Macro: Labor

Overall, the employment pictures remains healthy.

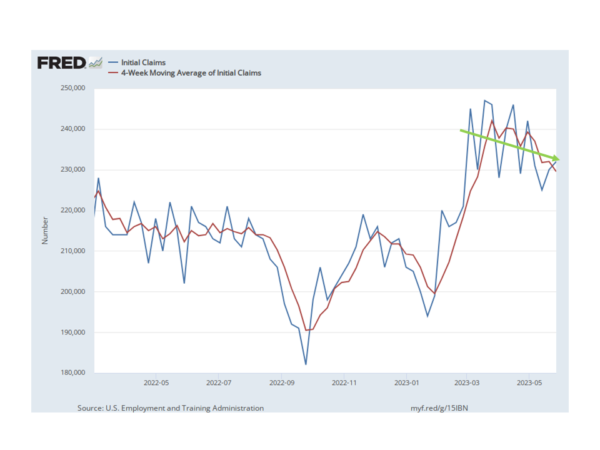

Higher frequency weekly initial claims are trending in the right direction (lower).

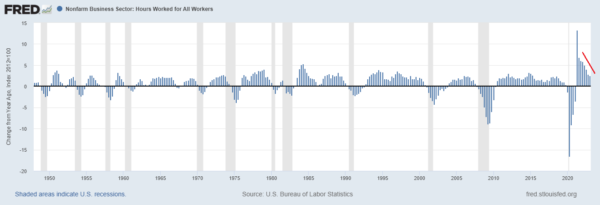

Aggregate hours worked are still growing at 2.2% YOY. While positive the growth in total hours worked continues to slow all be it at a lesser rate of decline. This will be a factor to watch in the coming months. The accelerated growth from the economic re-opening is in the rearview mirror. In the past, negative growth in aggregate hours has been a recession signal.

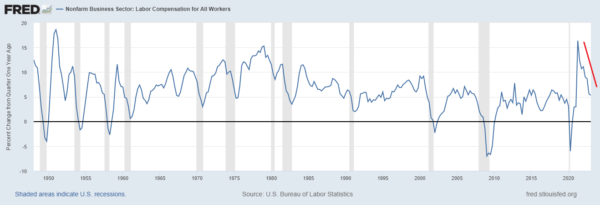

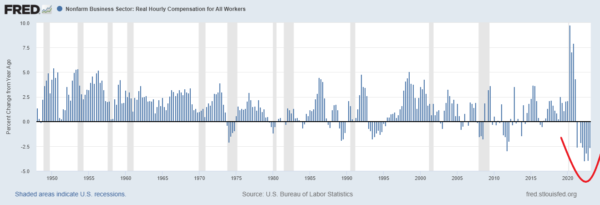

Compensation continues to grow at over 5%. But this growth is declining and, again, significantly slowing and especially negative compensation growth has been a good recession signal. More concerning is the growth in workers’ real purchasing power which has been negative for 2 years.

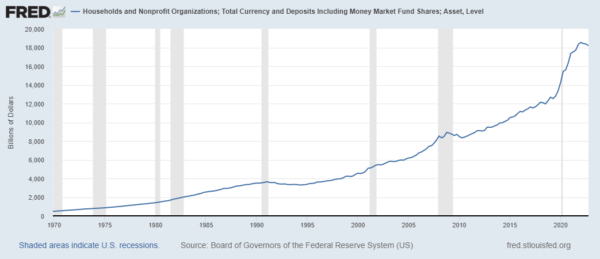

While not necessarily a recession indicator historically, loss in buying power versus inflation over the last 2 years continues to be at the worst levels in the last 75 years. Consumers have weathered the inflation very well given the bump in savings from pandemic stimulus. We’ve started to draw down our liquid assets, but not close to the amount they added the previous 2 years and liquid assets remain approximately 35% above pre-pandemic levels.

More By This Author:

Macro: Regional Business SurveysDo You Really Want AI To Pick Your Stocks?

Macro: Factory Orders