Market Briefing For Monday, Jun 26

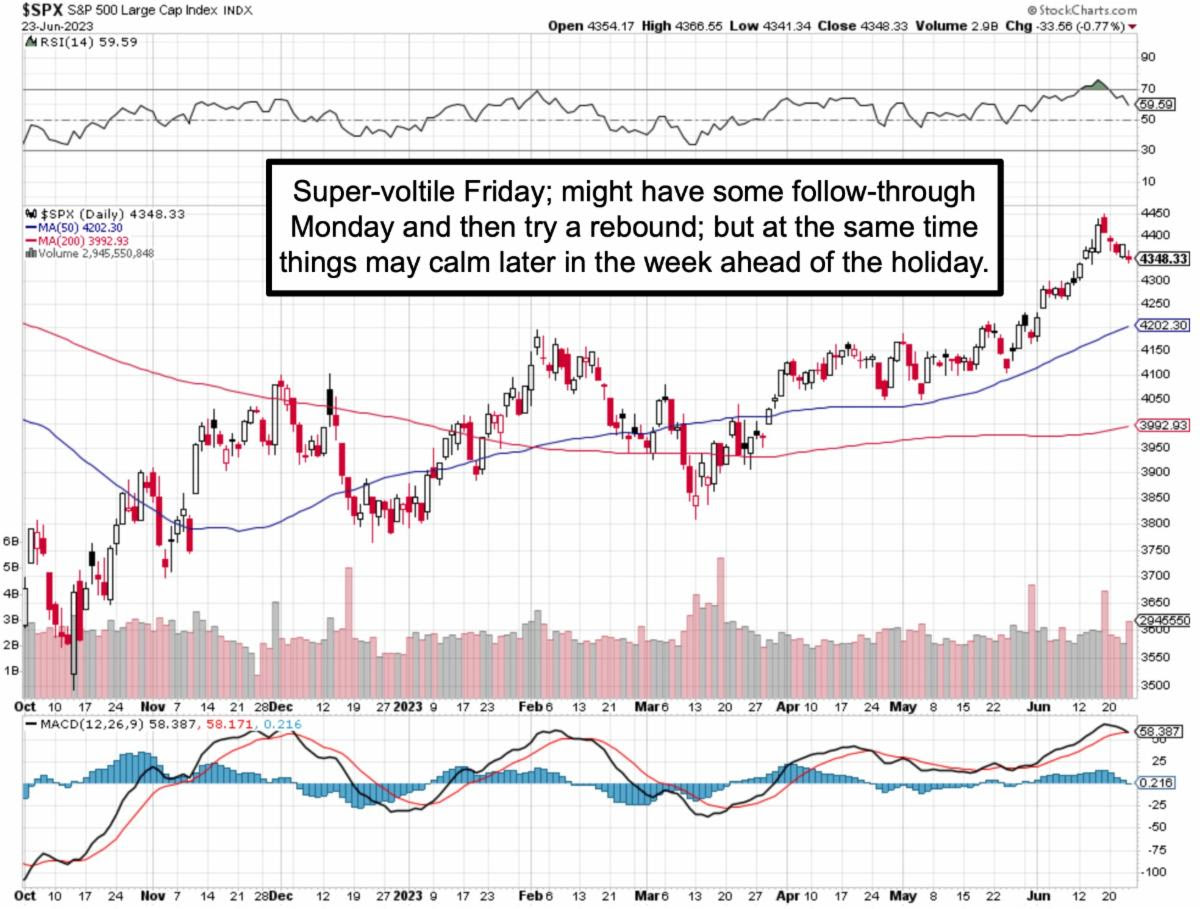

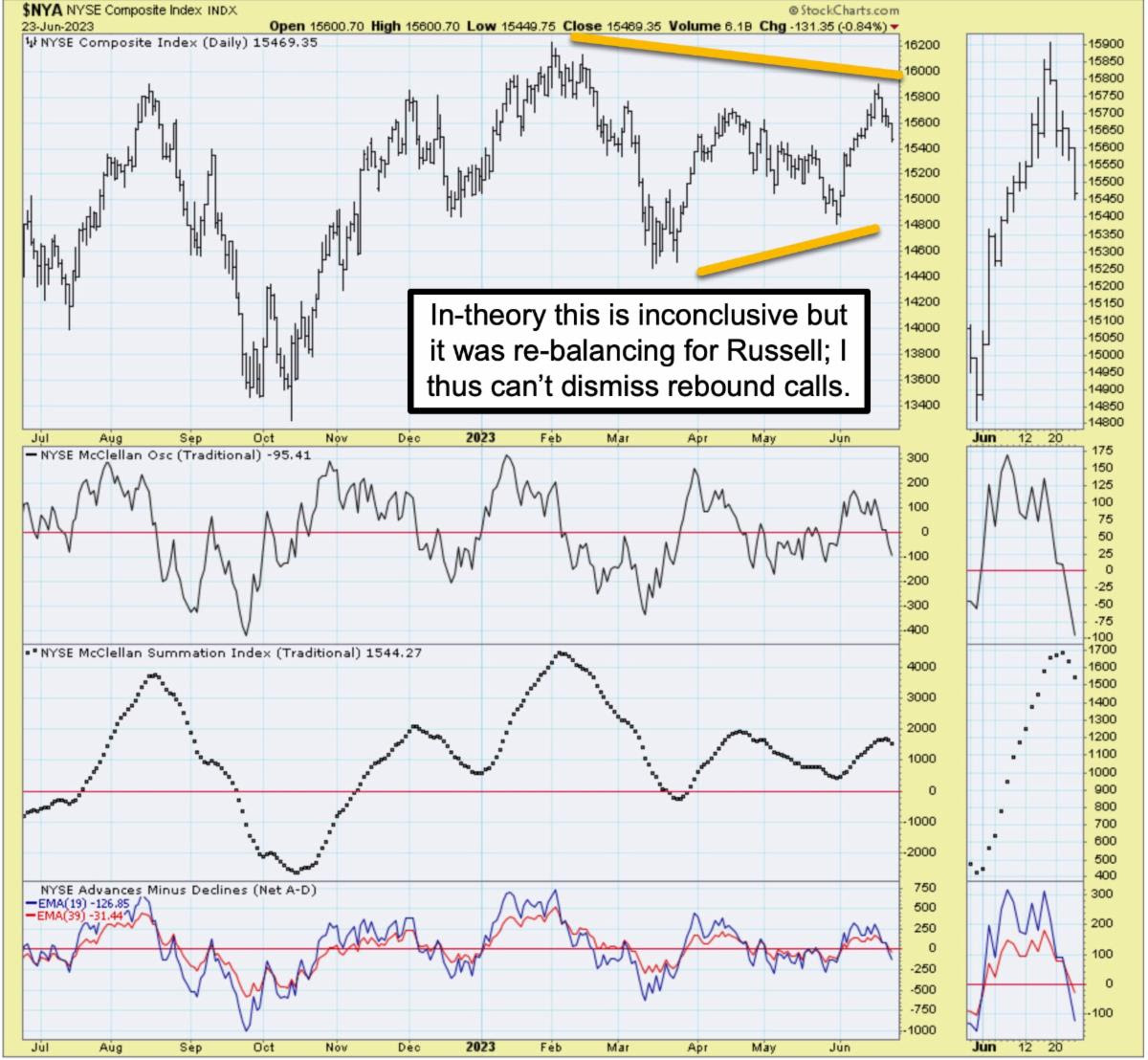

Quarter-end shuffling is a big part of huge 'churn' in the S&P and Russell (as Friday was the big day for changes in the Russell Indexes). Part of this is the shift from over-exploited to under-exploited sectors or stocks; and totally I suspect it is most easily visible in the QQQ, where a serious 3 billion Dollars in outflows occurred in this week; as bigger tech names didn’t hold gains. Well, we've been waiting for a mega-cap shakeout; even temporary; so there it was.

This isn't so much a bearish sign, although superficially ponders being that. Of course mega-caps are generally overpriced; been saying that for weeks. It's whether or not investors (especially money managers) let the market fall of its own weight so to speak, or absorb smaller-cap stocks (many eroding too) to offset sales in mega-caps, if indeed they had gains and thus cash available. It was mixed on the Close; so that's hard to say: except AEHR had a 2.5 million trade in Friday's final minute; held together and now part of the Russell 3000. I think it's reflecting a note of confidence amid many stocks that are uncertain.

So it's a bit opaque at the moment; we want to see if we get a down-up week toward the 'actual' Quarter's end (tends to be sloppy some times ahead of the 4th of July holiday); and then see grudging efforts to revive interest thereafter.

That of course would be the idea of a rebound into mid-July (maybe before); but it's hard to estimate at this moment. I used to call it the 'Mom's Birthday' rally (I still do in deference to Mom ... RIP). This year however it's more mixed as you have overpriced segments that deserve to correct and others that are being pummeled mercilessly sometimes, and without real justification. Mixed, but very defensive in Friday's late going; regardless of follow thru shifts again.

In sum: While I'm still anticipating a modified rebound (again bifurcated but a bit differently perhaps; can't tell yet); I must note that July often is rocky in the year before National Elections; but this is not the 'Farmer's Almanac', as we're in a convoluted bifurcated market (have been for more than this year) which it seems can minimize the significance of any seasonally-common patterns.

There might be some 'internal drama' that impacts the war's continuation. Hard to call it a civil war in Russia; but did Ukraine just flip a mercenary Army against Putin?

It's obvious the Wagner Group is even worse than Putin; scamming diamonds and gold in Africa (and they were in Syria) and really primarily convict types. I suspect Ukraine looks at this and says 'go get each other' and crosses fingers the Moscow maniac doesn't try offsetting this with tactical nuclear weapons.

We do find the expansion of 'Chip Act' funding to domestic semiconductor (or 'fabs') construction as interesting, because it clearly differentiates from global build-outs; not just those in China; although I thought the original 'Act' already provided that. If anything companies like Taiwan Semi., Global Foundries or Intel, will be more incentivized to build in the USA. (It's worth nothing that Intel has been scouting Mexico, Israel and Germany for potential sites; so this kind of funding - if Washington can find the money - helps point to domestic bias for build-outs, and that will likely evoke protestations from Europe etc.)

There are a number of companies trying to be everything to everyone when it comes to AI; and our interest is primarily in less expensive companies with at least the potential to increasingly monetize the AI business starting this year; with a couple speculative 'bets' on AI's whose success is further afield if at all.

I'm chagrined at the behavior of a couple stocks (BBAI and SOUN) on Friday; but generally have to see how they do after this re-balancing time-frame gets past

We anticipated a 'reversion-to-the-mean' trade for Nasdaq and the S&P; but Powell's comments of one or two more rate hikes didn't help hold things given right in the midst of not just our projected shakeout; but Russell re-balancing.

As to the Florida law (expect an injunction) against certain foreign buyers of real estate; well the State of Florida supposedly doesn't make Foreign Policy nor property law as they just did; but it has some bipartisan support. It didn't differential fairly in the case of 'refugees' as opposed to citizens of named countries just looking to buy. Russians and Chinese have been major buyers for years in Florida; a good part of price appreciation in Miami particularly. Venezuelans comprise a true 'expat' community and they panicked over this prospect.

Bottom line: Tech exuberance began fading this week; especially with a large QQQ outflow after Quarterly Expiration a week ago. This is not so much fears about banks, interest rates or geopolitics; but shuffling as we've discussed at the Quarter's end, which was temporarily masked by Quarterly Expiration and that set the market up for a shakeout. Maybe not comfortable; but projected.

The new week takes us into the July 4th weekend; so sometimes things calm if many are away; but this is a year where travel has been more of a hassle it seems than anything else; not to mention the mess in most American cities as well as generally bad weather 'across the Pond' (along with intense heat). So I wonder if that keeps more people watching markets than watching for sharks (of course there are some of those in lower Manhattan too .. hah).

More By This Author:

Market Briefing For Thursday, June 22

Market Briefing For Wednesday, June 21

Market Briefing For Tuesday, June 20

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more

thoughtful as usual.

Thank you Sir; I appreciate it.