Market Briefing For Tuesday, Sept. 14

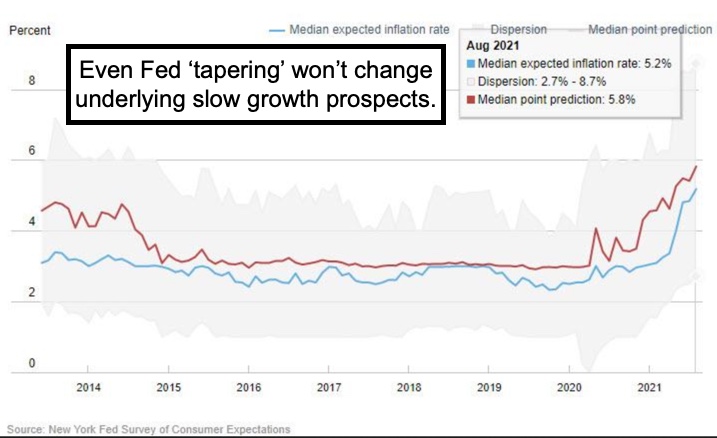

Inflation and COVID are tied at the hip in this market and economic scenario. I assessed inflation as 'enduring and not transitory' all along, and where COVID comes into-play is as a 'spoiler' of significant growth rates needed to avert the 'stagflation' condition that I've felt has already arrived. That's always been the 'wild card' looking forward to 2022 and still is. Delta variant is part of it, but the lack of effective treatments and drugs defines the persistent risk.

There's plenty of blame or daggers that can be thrown. At the Fed not being passive and unwilling to 'taper sooner', although that wouldn't entirely help as there are other issues contributing to higher prices. At the Congress for super insane spending, though there's little doubt the Nation needs infrastructure as well as other updates, but it's not happy when hearing about 'paying for it all'.

COVID 'boosters' don't provide meaningful additional protection (in general with a few exceptions), so besides hitting Moderna (MRNA) stock today, it reminds people that the vaccine protection is varied (depending on variants and differs in part of the world vs. another actually). So that because of variants, assumptions of the two-shot regimen are also not necessarily providing truly broad protection, and that's impacting the willingness of lots of people to resume normal life as far as activities, regardless of whether their State is open or more restricted.

That brings opportunity for next-generation vaccines to reinvigorate optimism, and a sense of getting through this pandemic, as does promise new treatment and drug prospects. And yet Washington bureaucrats, while seeming tired as well as frustrated over their flip-flopping and failure to get a handle on COVID, proceed to spin the idea of vaccine protection, and compelling getting it which makes sense in a way, or at least until there's a better product. (That sure is a golden opportunity for Sorrento (SRNE), if they can pick-up-their pace to test and also to market with the already approved Covi-stix for Mexico if nowhere else.)

Executive summary:

- Seasonally common weakness in the Senior Indexes evolves, however it is increasingly impacted by warnings from many sectors, like Retail.

- Inflation is 'what is available' is a given now, along with organic inflation in everything from foodstuffs to consumer non-durables.

- A sell-off can become precipitous when everyone fears everyone else is selling, so simply an 'absence of bids' can promulgate further decline.

- Such purges are interspersed by intraday and intraweek rallies, as likely persists until we get either a 'selling climax' or other development.

- Oil is firm and some are offering ridiculous upward targets (like 100 / bbl.) which I think is too high (barring geopolitical accident), but it stays firm as we have expected, with less interest in Oil Services than Oil itself (OIL, BNO).

- Demand in China and India is being cited for oil shortage, mostly that's aspirational as they have COVID restraints too, overall not enthusiastic about the integrated international oils, while Natural Gas IS stronger, should maintain it's stability (and enriches Russia selling to Germany).

- One reason Wall St. talks-up rising global Oil demand, is that they know it's important to support a bullish argument for the broad market, and for now the market is defensive, likely remaining so for a bit, Oil firm or not.

- All of this relates to COVID, even in Asia they have 'wave of disease' that are far greater than generally reported here, Vietnam and China included.

- Many are watching the Dollar closely, it's firm but likely not rising much, if the Fed were to get more hawkish it might, but trading-range for now.

- Oils will also be a hiding place for some banks and institutions trying to shift into 'safer' areas during this particularly wide-called-for shakeout.

- Since a correction or decline here (S&P began weeks ago for most, and a week ago for the Index's most recent record) suddenly is embraced by a slew of participants (some banks have been bearish all year), one tends to presume some of this shakeout is discounted by advance preparation (SPX).

- The 'obvious' market risk very well helped some intraday short-covering Monday, and we might see that again Tuesday, this time VIX 'did' decline as S&P revived late in the session, which implies they're not so cynical (VIX).

(Typo the world not should be 'none are approved yet' in table above.)

In-sum:

Our general outline was a 'reprieve' and then lower, erratic week, with of course Apple's iPhone 13 (AAPL) reveal Tuesday and Yom Kippur Wednesday, and the surprised after the holiday will be if S&P were to rebound then.

Summation:

Getting a 'serious correction' or not in the S&P (mega-caps) is debatable and will be resisted, in-fact that was part of what saved the Index late Monday. As and if it unfolds there can be a serious movement toward the exits, which can culminate (not start) with a trap-door decline. Likely not right here as too many are trying to pinpoint a drop, so maybe 'hail Mary' rally first.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more

There can arise a situation, where after a string of wrong moves, escape is not possible and the bad things will happen. Unfortunately the federal reserve bankers have been making poor choices for quite a while, And unfortunately that situation is here.

And as for some wonderful medication to completely banish the covid plague, well, Superman is stuck in the comic books and will not be around to help us for the forseeabl future. And on top of all that, there is arising a preponderance of stupidity worse than ever.