Short Interest Update

Image Source: Pexels

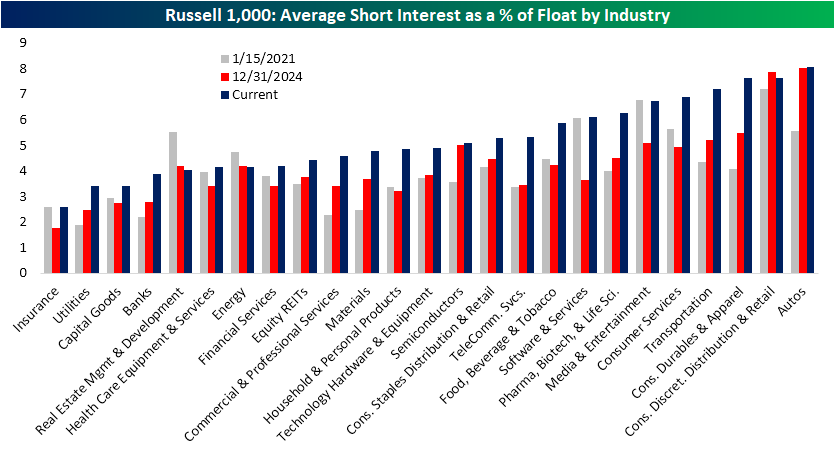

Short interest data through the end of October was published yesterday. For Russell 1,000 stocks, the average stock has 5% of float sold short (median: 3.5%). For the whole of the index, that is up a little over 1 percentage point from the start of the year. In the chart below, we show the average reading across all industries as of 10/31, at the end of last year, and in mid-January 2021, at the height of the meme-stock mania. Current readings are up versus both of those prior periods for Russell 1,000 members. With that said, we would note that for 2021 readings, the Russell 1,000 did not include some of the most heavily shorted and focused-on names like GameStop (GME) and AMC Entertainment (AMC), to name a few.

On an industry level, auto stocks continue to see elevated levels of short interest, largely due to the presence of EV-only names like Lucid (LCID). Behind that, many retailers and consumer-facing stocks make up the list of most shorted, while industries like Consumer Durables and Apparel, Transportation, and Consumer Services have seen some of the largest average increases. Another industry high up on the list of YTD increases has been out of the Tech sector, with Software and Service stocks going from 3.6% average short interest to 6.1% today. Conversely, the only declines in short interest since the start of the year have come out of the Energy and Real Estate Management and Development industries.

(Click on image to enlarge)

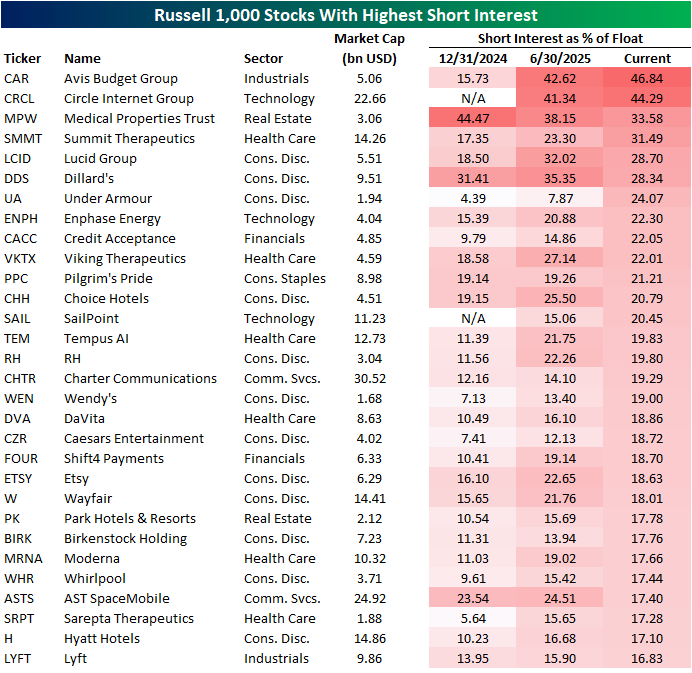

In the table below, we show the individual index members with the highest level of short interest per the latest update. Two stocks have readings above 40%: Avis Budget (CAR) and Circle (CRCL). The latter is a newer stock with an IPO in early June, while the former has seen short interest triple since the start of the year. The third-highest reading in short interest comes from Medical Properties Trust (MPW). While short interest remains high above 30%, it is down from 44.5% entering the year.

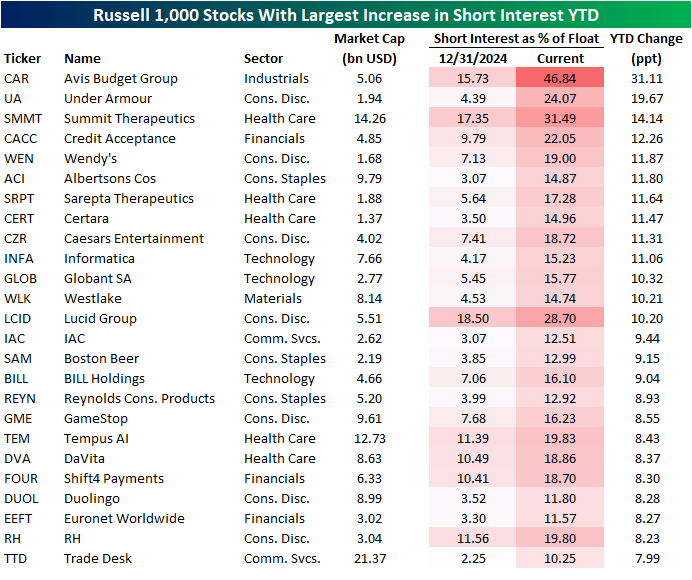

Again, CAR has seen short interest triple this year. That is by far the largest uptick of any current Russell 1,000 members. The next largest increase, Under Armour (UA) has seen an increase of less than 20 percentage points so far, although it started 2025 with a mid-single digit reading.

More By This Author:

The 25 Most Heavily Shorted Stocks

Small Businesses Concerned Over Quality

Home Is Where The Pain Is

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more