Small Businesses Concerned Over Quality

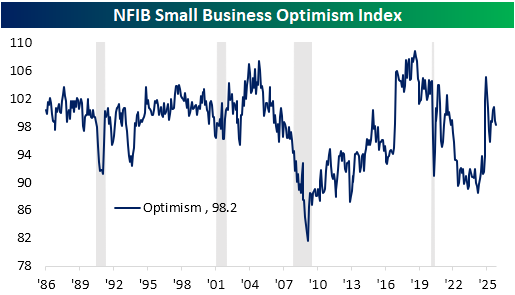

This morning's only economic report was the NFIB's Small Business Optimism Index. It came in weaker than expected, falling to 98.2 versus forecasts of 98.3. The index has now fallen in back-to-back months as it hovers in the 40th percentile of its historical range..

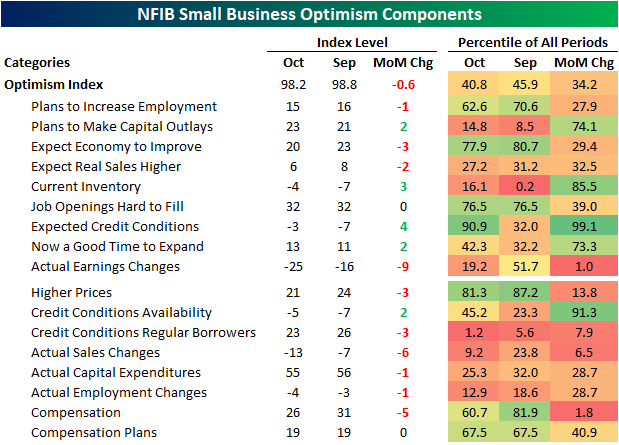

Of the inputs to the headline number, breadth was actually mixed with four declining categories, four rising, and the remainder going unchanged. As for the non-input categories, breadth was far weaker, with only two indices avoiding declines. As for those that did drop, there were a handful that saw bottom decile monthly declines.

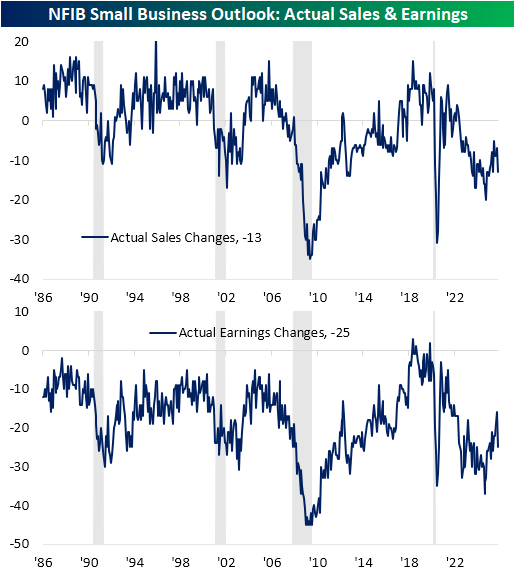

Of the inputs to the headline number, the most concerning decline was in actual earnings changes. That index fell 9 points MoM, which ranks as the sixth largest monthly decline in the index's history (data going back to 1986). Given that those are bottom-line changes, the cause for weaker earnings could be weaker revenues, higher costs, or a mix of both. However, weaker revenues appear to be the culprit.

For starters, the index for higher prices remains in the top quintile of readings throughout the survey's history, but there was a 3-point decline in October. Meanwhile, the index for actual sales changes (not an input into the overall optimism index) fell by a more significant 6 points in October to the lowest level since May.That six-point decline ranks in the 6th percentile of monthly moves, and the current level of the index is now in the bottom decile of historical readings. Interestingly, despite the moves in those indices, the share of respondents who reported poor sales as their biggest problem was unchanged at 10%.

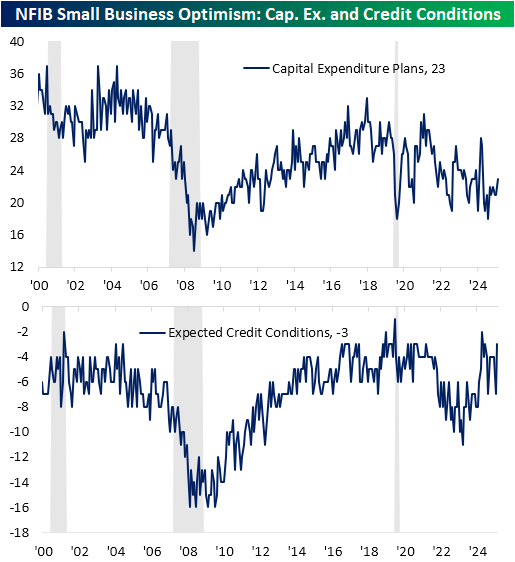

One bright spot of the October report concerned financing.As rates have continued to fall, there has been an uptick in capex plans and expected credit conditions. For the latter, the 4-point jump month-over-month was one of the largest one-month increases on record, and current levels are also at the high end of the past few decades' range.

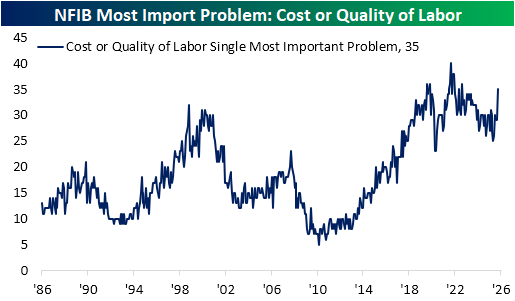

As noted earlier, for the topics labeled as small businesses' biggest problems, poor sales didn't move in October, and at 10% it ranks as the fourth-biggest issue of the 10 listed. Ahead of poor sales, inflation took a step back, falling 2 percentage points to 12% of responses, and taxes fell an identical amount to 16% of responses.The single most commonly reported problem in October was quality of labor. Of responding firms, 27% reported this as the biggest issue. In spite of other weak indicators concerning labor markets, that was the strongest reading since November 2021 and was up significantly from September. In fact, the 9 percentage point jump marked a record monthly gain.What's more, the share reporting cost of labor as the biggest issue actually fell 3 percentage points to 8%.

More By This Author:

The 25 Most Heavily Shorted StocksHome Is Where The Pain Is

The "Kingda Ka" Of Stocks

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more