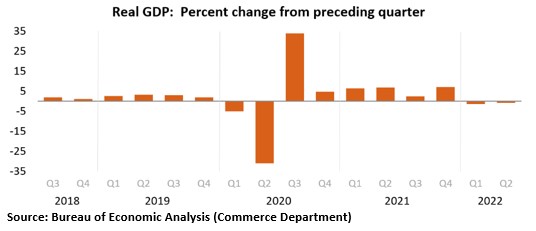

2Q GDP Falls 0.9% – Looks Like We Are Now In A Recession

The Commerce Department reported this morning that US Gross Domestic Product fell at an annual rate of 0.9% in the second quarter. This followed a decline of 1.6% in the first quarter. Thus, by the traditional definition of two or more consecutive quarters of negative GDP growth, we are now in a recession.

Today’s report came in weaker than expected. A pre-report survey of economists and forecasters by Bloomberg showed the advance 2Q GDP report coming in at +0.3%, so today’s 0.9% decline is clearly a disappointment — although it could be revised higher in subsequent reports.

The big question now is, what will the economy do in the 3Q of this year? It is very rare for the economy to contract three quarters in a row, but it could happen if growth doesn’t pick up in the July-September quarter. Time will tell.

The 0.9% decline in the 2Q was highlighted by decreases in private inventory investment, residential fixed investment, federal government spending, state, and local government spending, and nonresidential fixed investment, according to the Commerce Department.

The good news in today’s GDP report was that consumer spending actually rose slightly in the 2Q. Consumer spending accounts for over two-thirds of GDP. With consumer spending remaining strong, at least for now, this would suggest the recession will not be a severe one. This is the indicator we’ll want to watch most closely in the weeks just ahead.

Also, the labor market remains incredibly strong and several other sectors are solid as well. The US unemployment rate remained at 3.6% for the fourth consecutive month in June, the lowest level since February 2020. Plus, the number of unfilled jobs remains near a record high at approx. 11 million, as employers continue to struggle to fill openings.

And finally, back-to-back quarters of negative GDP do not automatically mean we’re in a recession, especially when they are modest declines as we’ve seen this year. The official arbiter of when recessions occur is the National Bureau of Economic Research, so it will be important to see what they have to say about whether we are actually in a recession or not.

Fed Raises Key Interest Rate Fourth Time This Year

As was widely expected, the Federal Reserve raised the target range for its benchmark Fed Funds Rate by 75-basis points to 2.25%-2.50% at the conclusion of its July policy meeting yesterday. The latest increase marks the fourth consecutive rate hike this year, pushing borrowing costs to the highest level since 2019.

In his press conference following the meeting, Fed Chairman Jerome Powell said more interest rate hikes are likely this year, but he didn’t give much of a clue how large they might be. The next Fed Open Market Committee Meeting is on September 20-21.

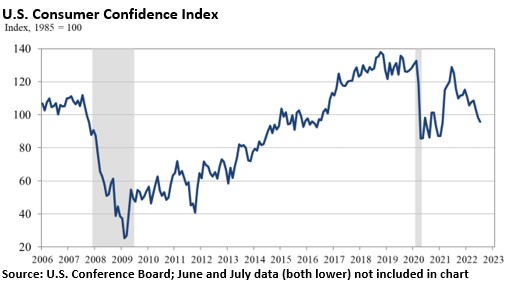

Consumer Confidence Slides For 3rd Consecutive Month

US consumer confidence slid again in July as higher prices for food, gas and just about everything else continued to weigh on Americans.

The Conference Board reported Tuesday that its Consumer Confidence Index fell to 95.7 in July from 98.4 in June, largely due to consumers’ anxiety over the current conditions, particularly four-decade high inflation. The business research group’s Present Situation Index — which measures consumers’ assessment of current business and labor market conditions — fell from 147.2 to 141.3, a big drop in one month.

The government’s Consumer Price Index soared 9.1% over the past year, the biggest yearly increase since 1981, with nearly half of the increase due to higher energy costs. US inflation surged to a new four-decade high in June because of rising prices for gas, food, rent, and just about everything else — squeezing household budgets and pressuring the Federal Reserve to raise interest rates aggressively. This raises the risk of a recession if we’re not already in one.

Biden Most Unpopular President In US History

In June, President Joe Biden had the lowest approval rating in the history of modern polling. According to the average of FiveThirtyEight’s polls, apprx. 60% of American citizens do not approve of the job Joe Biden is doing. Only 38% of Americans said they had a favorable opinion of Joe Biden. Biden’s approval rating is now lower than Harry S. Truman who previously held that distinction.

Inflation that is out of control and the worsening condition of the nation’s economy are both being blamed on Biden by voters. His record low approval rating will no doubt be problematic for Democrats in midterm elections. Even among Democrats and minorities, there is evidence to suggest that they are turning against the ailing president, and some are openly urging him not to run for re-election. We’ll see what happens.

More By This Author:

Americans’ Inflation Expectations Hit Record High In JuneBiden Policies Created Worst Inflation In 40 Years

First Half 2022: A Terrible Time For Most Investors