Social Security Checks Could Rise By 10% In 2023

Last month, the Social Security Administration said it planned to increase its cost-of-living adjustment (COLA) for 2023 by 10.5%, the largest boost in decades. That would have brought the average Social Security recipient’s benefit up by $175 to $1,668 a month.

The change in the expected COLA each year is largely based on the Consumer Price Index (CPI) which rose at an annual rate of 9.1% in June, the highest level in more than 40 years. But then the CPI dropped slightly to 8.5% in June, suggesting the COLA would increase only 9.6% next year – still the largest increase in decades.

The Social Security COLA for the next year is determined based on the CPI for the 12 months ended in September. So, once we get the CPI for September, the COLA for 2023 will be calculated and the final result will be announced in October.

So, it looks like Social Security recipients are about to receive a COLA that finally meets or beats inflation. Of course, that still depends on what inflation does next year, but it is good news for seniors.

This year, Social Security raised the COLA by 5.9%. While the 51 million Social Security recipients were undoubtedly happy for the increase, it has not kept up with inflation, forcing many seniors to tap into their savings to cover such essentials as gas and food.

However, if inflation doesn’t continue to rise significantly – and more and more forecasters believe it probably topped out in June – Social Security recipients will finally get a COLA which beats the CPI inflation rate. That’s the good news.

Real Inflation Rate Significantly Higher Than The CPI

The bad news is that many economists agree the Consumer Price Index understates the real rate of inflation, not only due to the way it is calculated but also the basket of goods and services it considers.

Another widely followed inflation gauge is the TIPP Poll which is created by TippInsights.com and has been published monthly for over 30 years. The TIPP organization also publishes other polls including one on presidential elections. The TIPP Poll has the much-coveted distinction as the most accurate poll out there, being the only poll to accurately predict the winner of the last five US presidential elections.

The latest TIPP Poll has the US inflation rate running at 12.6% for the 12 months ended July, a 4.1-point increase over the CPI. If the TIPP Poll is indeed more accurate, and many forecasters believe it is, then Social Security recipients are still receiving benefits which are below the real inflation rate.

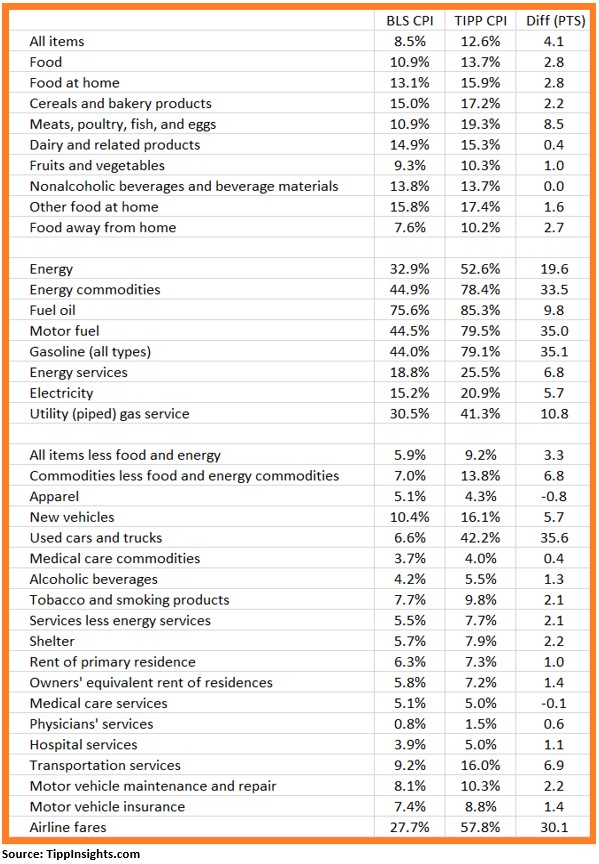

Let’s look at some examples of how inflation has increased in specific sectors in the TIPP Poll versus the Bureau of Labor Statistics’ (BLS) Consumer Price Index since President Biden took office.

Core inflation is the price increase for all items, excluding food and energy. The annualized TIPP Core CPI was 9.2% in July, compared to 5.9% BLS CPI in the year-over-year measure, a 3.3-point difference.

Food prices increased by 13.7% per TIPP since President Biden took office compared to 10.9% as per BLS CPI, a difference of 2.8 points.

Energy prices increased 52.6% per TIPP compared to 32.9% according to BLS CPI, a difference of 19.6 points.

Gasoline prices have increased by 79.1% since President Biden took office, according to TIPP. However, the BLS CPI for gasoline rose only 44.0%, a huge difference of 35.1 points.

Airline ticket prices under President Biden have risen 57.8% per TIPP, compared to BLS CPI of only 27.7% for the same period.

Here is a more detailed list of the TIPPs vs. BLS CPI:

I’m not sure exactly why there is such a disparity between the TIPP CPI and the BLS CPI, other than the methodology used to calculate them. But as noted above, many economists – and many consumers for that matter – have long believed the BLS CPI understates the real inflation rate.

Inflation Remains Americans’ Top Concern

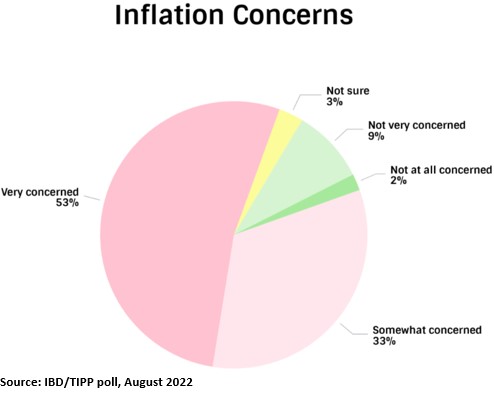

The latest Investor’s Business Daily/TIPP Poll completed earlier this month showed that nearly nine in ten, or 86%, of survey respondents are worried about inflation. Over the past 12 months, inflation concerns have stayed above 80%, making inflation their top concern. The share of “very concerned” has been around 50% consistently.

Most respondents (54%) say their wages have not kept pace with inflation. Only one in six (17%) say that it has. The share who said wages had kept pace has hovered in the 17% to 20% range since January 2022.

The bottom line is inflation is at the highest level in more than 40 years. Maybe it peaked in June at 9.1%.We’ll see. Whether it did or not, inflation remains Americans’ number one concern, and wages are still running below the inflation rate if we use the TIPP data.

More By This Author:

Household Debt Tops Record $16 Trillion In 2022

Economy Not In Recession Until NBER Says It Is

2Q GDP Falls 0.9% – Looks Like We Are Now In A Recession