Home Is Where The Pain Is

Image Source: Pexels

Normally, on a day when the S&P 500 rallies more than 1%, you would expect to see most stocks trading higher along with it, but if there’s one group that seems to lag the market every day lately, it’s the homebuilders. Right on cue, the group’s performance today trails the overall market so much so that the iShares Home Construction ETF (ITB) is down on the day, just like it’s down on the year as well.

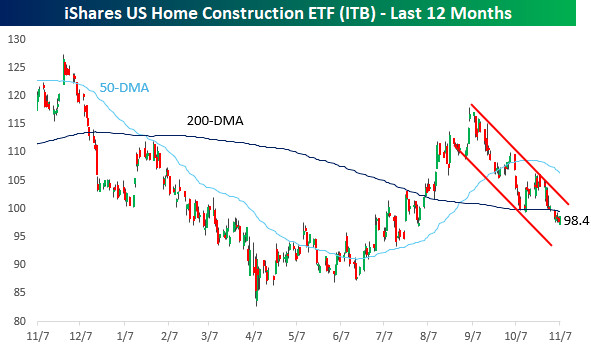

It's been a painful year for homebuilders. You have to go back nearly a full year to find the sector’s 52-week high, and from that peak in late November last year through the tariff-tantrum low, ITB plunged over 30%. Through late August, the sector erased most of its prior losses, but it has been a painful fall as Americans remain locked in their current homes because of low-rate mortgages, and most prospective buyers don’t have anywhere near enough money to afford a starter home. This is why the average first-time homebuyer is now a record 40 years old. As shown below, ITB remains stuck in a steep short-term downtrend, below its 200-DMA and much closer to 52-week lows than highs.

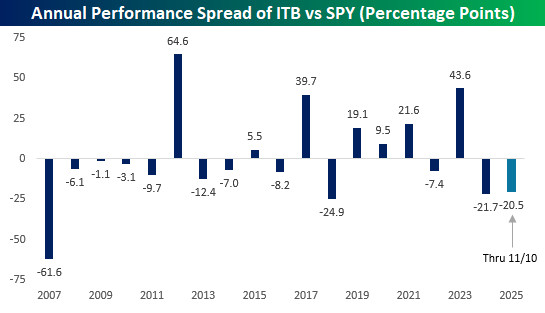

It’s been a bad year for homebuilders, but the underperformance versus the market isn’t anything new. The year’s not over yet, but last year, ITB underperformed SPY by an even larger amount than it has YTD. In 2018, ITB underperformed by close to 25 percentage points, and back in 2007, the performance spread was over 60 percentage points in favor of the S&P 500.

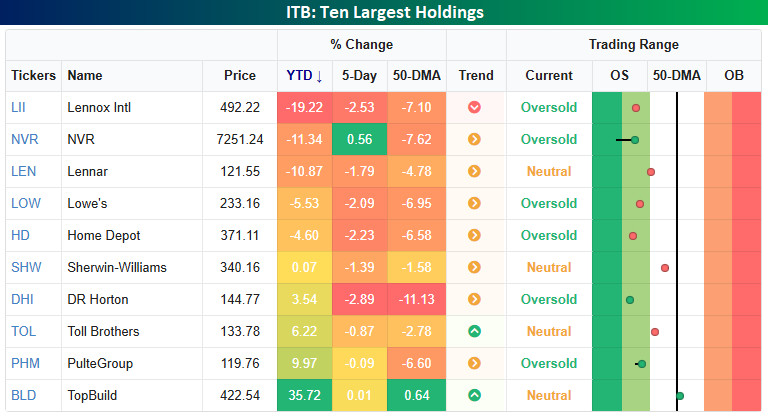

Looking at the performance of the ten largest holdings in ITB, YTD returns have been mixed. As its name suggests, ITB is a home construction ETF, so it’s not just made up of homebuilder stocks. Of the top ten holdings, only five stocks would be considered pure-play homebuilders, and only two of them – NVR and Lennar (LEN) - are down YTD. The worst performing stock of the group has been Lennox International (LII) with a decline of close to 20% YTD, while TopBuild (BLD), another non-homebuilder company, has rallied over 35%. It’s also the only stock listed that has managed to outperform the S&P 500.

Overall, six of the ten stocks shown are oversold, and all but BLD are below their 50-DMAs. For much of the last year, investors in the homebuilding space would say that lower rates would provide a tailwind for the sector. This year, though, the 10-year yield has declined from a peak of 4.8% in January to 4.1% now, and yet homebuilders haven’t been able to get out of their own way.

(Click on image to enlarge)

More By This Author:

The "Kingda Ka" Of StocksThe Best And Worst Stocks And ETFs Through October

What Volatility?

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more