The 25 Most Heavily Shorted Stocks

Image Source: Pixabay

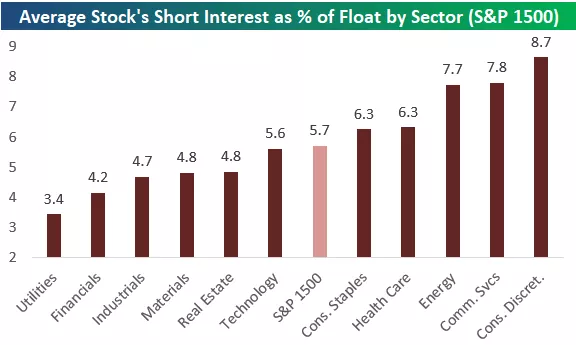

The average stock in the S&P 1500 - which contains large-caps, mid-caps, and small-caps - has 5.7% of its equity float sold short. Overall short interest levels are currently subdued relative to history.

As shown below, Consumer Discretionary stocks are the most heavily shorted at 8.7%, followed by Communication Services and then Energy.

Technology stocks are shorted slightly less than the broad market, while Utilities and Financials are the least shorted sectors.

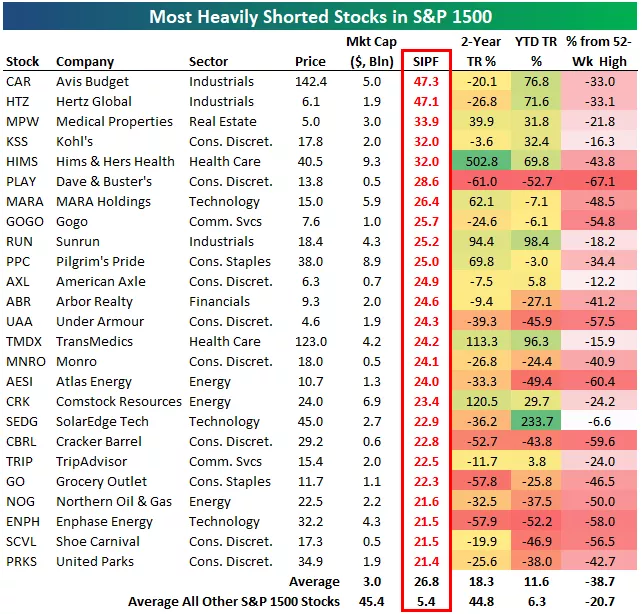

The table below lists the 25 most heavily shorted stocks in the S&P 1500 based on short interest as a percentage of float.

For each stock, we also include its two-year and year-to-date return along with its distance from its 52-week high.

Notably, two rental car companies -- Avis (CAR) and Hertz (HTZ) -- are the most heavily shorted with nearly half of their floats sold short.

Medical Properties (MPW), Kohl's (KSS), and Hims & Hers (HIMS) rank 3rd, 4th, and 5th with short interest levels at just over 30%.

All five of the most heavily shorted stocks are up more than 30% year-to-date, so the shorts have had a rough 2025 in these names.

Many of the other names on the list are down significantly on the year, but the overall average YTD move for these 25 stocks has been +11.6%, or a little over five percentage points stronger than the average YTD change for the remaining stocks in the index.

More By This Author:

Home Is Where The Pain Is

The "Kingda Ka" Of Stocks

The Best And Worst Stocks And ETFs Through October

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more