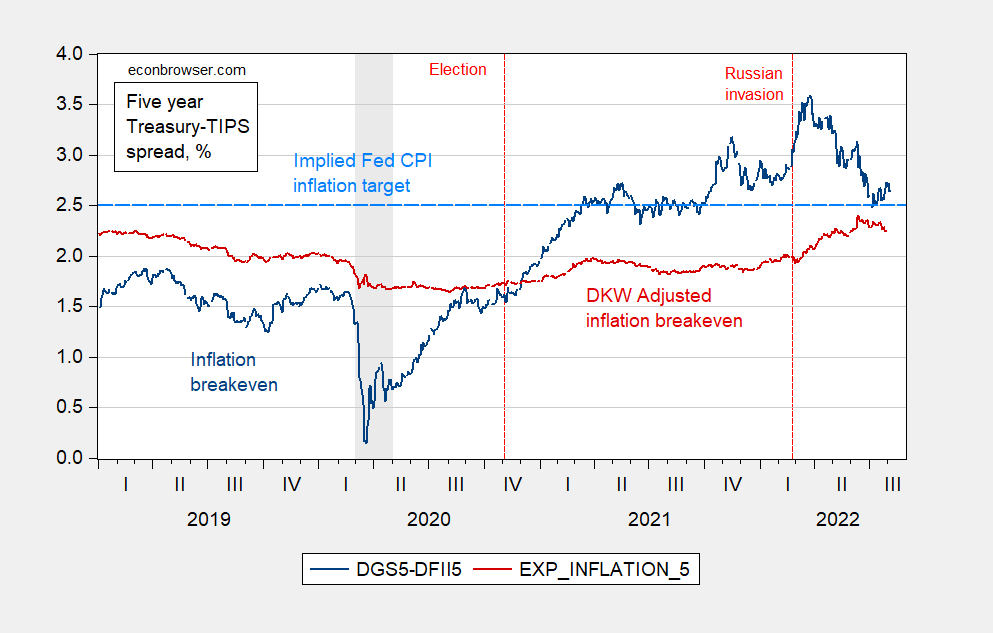

Inflation Expectations Vs. Fed Inflation Target: Now Not That Far Off (If It Ever Was)

The Fed’s inflation target is 2% on PCE inflation. CPI inflation has averaged 0.5 ppts above PCE inflation since 1967. Putting these two points together, we see that expected inflation over the next five years is pretty close to target (h/t Mark Zandi).

Figure 1: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue, left scale), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red, left scale), both in %. Light blue dashed line at 2.5% CPI inflation, consistent with 2% PCE inflation. NBER defined recession dates shaded gray. Source: FRB via FRED, Treasury, NBER, KWW following D’amico, Kim and Wei (DKW) accessed 8/4, and author’s calculations.

That characterization uses the conventional 5 year Treasury-TIPS spread as the market’s measure of expected inflation. Accounting for inflation risk and liquidity premia, an alternative measure of estimated inflation compensation (red line) indicates we are below target.

More By This Author:

NFP Growth Of Over 500K In Historical PerspectiveInflation Breakeven And Term Spreads Adjusted For Premia

So You Think We’re In A Recession As Of Mid-July?