Market Briefing For Monday, June 28

A step-up in growth is essential for next year, if current big-cap prices have a chance of being maintained. That's also where monetary policy and Covid fit into the picture. However, growth and tech must participate for S&P advance.

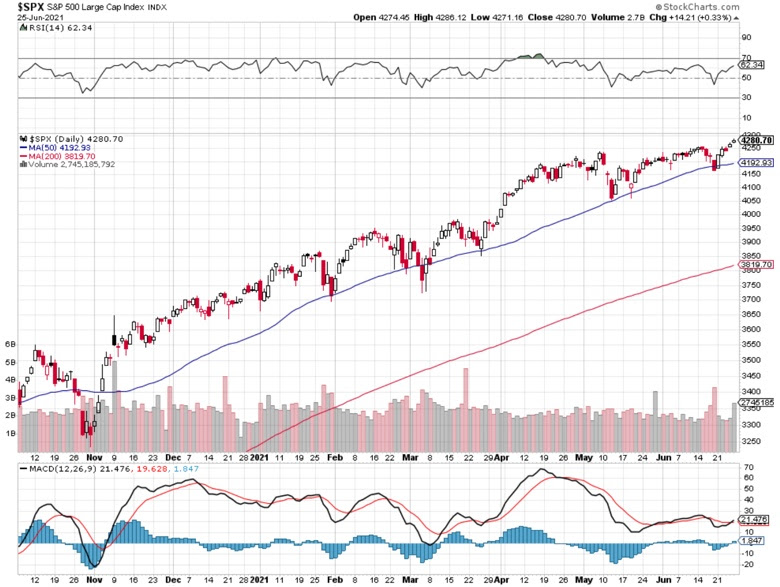

We are well past the peak strength and enthusiasm for our 15-month rally that dates from not just my 'bottom' call; but what I believed to be a 'cycle low' that March 23rd of last year. Yes S&P overdue for more corrective action but most are leaning that way; balanced their holdings; hence the limited disruptions.

That's so far of course. Every now and then we get a shot to the S&P or NDX which serves not so much a wake-up call for a trend reversal; but a warning of potential volatiity as many of these hedge managers use similar algorithms.

The leadership you know; much has been jammed into 'consumer related' or home-related stocks; and that's something that might run out of steam just for now. What matters is whether things pick up here and in Europe late this year.

Whether the 'reconciliation bill' has tax increases and/or spending increases is not known; but also isn't the core push behind this market. Again, the Fed. But it is not bad for stocks 'if' these bills go thru. That doesn't mean I view what all this does with respect to Debt favorably (I don't); I'm just reflecting reaction we expect from the market.

Some believe there is more to this market than the Fed; but watching 'actions' in response to anything any Fed-head says, substantiates their dominant role. Relative to the history of monetary policy, any tapering or even rate hike will of course be minor to say the least; however it's the signal Wall St. cares about.

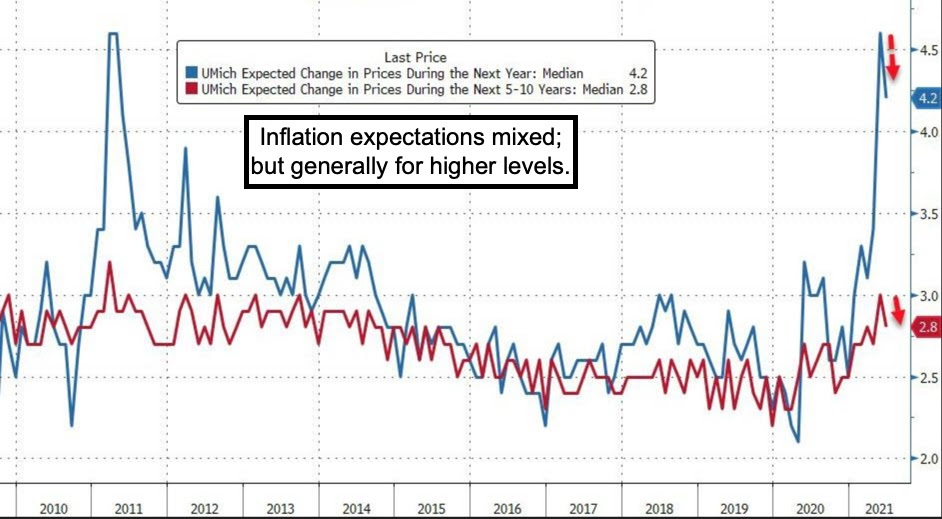

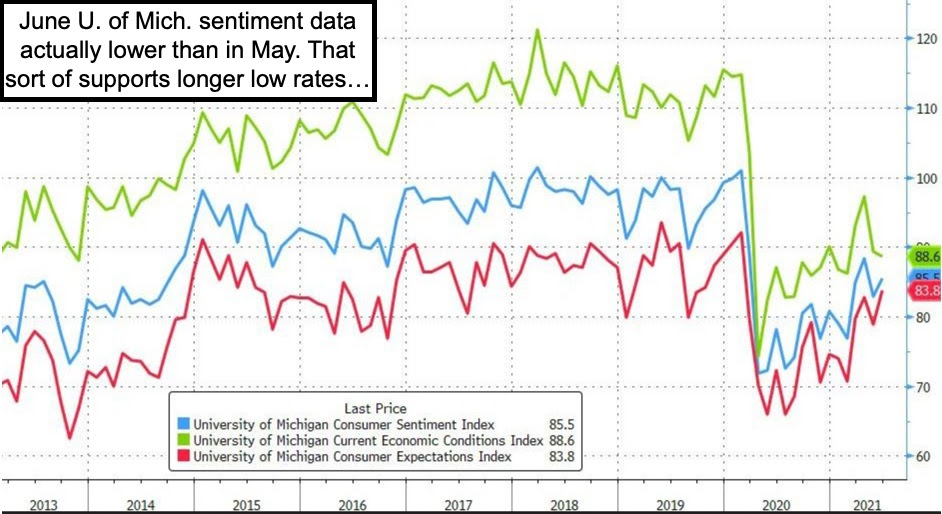

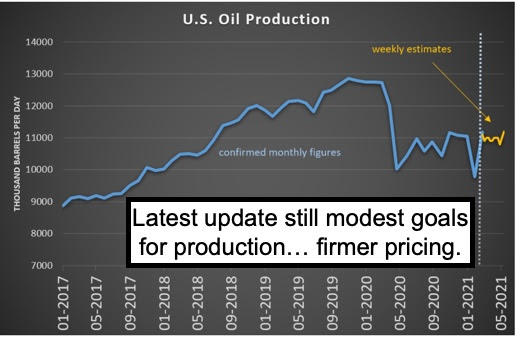

Commodities are high; some like lumber are coming down as I expected; but a slew of other factors make this very slow going; and as I've suggested, view inflation as 'mostly' enduring going forward, rather than 'transitory'; although it is possible to get enough consumer frustration to actually see some slowing of demand; but there's really no sign of that (other than Univ. of Michigan that shows in the Sentiment cards the prospect that this spending spree is limited).

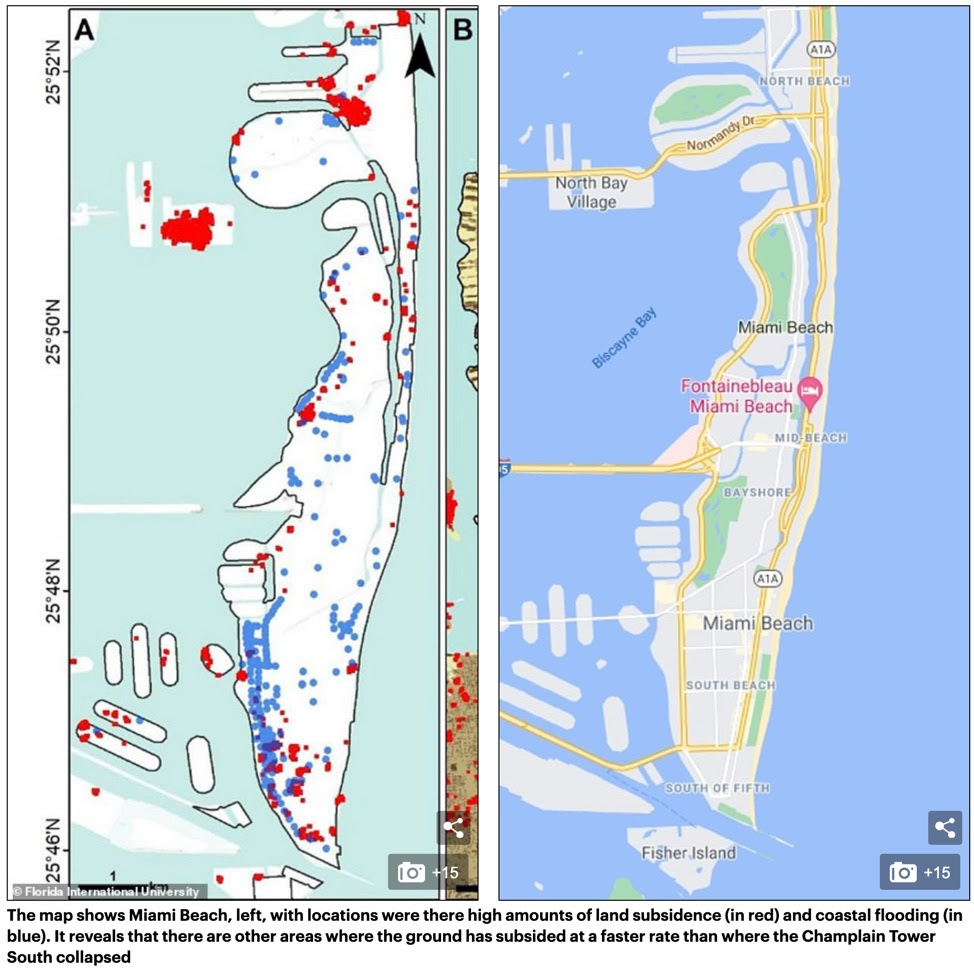

Finally I have to mention two things: one, that CBS reports engineers are now concerned that insufficient piling depth or saltwater-corroded rebar may have contributed to the collapse. If so this could trigger a South-Florida wide review of old building records to determine piling depths; and also whether 'beach or other sand' was used in concrete mixes. This also should effectively dampen the resale market for any over 20-year old Miami area beach hi-rise condo's.

According to a map regarding the years of warnings about saltwater intrusion and rising tides, we learned that three other sites were sinking at a faster rate; another in Surfside's Park View Island (homes and an elementary school may be at risk) nearby, two in south Miami Beach in the Flamingo neighborhood (I have mentioned a few times how the pump project in South Beach is pouring money down the drain as you can't pump out the ocean, and with Limestone underlying much of Florida, it's fairly unfeasible to protect with large seawalls). You can do that to protect Manhattan from rising tides; but not Florida, NJ or a slew of low-lying coastal properties along the East Coast.

I know people are frightened; and not just in the sister building in Surfside you'll hear about; but psychologically likely in every taller building along the shore. I realize how bizarre this disaster is; but it is also a wakeup call for related fears including global warming and how rising tides contribute to 'circumstances'.

I would go so far as to say the top of the Miami Beach condo market is 'now'. A lot of Northern buyers just flocked there during the pandemic, fleeing taxes too. Bought the Miami high perhaps. And the West Coast of the US will hit historic high temperatures this weekend; along with high fire danger and limited water.. So climate change is real; land is sinking and the seas are rising. I won't venture a thought about rising earthquake activity or a rising/active Yosemite caldera. Meanwhile we all pray for miracles; but realistically the clock has been ticking with respect to this horrible disaster; also time to retreat from low-lying coasts.

In sum: There was a fair steady upside Friday, especially with re-balancing. So I think (barring bad news) we consolidate perhaps; but do work slightly higher.

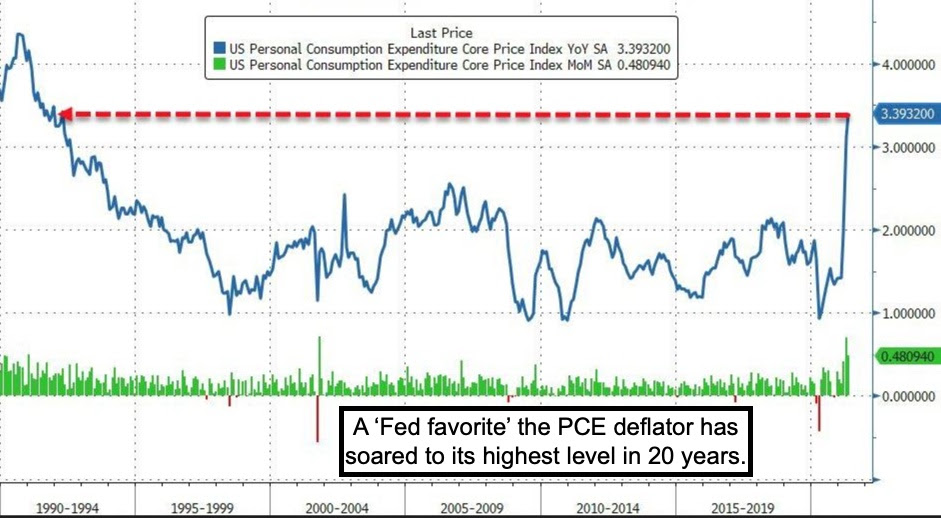

Fed officials thankfully kept quiet about 'tapering' for a day at least. On Friday we had Boston President Eric Rosengren say rising inflationary pressures still appear to be temporary, shrugging off new data showing prices rising at rates unseen since 1992. Rosengren said he's 'expecting prices to continue surging since airfare, hotel, and rental car prices still have yet to reach pre-pandemic levels'. (He's wrong or using old data on some of that; and the overall trend.)

It's hard for that to make sense; although I thought prices were extremely high more so than typical before pandemic; especially for hotels, airport rental cars and spiking air fares. Wishful thinking (due to post-Covid lingering issues) but I verified this by checking flights to the West Coast, to Europe and to Puerto Vallarta (ha my favorite). Rental car prices are so high a frugal doctor friend with a second home in Florida bought a Honda just to leave here because he was upset the cheapest weekly rental was over $700.

Anyway back to Fed Pres. Rosengren; he said (inflation) “It’ll continue maybe a little longer than we were expecting, but I think the best guess going forward is that when we get into next year we’re going to be seeing inflation just barely above 2%". Fine that's reasonable to say; but I'd say not very 'transitory' at all.

Consumer Sentiment is mixed; and of course 'Government lifestyle' subsidies are ending; and it's amazing that some would view Nike sales as relatively important vs. the University of Michigan Consumer Sentiment Survey. They had a strong quarter and lots of people treated themselves to new sneakers (personally I got my favorite Asics Kayanu 28; more stability, less status; ha).

Multiples on a Nike or so many stocks is very challenging. One member (very humorously I presume); asked me why I was so 'incredibly bullish on stocks or paying the highest price in history for stocks'. I laughed; actually buying no big stocks at all here; and nibbling on pullbacks was limited to a couple 'value' speculative plays (Ford, LightPath and Sorrento fit that description). Even F was at it over-hyped (how often have I heard Ford vs. Ferrari justification for the new CEO; which it is; but shares may reflect that); but eventually higher.

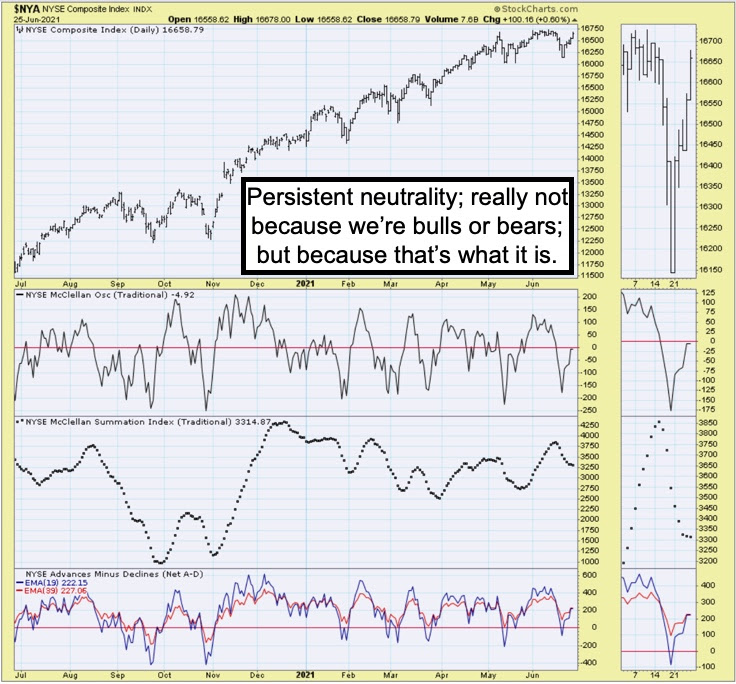

I have no interest in chasing the pricey stocks. Wrong guy! However my task clearly is to analyze the market, as it is, not how I might prefer it to be. And I do. It's how we got to where we're at without getting hurt by shorting; by not at all 'fighting the Fed', realizing it's 'The Roaring 20's' as forecast 15 months or so ago; and it's even a possibility that this week's new highs are... 'transitory'.

Kidding aside there are no major technical indicators screaming disaster; but I note there are ways of viewing big-cap fundamentals as making little sense. I will look at this again next week; and glad we've listened to the market; not a slew of technicians that mostly have fought this S&P rise for well over a year.

Of course it's exhausting; of course many components have corrected over a period of months; and of course some are pending correction. It's bifurcated it seems in ways described for many months; and that hasn't changed. It might not be exciting; it's Oil-led, but was a valid taking of the market's temperature.

On the economy, we have to be pretty humble about what’s going to happen with inflation or labor markets, which is not transitory from a macro viewpoint. This remains a time where the Fed should be data-driven; and they are. We're not fighting the Fed, even though we don't concur about inflation as 'transitory' (we will adjust if it promises to be; for instance, the low sentiment numbers do support the Fed's view; and if so that's more bullish than bearish for focusing on money flowing into stocks; even if it makes since sense to an Austrian lol).

This is an excerpt from Gene's Daily Briefing (distributed nightly). It typically includes videos as well as charts and analysis. You can subscribe more

As for that collapsing High Rise: There is a Biblical caution about building on sands, and so the clear warning was delivered a long while back. It should be clear to all that at least some of those folks building on sand consider that they are building TEMPORARY structures. And very likely those pilings do not go nearly deep enough.

As for the inflation concern, "transitory" only means not permanent. No mention of duration, just that it is shorter than "forever."