The "Kingda Ka" Of Stocks

Image Source: Pexels

When it comes to whatever area of the technology sector is popular, it’s usually safe to assume that Japanese billionaire Masayoshi Son’s investment holding company SoftBank (SFTBY) is active in it. The company always rides the wave when certain tech sectors get hot, but it’s usually along for the ride as the wave crests and starts to roll over. The last several weeks provide an excellent example.

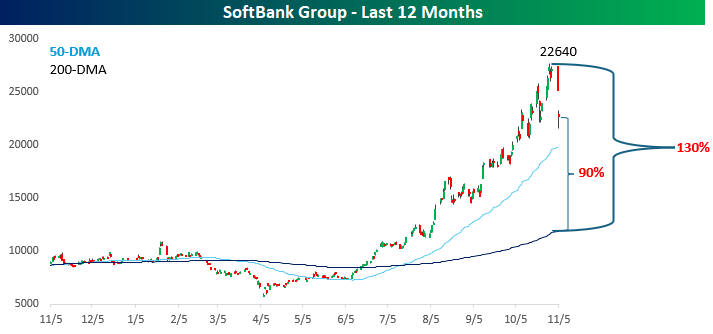

From the April low through its recent intraday high a week ago today, shares of SoftBank rallied more than 380% in the span of just over six months! However, as investors start to question the valuations of AI-related stocks and cryptocurrencies, the stock has quickly corrected. Shares kicked off the week on Tuesday (Monday was a holiday in Japan) by declining 7% and followed that up with an even larger encore overnight, falling more than 10% today. On both a one-day and two-day basis, the declines rank as the steepest since the April lows.

What’s bananas about SoftBank, though, is that even after the declines in the last two days, the stock is still 90% above its 200-day moving average (DMA)! Robinhood (HOOD), the best performing stock in the S&P 500 this year, is ‘only’ 65% above its 200-DMA, so 90%, let alone the 130% that SoftBank was trading above its 200-DMA last week, is incredible.

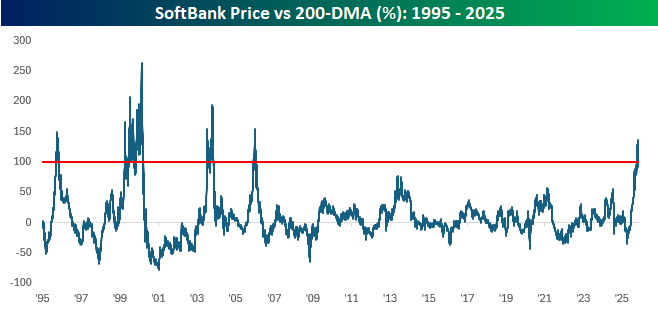

Relative to its own history, SoftBank’s recent peak of trading 130% above its 200-DMA was the widest spread since December 2005, when its 200-DMA spread reached 154%. Believe it or not, that wasn’t even the stock’s peak. In 2003, the spread reached 190%, and at the height of the dot-com bubble, the spread surged to 262%, or double what the spread just recently peaked at. Double! When it comes to investing, most advisors suggest that slow and steady wins the race, but Masayoshi Son has shown that there are other ways to get from here to there.

More By This Author:

The Best And Worst Stocks And ETFs Through OctoberWhat Volatility?

Anticipation Builds

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more