Empire Fed Rising

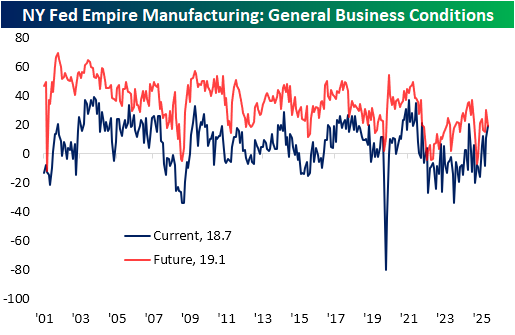

The first regional Fed manufacturing report covering the month of November hit the tape this morning in the form of the New York Fed's Empire Manufacturing Survey. The headline index rose 8 points month over month to 18.7, moving the index to the top quartile of historical readings. Outside of last November's reading of 20.2, this was also the highest reading in the index since April 2022.

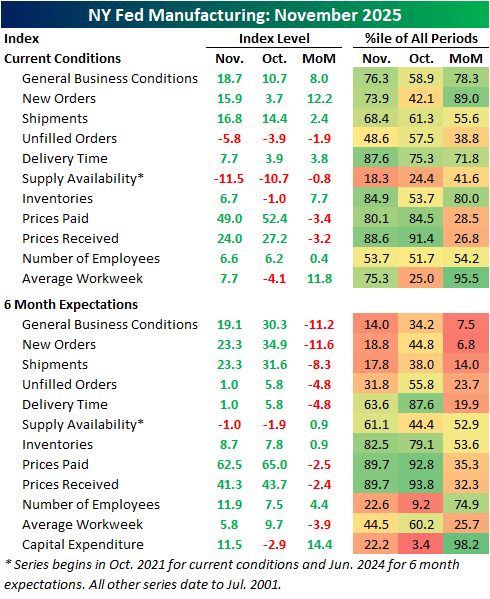

Breadth in this month's report was solid, with six of ten categories rising month over month while four declined. Of the decliners, both price indices moderated. New orders picked up materially, as did both employment indices. Current condition indices are mostly solid now, with only two in contraction (unfilled orders and supply availability), and those same two indices are also the only ones below their median historical readings.

Six-month expectations, on the other hand, leave room for improvement. Across the board, only five expectation indices are above their historical median, with the two price indices the most elevated, just shy of top decile readings. The headline index experienced a double-digit drop in November. In other words, the report showed optimism about current conditions but uneasiness for the months ahead.

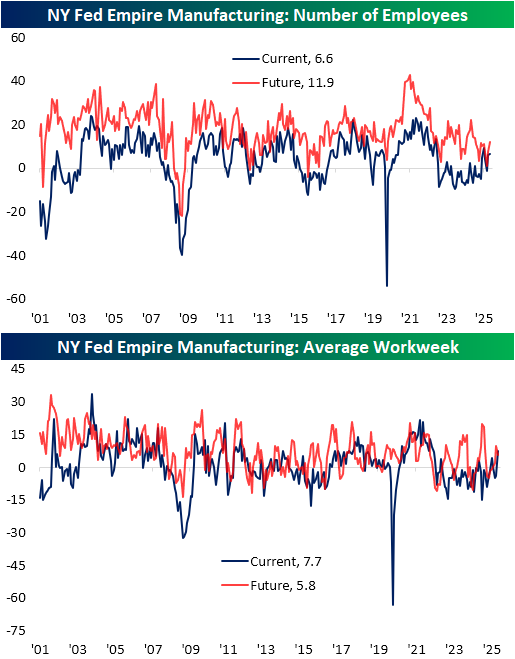

One of the stronger categories for current conditions was employment. Number of employees wasn't much to write home about, as the current conditions index rose a modest 0.4 points to 6.6. Expectations were also higher, reaching the most elevated reading since January. Average workweek was much stronger as the index surged from contractionary territory, up 11.8 points to 7.7. Put differently, in just one month, that index went from the bottom to the top quartile of historical readings. In fact, the index for current conditions is now the highest since May 2022.

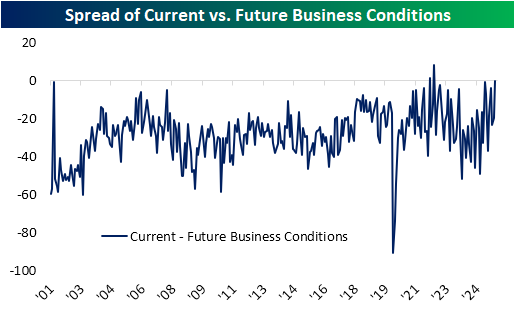

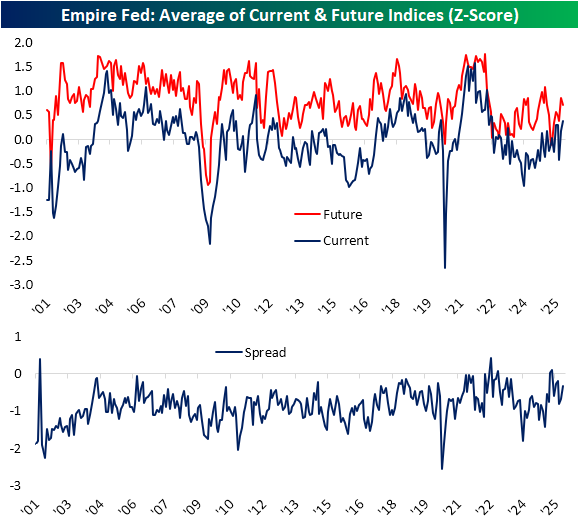

Circling back on the spread between current conditions and expectations, it was a weird month as current conditions improved and expectations deteriorated. Below, we show the spread in those readings for the headline index. As shown, optimism has been the historical norm, as positive spreads (current conditions stronger than expectations) have been extremely rare. In fact, it's only happened twice, the first in April 2022 and the second a few months later in July 2022. While the November reading wasn't positive, it came close with the third-highest reading on record at -0.4.

Standardizing and averaging across all categories, the spread between the two is less extreme. Again, current condition indices are solid at the strongest levels since the summer of 2022 while expectation indices were down slightly this month. Taken as a spread, there were higher readings as recently as three months ago, including a rare positive reading in April and May. Regardless, the move upward in November still ranks in the 90th percentile since the start of the survey in 2001.

More By This Author:

Short Interest UpdateThe 25 Most Heavily Shorted Stocks

Small Businesses Concerned Over Quality

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more