One Year Ahead Inflation Expectations For July (And Forward 2-3 Year) Drop

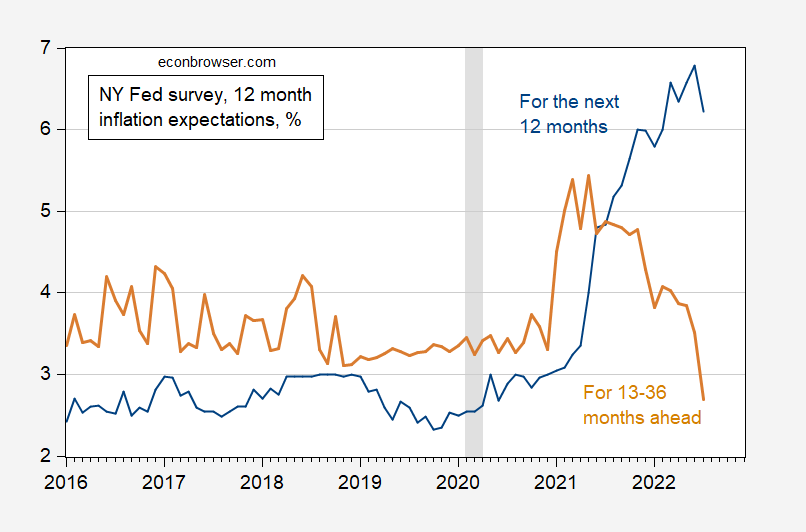

The NY Fed measure of inflation expectations dropped dramatically from 6.8% in June to 6.2% in July. This is a much larger drop than the Michigan series (0.1ppt).

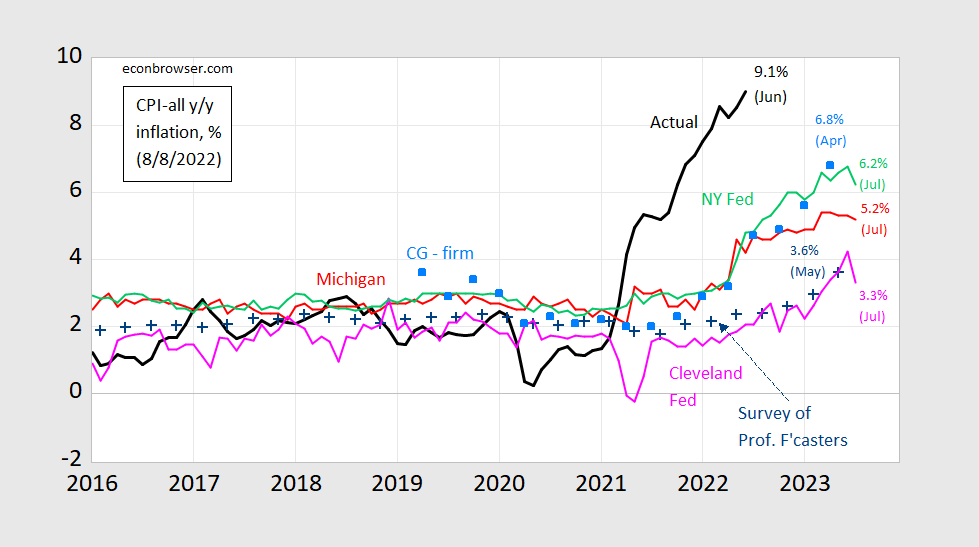

Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink), mean from Coibion-Gorodnichenko firm expectations survey [light blue squares]. Michigan July observation is preliminary. Source: BLS, University of Michigan via FRED and iPhiladelphia Fed Survey of Professional Forecasters, NY Fed, Cleveland Fed and Coibion and Gorodnichenko.

Not only did the median one-year expected drop, so too did the implied 12-month inflation rates for 2-3 years out (h/t Steven Englander/Standard Chartered).

Figure 2: One year median from NY Fed Survey of Consumer Expectations as of indicated date (blue ), implied 12 month growth rates for 2-3 years out (tan). Source: NY Fed, and author’s calculations.

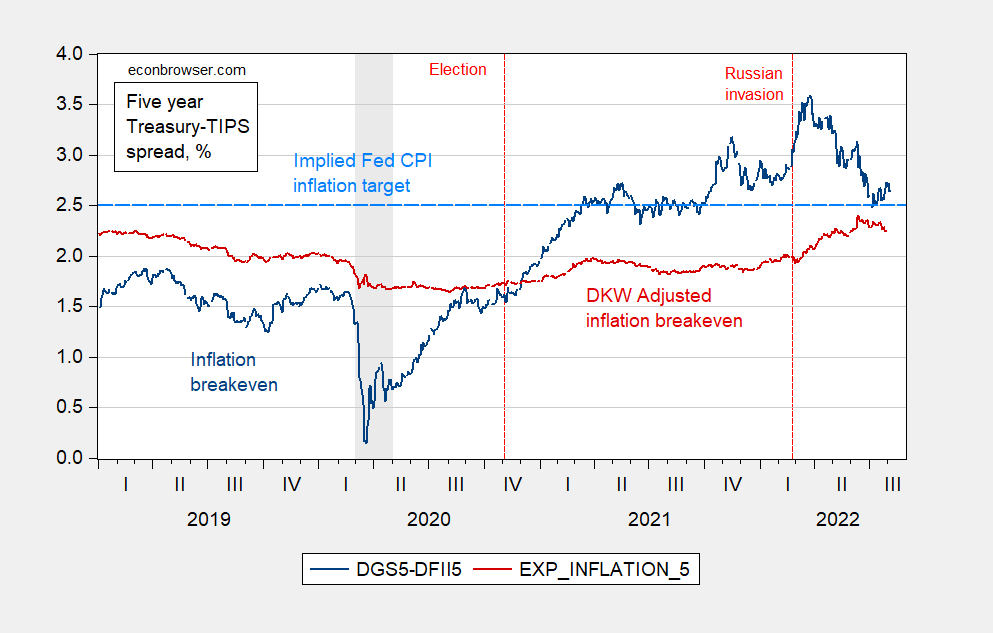

Notice that the longer term expected rate 2-3 years out is back to (and less) than where it was pre-pandemic. This is consistent with the five-year inflation breakevens (unadjusted and adjusted) reported in yesterday’s post.

Figure 3: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue, left scale), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red, left scale), both in %. Light blue dashed line at 2.5% CPI inflation, consistent with 2% PCE inflation. NBER defined recession dates shaded gray. Source: FRB via FRED, Treasury, NBER, KWW following D’amico, Kim and Wei (DKW) accessed 8/4, and author’s calculations.

More By This Author:

Inflation Expectations vs. Fed Inflation Target: Now Not That Far Off (If It Ever Was)NFP Growth Of Over 500K In Historical Perspective

Inflation Breakeven And Term Spreads Adjusted For Premia