Market Briefing For Thursday, June 22

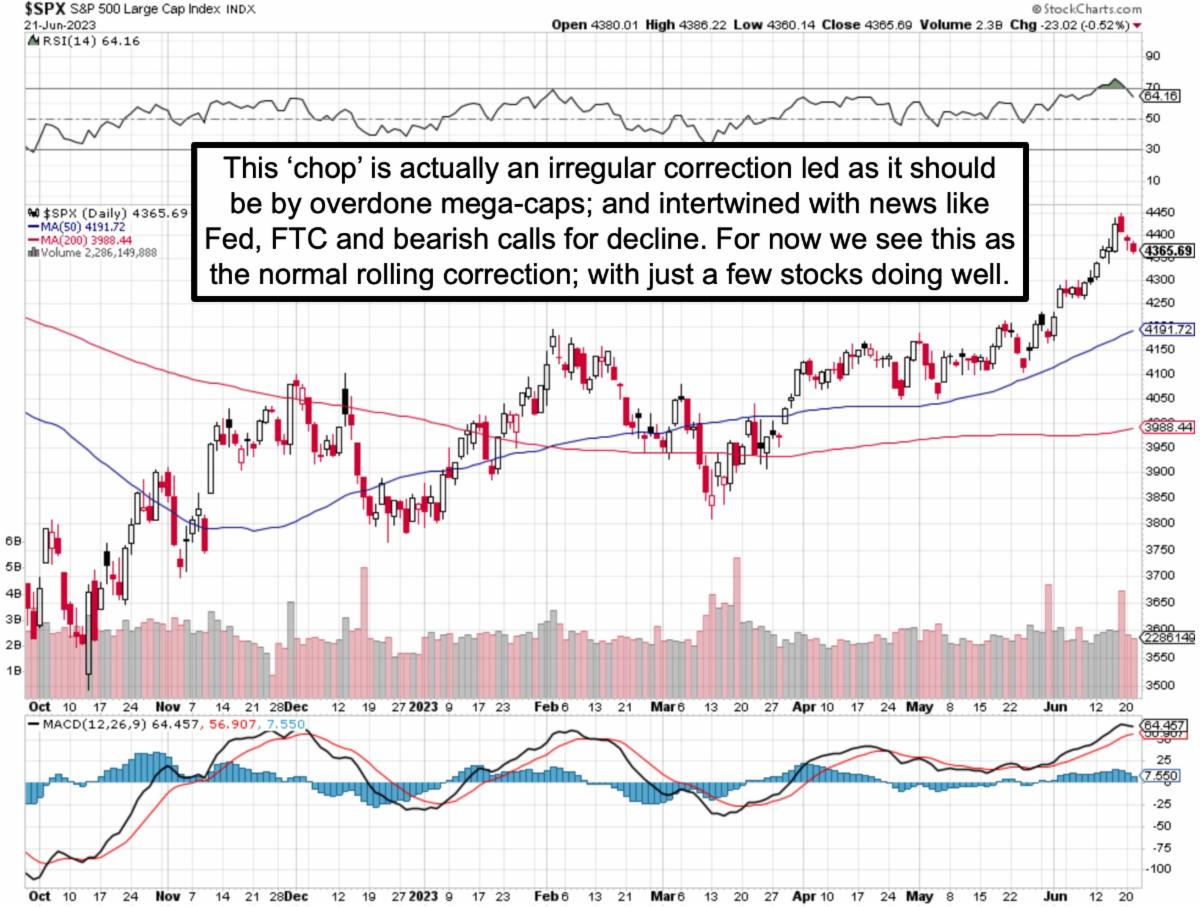

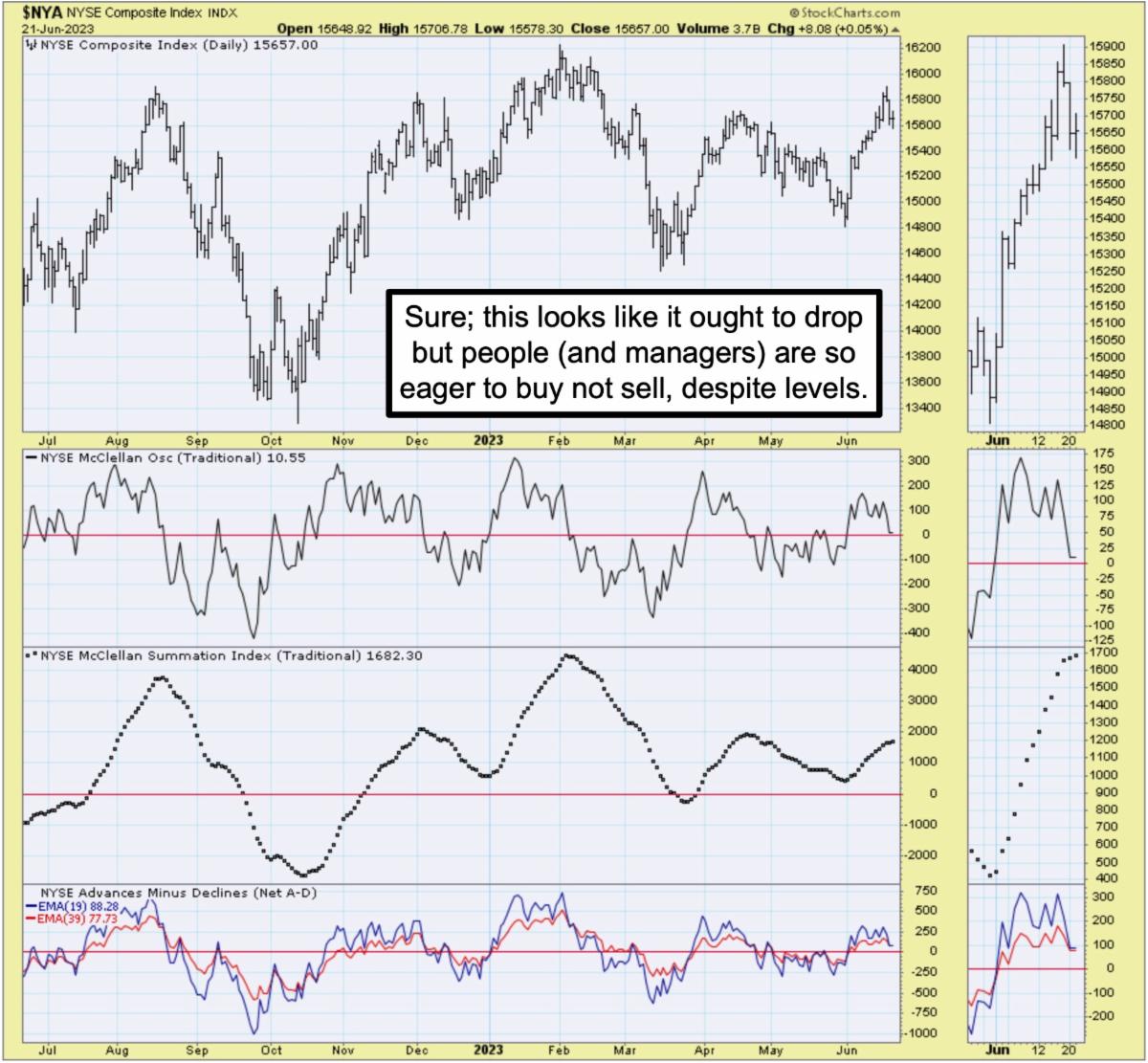

Skating on a razor's edge is how many technicians have and do view S&P action here. I do not. I believe it's circling at a high level (even over a trading range that prevailed), and depends more on the 'run of the mine' stock than dependency on the magnificent 7' or so, to lead the forward Index movement.

The market remains out-of-balance, or bifurcated as I described it last year as well as most of this year. Tech is still leadership, Oil is lagging but recovering as I suspected likely, and buyers are digging for under-exploited small-caps in AI and some tech areas (like SoundHound), versus overpriced (like Nvidia).

At the same time the FTC's action against Amazon (AMZN) is almost irrelevant, as it got some media attention, but this is nonsense about not being able to easily cancel 'Prime' (delivery and video service and so on). It's not hard with just an once of computer knowledge, but may reflect Washington's desire to throttle a few mega-cap companies. In fact that 'sense' might be attributed to by some as reasons for an S&P shakeout, but actually the post-Expiration dip was just part of a logical pattern we looked for in these day's after that upward phase.

In-sum:

The evolution, including weeks of generally improving breadth and the higher range for the S&P, continues. That pattern-call included post-Expiration shakeout risks, followed by a trading buy point ahead of a rally into early July.

All that was simplified by our weekend call for a 'choppy' week, which this is in spades, that's for sure. It is truly a 'Summer Market' (some are up and some are down). There's no particular issues to reflect upon other than I do in video.

I do suspect there could be some spillover about the monopolies implied by a stronger Federal Government, regardless if the FTC practices alleged really ended awhile ago. So hefty fine or not it's more an issue of 'symbolism' that it is anything else. But you also have Alphabet (GOOGL) accusing core rival Microsoft (MSFT) of anti-competitive practices in a separate complaint to the FTC.

I don't know if a further linear shakeout occurs or not, but generally choppy for a few days here was and is the expectation, towards the Quarter's end and the re-balancing that's still ongoing and not directly tied to the past Expiration.

Bottom-line:

More chop.

More By This Author:

Market Briefing For Wednesday, June 21

Market Briefing For Tuesday, June 20

Market Briefing For Thursday, June 15

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more