Market Briefing For Wednesday, July 5

Consensus on a 'steepening yield curve' still has many money managers as well as strategists either defensive, bearish, or rationalizing how they missed this year. It's not been easy and even the case for those of us who argued for 'no catastrophe', no debacle, and no short-selling.

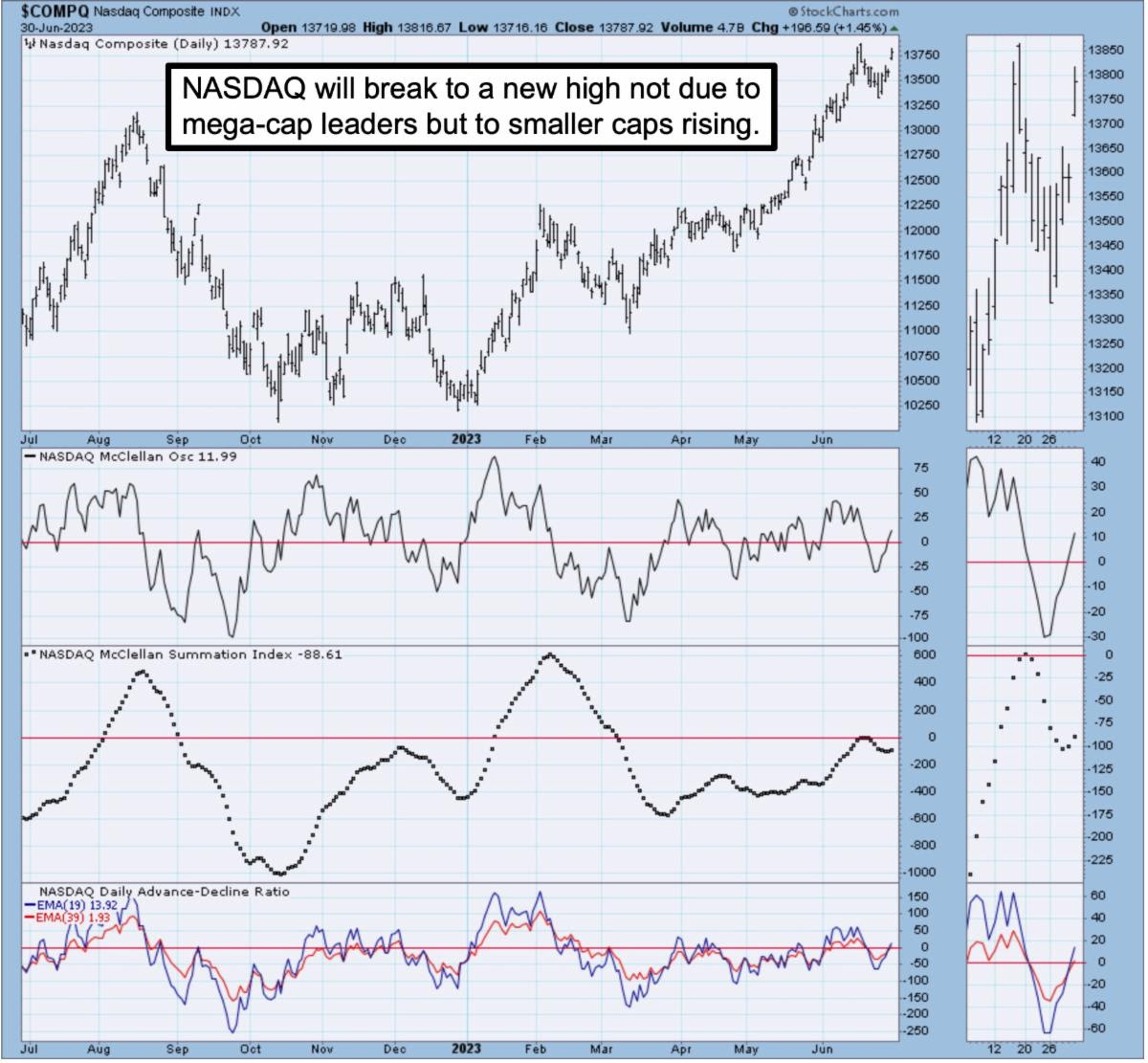

It was a complex bottom painfully patiently constructed (October inverse 'head & shoulders' bottom). The interesting part is that 'fireworks' only were mostly visible in the 'magnificent 7' or a couple AI stocks. But it's more than AI; while it is fine to use that as an excuse by those who didn't foresee the grinding rise that is still ongoing.

In selected areas envision those naysayers as somehow finding their way to the buy-side of the ledger trying to recover performance in the 2nd half, which is usually the rockier half of the year. So that's the challenge ahead and sure needs to avoid significant major geopolitical clash expansion in months ahead.

Believe it or not.. buyback are back and that may help the 2nd half too. Citi, General Motors. Cleveland Cliffs, Apple or others in Energy, Financial and so on, which are doing and/or planning too. That should also stabilize things to enable the 'real' fireworks we suspect in (again) Ai, and some 'space' stock selections that have been very mediocre so far this year; but might catch bids.

In sum: market strong; first half challenging but made it higher close to the pattern outlines provided all year; and we see 2nd half also tricky but with money managers eager to provide performance this missed in the first half.

Bottom line: Just charts mostly; things going as anticipated and will likely be continuing for now (up into early-mid July has been the forecast for weeks).

Cheers... enjoy the rest of the weekend!

More By This Author:

Market Briefing For Monday, Jun 26

Market Briefing For Thursday, June 22

Market Briefing For Wednesday, June 21

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more