebuilders Select Industry Index. The fund holds about 35 securities in its basket. It has AUM of $1.35 billion. The fund charges 35 bps in annual fees.

Invesco Dynamic Building & Construction ETF (PKB)

This fund follows the Dynamic Building & Construction Intellidex Index, holding a basket of well-diversified 30 stocks, each accounting for less than a 5.16% share. It amassed assets worth $167.6 million. The expense ratio is 0.59%.

Hoya Capital Housing ETF (HOMZ)

The fund seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the Hoya Capital Housing 100 Index, a rules-based Index designed to track the 100 companies that collectively represent the performance of the US Housing Industry. It has AUM of $41.9 million. The fund charges 30 bps in annual fees."

Not to let good news get too, far ahead, TalkMarkets contributor Bill Kort contributes a slightly cynical, but sober perspective in ” … The Good News Is Already Baked Into Stocks.” . Among the many pithy remarks in Kort's column, I include the following:

"So, we now have $3 trillion in stimulus in place, plus zero interest rate for the next two years or more, plus 4 preceding years of near-zero rates, plus an unfunded $2 trillion tax cut (more stimulus) in 2018 and, don’t forget the multiplier effect. These dollars just don’t get spent once. Oh yes, and this has been going on all over the world. WHAT COULD GO WRONG?

As I have repeatedly stated in this blog, “this will end badly.” This secular bull is exactly the same as every other secular bull before it. According to the late Sir John Templeton, the life cycle is thus:

“Bull markets are born on pessimism, grown on skepticism, mature on optimism and die on euphoria.”

I maintain that, even though we have seen significant speculation in certain quarters of the market, most individual investors and many professionals (so-called media experts included) have spent the past 11 years looking in the rearview mirror at their experience with the 2000 tech bubble explosion and the even worse 2008 financial crisis. Individuals have been eschewing stocks in favor of no yield, or low yield, fixed income. The collapse in March/April has reinforced their SKEPTICISM. We appear to be nowhere near the OPTIMISM stage. We are definitely nowhere close to EUPHORIA

EUPHORIA will look something like this: In the late 1990s local New York TV stations would camp out in front of Charles Schwab offices interviewing clients about their views of the market. To a man or woman the answers looked something like this: I’m not worried about the market. I’m in it for the long-term. Where else can you get 8, 9, 10% on your money?’ Before this is all over the vast majority of people will love and trust stocks. That is the kind of EUPHORIA Sir John was eluding to."

Read the whole article for the rest.

Kevin Mahn in Top 10 Investment Themes For 2021 gives readers some topics to consider as the New Year approaches. I've presented them here in condensed form.

As holiday celebrations will definately be subdued this year, I'll leave you with a link to Eric Clapton's version of "Have Yourself A Merry Little Christmas". Enjoy yourselves and remember to be thankful for all that you have and be mindful of those in need.

See you next week.

It will certainly be a Christmas to remember... and not in a good way!