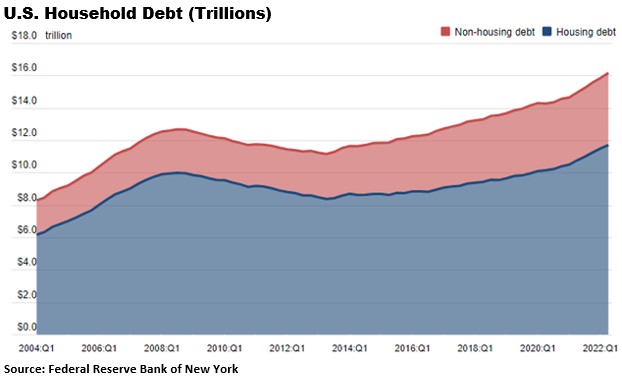

Household Debt Tops Record $16 Trillion In 2022

US household debt increased to a record $16.15 trillion in the second quarter, driven mostly by a $207 billion jump in mortgage balances, with credit card and auto loan debt also rising as consumers lifted their borrowing to deal with soaring inflation, a Federal Reserve report showed on Tuesday.

Overall delinquency rates also rose modestly for all debt types, with delinquencies for credit cards and auto loans “creeping up,” particularly in lower-income areas, the New York Fed’s quarterly household debt report said.

Mortgage debt increased to $11.39 trillion at the end of June, according to the report. Purchase mortgage originations were up 7% in the second quarter, with much of the increase attributed to higher borrowing amounts.

There has been a steep rise in prices for big-ticket items such as homes and autos over the past two and a half years as demand outstripped supply. As a result, the average dollar amount for new purchase originations for both those items has risen 36% since 2019.

More recently, Russia’s February invasion of Ukraine caused a spike in food and energy costs around the world.

Total US household debt balances are now more than $2 trillion higher than they were in the fourth quarter of 2019, just before the pandemic began, the New York Fed said.

Credit card balances increased by $46 billion in the second quarter, among the largest seen by the Fed since 1999, while auto loans rose by $33 billion to $199 billion. This primarily reflected higher amounts per new vehicle than a greater volume of loans, the report said.

“All debt types saw sizable increases, with the exception of student loans,” the regional Fed bank’s researchers said. “In part, the growth in each debt type reflects increased borrowing due to higher prices.”

The average interest rate on a 30-year fixed-rate mortgage has shot up by more than 240 basis points (2.40%) since the turn of the year to levels not seen since 2008, according to the Mortgage Bankers Association. It now stands at 5.74%.

New York Fed researchers said delinquency rates were increasing to more typical pre-pandemic levels seen in 2019 that are still historically low. “But we have to keep an eye on that because if they rise above that we’ll be a little more concerned about the state of household balance sheets. The concern is where we are heading.”

The US central bank began raising interest rates in March as it exited the easy money policies it had kept in place during the worst of the COVID-19 pandemic to shield an economy pummeled by lockdowns and other protective measures.

Since then, stubbornly high inflation running at four-decade highs has compelled policymakers to raise the Fed’s benchmark overnight lending rate by 225 basis points (2.25%) to a target range between 2.25% and 2.50%. Further interest rate increases are forecast for the rest of this year as the central bank attempts to quash inflation that is sapping the pocketbooks of Americans.

The Fed Open Market Committee meets three more times this year on September 20-21, November 1-2 and December 13-14. My guess is the FOMC will raise the Fed Funds Rate by 0.50% at each of those meetings, following the 0.75% increases at each of the previous two meetings. That would put the Fed Funds target range at 3.75% to 4.0%.

The Consumer Price Index rose at an annual rate of 9.1% in June (latest data available), the highest level in over 40 years. The Personal Consumption Expenditures Price Index (PCE), the Fed’s favorite inflation index, rose at a 6.8% annual rate in June, also the highest in decades.

The Fed’s mission is to get the inflation rate down to its target of 2%, but even with three more interest rate hikes this year, I don’t think the Fed will get inflation anywhere close to that number by the end of this year. So, I look for more interest rate hikes by the Fed early next year, unless we’re in a recession – which is looking more and more likely.

As I wrote in Forecasts & Trends on Tuesday, many forecasters believe we’re already in a recession, what with back-to-back negative quarters of GDP growth in the first half of this year. It remains to be seen when the National Bureau of Economic Research will declare that we are officially in a recession. I’ll let you know if they do.

More By This Author:

Economy Not In Recession Until NBER Says It Is2Q GDP Falls 0.9% – Looks Like We Are Now In A Recession

Americans’ Inflation Expectations Hit Record High In June