Stuck In A Downtrend, But Getting Oversold

Image Source: Unsplash

Where'd the Gains Go?

After a strong spring and summer rally, US equity markets have been treading water for the last month or so now.

Declines have left the average stock just about flat over the last year.

Since last Thanksgiving, the S&P 500 Equal Weight ETF (RSP) is now down more than 1%.

Year to date, there are now more stocks down in the large-cap Russell 1,000 than up.

That definitely doesn't sound like a market firing on all cylinders.

Declines have left investor sentiment back in the tank, with bears outnumbering bulls by a wide margin last week (AAII). From a contrarian perspective, that's a good thing.

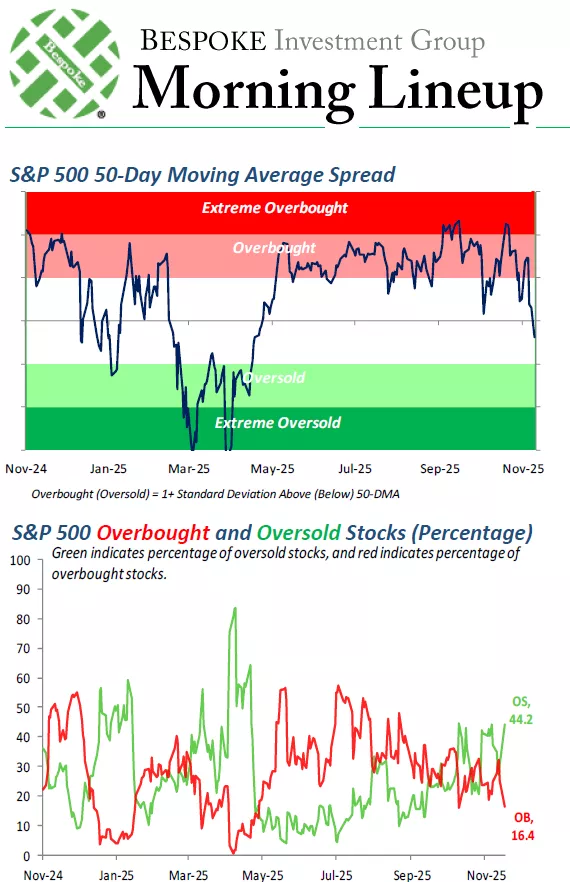

Below are two charts always included in Bespoke's Morning Lineup.

The first shows the S&P 500's 50-day moving average spread dipping back into negative territory, while the second shows that nearly half of S&P 500 stocks are now oversold while just 16.4% are overbought.

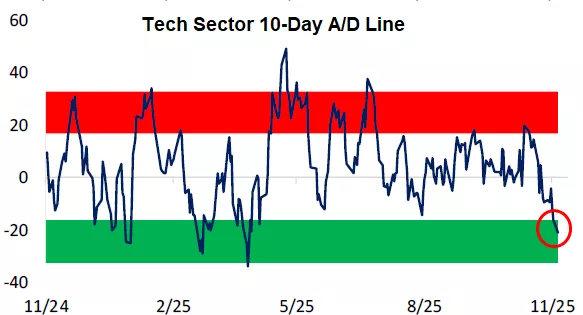

The Tech sector, which had been driving all of the market's gains in the middle part of the year, has seen its 10-day advance/decline line move back into oversold territory as the selling has intensified:The Tech sector, which had been driving all of the market's gains in the middle part of the year, has seen its 10-day advance/decline line move back into oversold territory as the selling has intensified:

More By This Author:

Empire Fed Rising

Short Interest Update

The 25 Most Heavily Shorted Stocks

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more