Futures Rally Fizzles As Dollar, Yields And Oil Slump

Image Source: Pixabay

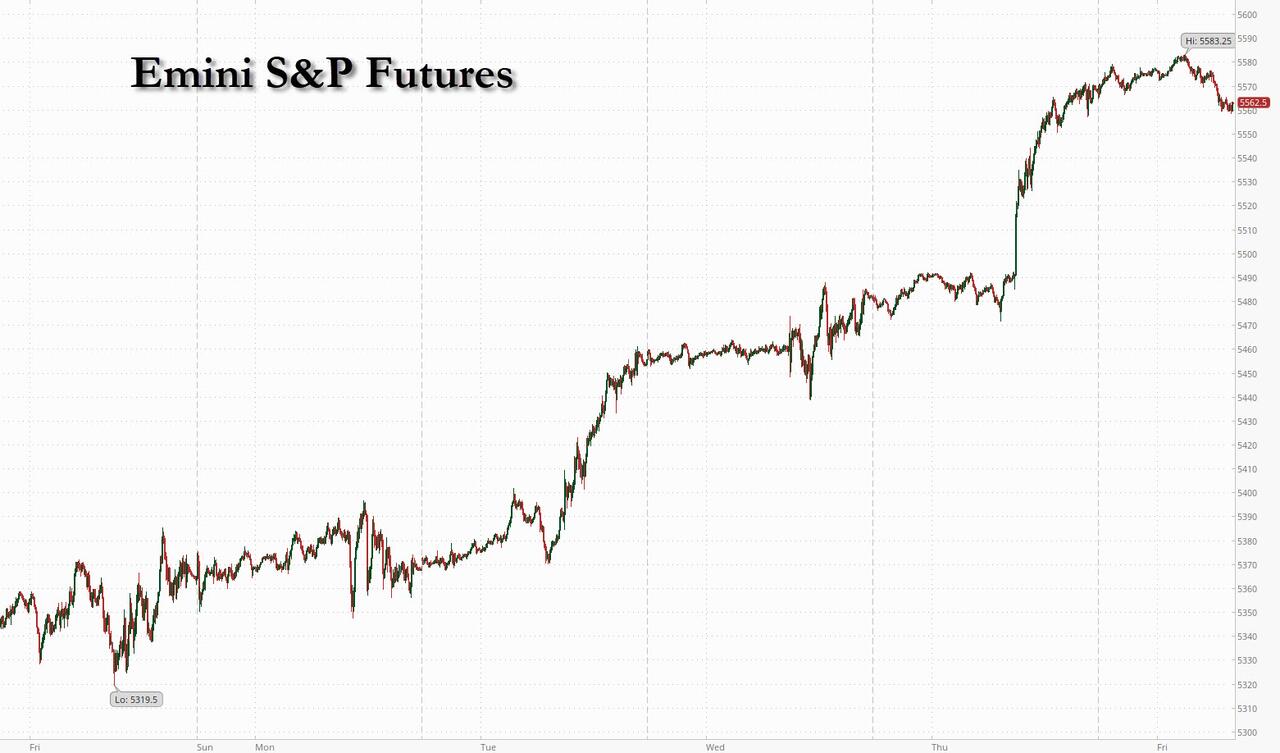

US equity futures erased earlier gains and were trading with modest losses as the dollar, oil, and yields all slumped entering the US session. On Friday, as of 7:45 am, S&P futures traded down 0.1% around 5,562 as consistent selling pressure emerged around the European open, even as Asian stocks had another solid session. Nasdaq futures were unchanged, with mega-cap tech mostly higher led by NVDA +56bp, and AMZN +60bp. Bond yields and USD are both lower; 2-, 5-, and 10-yr yields are 2bp, 5bp, and 10bp lower, pulled down by a sharp drop in oil as the Harris oil trading desk resumes shorting. Other commodities were mixed with base metals higher. The key macro focus will be U of Mich Sentiment and housing data (Housing Starts and Building Permits).

In premarket trading, Applied Materials fell after the semiconductor capital-equipment company’s forecast disappointed bullish investors looking for a bigger payoff from artificial intelligence spending. Bayer AG jumped 10% following a significant win for the German company in long-running cancer litigation over its Roundup weedkiller. Here are the other premarket movers:

- Bumble slips 2% after TD Cowen downgrades the stock to hold, citing an uncertain path to recovery.

- Coherent rises 3% after the semiconductor device company posted quarterly results. Analysts were positive on comments made by new CEO Jim Anderson who is focusing on improving profitability.

- H&R Block gains 8% after the professional services provider forecast revenue for 2025 that beat the average analyst estimate.

- Microchip Technology gains 2% as Piper Sandler raised the recommendation on the chipmaker to overweight, predicting gross margin upside due to decreasing charges.

- Texas Instruments gains 1.6% as the company is set to receive $1.6 billion in Chips Act grants and $3 billion in loans, the Biden administration announced Friday.

A flurry of data reversing the dismal post-payrolls hard-landing sentiment, and signaling that the American economy still has some has in the tank, has put US stocks on course for their strongest week of the year. The latest goalseeked readings, from inflation to jobless claims and retail sales, have reassured investors and supported hopes that the world’s biggest economy is heading for a “Goldilocks” scenario of contained price pressures accompanied by resilient growth (spoiler alert: it isn't, and the truth will be revealed on Nov 6 or thereabouts). As a result, the S&P 500 has rallied 3.7% this week, while the Nasdaq 100 is up more than 5%, the biggest gains for both indexes since November.

“There is little in the data flow now to really derail sentiment in the immediate near-term,” said Pepperstone Group strategist Chris Weston.

The powerful rebound means that stock markets around the world have erased last week’s losses, when traders were worried the Federal Reserve wouldn’t cut interest rates fast enough to achieve a soft landing for the US economy. In Europe Friday, the Stoxx 600 Index added 0.3% as it headed for its best week since May. US equity futures were little changed.

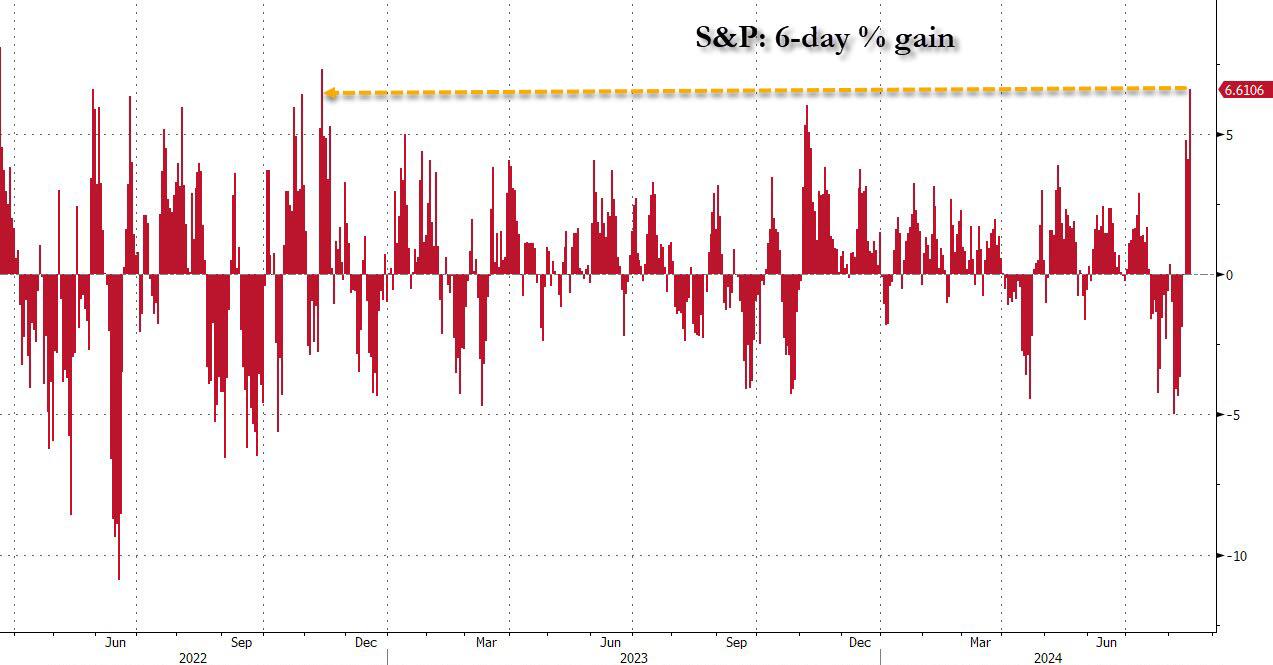

The latest surge on Wall Street saw the S&P 500 notch its strongest six-day winning run since November 2022. Bank of America's Michael Hartnett said US stocks just recorded a seventh straight week of inflows, underscoring the sustained appetite for equities among investors. BofA said about $5.5 billion went into US equity funds in the week through Aug. 14.

US officials have been trying to use higher rates to ease inflation without causing the economy to contract. Fed Bank of St. Louis President Alberto Musalem said the time is nearing when it will be appropriate to cut rates. His Atlanta counterpart Raphael Bostic told the Financial Times he’s “open” to a reduction in September.

“A soft landing is no longer a hope. It’s becoming a reality,” said David Russell at TradeStation. “These numbers also suggest that recent market volatility wasn’t really a growth scare. It was just normal summer seasonality amplified by moves in the currency market.”

European stocks pared earlier gains of 0.5% to just 0.1% as they head for their best week since May amid evidence of economic resilience that’s supporting global equity markets. Auto and retail sub-indexes were the best performers, rising 1.7% and 1.2%, respectively. Bayer (BAYZF) shares rose as much as 10%, the most in five years after a US appeals court concluded that federal regulations governing the Roundup weedkiller’s warning label supersede Pennsylvania laws. Here are the other most notable European movers:

- NIBE Industrier shares rise as much as 16%, the most since May 2021, after the Swedish heat-pump maker beat estimates in its second-quarter earnings. Morgan Stanley analysts say the company’s results were a “positive surprise” and mainly driven by inventory completion.

- Saint-Gobain shares rise as much as 0.9% after the French building-materials producer agreed to buy construction-chemicals company Ovniver Group for $815 million. Analysts say this will strengthen Saint-Gobain’s position in Latin America, with Citi seeing scope for more bolt-on acquisitions.

- NKT shares rise as much as 6.1% after the Danish electrical components firm’s second-quarter results showed what Jefferies called strong execution. NKT raised its full-year outlook in July.

- GSK shares were little changed after a US state court ruled in favor of the drugmaker and other defendants, by deciding to exclude the plaintiff’s expert testimony claiming that ranitidine was a significant risk factor for Wilson’s prostate cancer.

- Kingspan shares fall as much as 4.4% after trading profit for the first half missed estimates. Analysts see continued price deflation and sluggish end-market demand weighing on the Irish insulation maker’s growth.

- Scout24 shares fall as much as 1.9% after being downgraded to hold by analysts at M.M. Warburg Investment Research, which remain impressed by the online property portal’s performance but believe it is now fairly valued.

- Mobilezone shares fall as much as 4.8%, the most in more than four months, after the Swiss-based mobile-phone retailer posted its first-half results.

- Alm Brand falls as much as 2% on Friday, as Nordea cuts the Danish insurer to hold. The firm is extending yesterday’s drop after the second-quarter results missed analyst expectations.

- Boozt drops as much as 5.2% after the Swedish online retailer reports second-quarter results that DNB Markets says appear “soft.”

Asian equities are higher following Thursday’s US rally. Nikkei jumps more than 3% and Kospi rises 1.8%. Taiex rallies as much as 2.2%. Hang Seng adds 1.7%; mainland China indexes eke out modest gains. Asia sported Friday’s strongest market gains as stocks in the region headed for their best weekly performance in over a year, led by Japan as a weaker yen boosts exporters’ earnings prospects. The currency is set for its sharpest weekly drop since June after sliding 1.3% against the dollar Thursday. It was trading around the 149 level, easing fears of a massive carry trade unwind.

In FX, the dollar slipped, on course for a third week of declines, the longest such losing streak in more than five months. The USD/JPY slipped as much as 0.1% to 148.00, while 10-year bond yield dropped 2bps to 3.8940% The yen “has tracked the swing in rates differentials overnight,” said Rob Carnell, head of research and chief economist for Asia Pacific at ING Bank

In rates, Treasury 10-year yield eased 5bps to trade near 3.86%. Australian 3-year yield remains about 6bps higher following the RBA Governor Bullock’s hawkish testimony; Aussie dollar 0.2% stronger. JGB futures sharply lower with Japan’s benchmark yield 5bps firmer. Treasury yields slumped across the curve, after surging Thursday as the resilient US economic data prompted traders to dial back bets for a jumbo September Fed rate cut, and as oil tumbled right on schedule ahead of Kamala Harris' big policy reveal later today. A 25 basis-point reduction remains fully priced, with more than 90 basis points of easing expected by the end of 2024.

In commodities, gold was on track for a weekly gain. Crude is lower in a paring to the prior day's gains. Friday morning's price action has been contained to within Thursday's range, although some downticks coincided with reports that Libya's Waha oil field is to return to full normal levels within the coming hours after production was reduced amid a fire. Brent is sliding as low as $79.

Looking at today's calendar, US data slate includes July housing starts/building permits, August New York Fed services business activity (8:30am) and University of Michigan sentiment (10am). Fed speakers scheduled for the session include Goolsbee (7am, 1:25pm and 4:15pm)

Market Snapshot

- S&P 500 futures down 0.1% to 5,559

- STOXX Europe 600 up 0.3% to 511.60

- MXAP up 2.3% to 182.50

- MXAPJ up 1.7% to 568.04

- Nikkei up 3.6% to 38,062.67

- Topix up 3.0% to 2,678.60

- Hang Seng Index up 1.9% to 17,430.16

- Shanghai Composite little changed at 2,879.43

- Sensex up 1.4% to 80,244.35

- Australia S&P/ASX 200 up 1.3% to 7,971.05

- Kospi up 2.0% to 2,697.23

- German 10Y yield little changed at 2.25%

- Euro up 0.1% to $1.0987

- Brent Futures down 0.6% to $80.55/bbl

- Gold spot up 0.3% to $2,463.22

- US Dollar Index down 0.12% to 102.85

Top Overnight News

- Fed Chair Powell is to speak on August 23rd at 10:00EDT/15:00BST at the Kansas City Fed's Jackson Hole Symposium.

- Atlanta Fed GDPnow (Q3): 2.4% (prev. 2.9%) following the retail trade, industrial production, and import/export prices data.

- US VP Harris is to call for the construction of 3mln new housing units and tax incentives to build homes for first-time buyers, according to WSJ.

- Texas Instruments (TXN) signs prelim agreement to receive up to USD 1.6bln in Chips and Science act proposed funding for semiconductor manufacturing in Texas and Utah

- A popular yen-centered carry trade that blew up spectacularly two weeks ago is staging a comeback.

- The largest unwind in US equities since the Covid-19 pandemic is over, and now trend-following quant funds are ready to return to the stock market

- China’s central bank chief pledged further steps to support his nation’s economic recovery, while cautioning that it won’t be adopting “drastic” measures

- UK retail sales bounced back in July after summer discounts and the Euros football competition unleashed spending at department stores and sports shops

- Saudi Arabia is expected to put less money into the oil industry than initially predicted in its goal to invest $1 trillion in strategic sectors by the end of the decade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks followed suit to the rally on Wall St after a US data deluge soothed recent economic concerns. ASX 200 gained as the commodity-related sectors spearheaded the advances seen across all industries. Nikkei 225 outperformed and surged firmly above the 37,000 level following recent currency weakness. Hang Seng and Shanghai Comp. were positive with JD.com, MTR, Li Ning and Alibaba among the biggest gainers in Hong Kong post-earnings, while the mainland index continued to lag amid lingering economic concerns.

Top Asian News

- RBA Governor Bullock said the board is of the view that it currently has the balance right between reducing inflation in a reasonable timeframe and noted their full employment goal is not served by letting inflation stay above target indefinitely. Bullock said based on what the board knows at present, it does not expect that it will be in a position to cut rates in the near term and the board’s message is that it is premature to be thinking about rate cuts, while she added that although goods price inflation has declined substantially, it has not been enough to offset continued high services price inflation. Furthermore, Bullock said the government and RBA are in complete agreement regarding inflation reduction and stated that public demand is currently not the main priority.

- RBNZ Governor Orr said the committee has achieved a very strong level of confidence that low and stable inflation is back within 1% and 3%, while he wants to see inflation expectations and pricing intentions continue to remain anchored.

European bourses, Stoxx 600 (+0.5%) are almost entirely in the green, in a continuation of the optimism seen following the strong US Retail Sales figure seen in the prior session. European sectors hold a positive tilt and with a cyclical bias; sectors such as Autos, Retail and Travel & Leisure are towards the top of the pile. Telecoms is towards the foot of the pile alongside Optimised Personal Care. US Equity Futures (ES +0.1%, NQ +0.2%, RTY +0.3%) are entirely in the green, continuing the Retail Sales induced strength; the RTY, once again, outperforms.

Top European News

- EU's Vestager will not return for a third term as the EU's top antitrust official with the Danish government preparing to nominate a different candidate as their EU commissioner, according to FT.

FX

- USD is softer across the board vs. peers in an unwind of some of the bullishness seen in the wake of Thursday's solid US retail sales. DXY is now back on a 102 handle after being as high as 103.22 on Thursday.

- EUR is edging gains vs. an across-the-board weaker dollar but the EUR/USD pair is unable to reclaim a 1.10 status after being as high as 1.1047 earlier in the week (YTD peak). Currently trading around 1.0980.

- GBP is stronger vs. the USD and to a lesser extent the EUR. Little follow-through into the pound was seen after a broadly in-line UK retail sales print. Currently trading near session highs at around 1.289.

- JPY is firmer vs. the USD with the Yen attempting to claw back some of the damage done by yesterday's US retail sales report. Thus far, USD/JPY has been as low as 148.61.

- NZD/USD is attempting to claw back lost ground seen in the wake of this week's RBNZ rate cut and dovish commentary from Governor Orr. AUD/USD is extending its rise on a 0.66 handle and moved back above its 200 and 100DMAs at 0.6601 and 0.6605 respectively.

- PBoC set USD/CNY mid-point at 7.1464 vs exp. 7.1739 (prev. 7.1399).

Fixed Income

- USTs have climbed slightly above 113-00, as the complex received a modest bid in recent trade. Docket features Building Permits/Housing Starts, Uni. of Michigan prelim. and remarks from Fed's Goolsbee.

- Bunds are contained as benchmarks generally hold around the post-Retail Sales/IJC lows seen on Thursday. In a thin 25 tick band which is entirely within yesterday's much wider 134.08-135.07 range.

- Gilts are incrementally firmer with the narrative in-fitting with EGBs. No move in Gilts or BoE pricing after an in-line set of Retail data. Currently holding shy of 100.00 in 99.86-100.08 parameters.

Commodities

- Crude is lower in a paring to the prior day's gains. This morning's price action has been contained to within yesterday's range, although some downticks coincided with reports that Libya's Waha oil field is to return to full normal levels within the coming hours after production was reduced amid a fire. Brent Oct at the foot of an 80.02-81.02/bbl parameter.

- Mixed trade across precious metals, with the gains in spot gold and spot palladium modest at the time of writing, while spot silver resides in the red as it gives back some of the gains following yesterday's upside in which the metal soared some 3%. Spot gold sits in the green after finding support at USD 2,450/oz (vs high USD 2,464.57/oz).

- Modest losses across base metals following yesterday's surge fuelled by the US data deluge which ultimately pointed to a more balanced economy.

- Qatar lowered its October Al Shaheen crude term price to USD 0.87/bbl above Dubai quotes from a previous premium of USD 1.88/bbl in September.

- China July Crude Iron Ore Output -20.9% Y/Y at 70.22mln metric tons; Alumina +3.9% Y/Y at 7.21mln; Refined Copper +7% Y/Y at 1.1mln; Lead +1.1% Y/Y; Zinc +0.9% Y/Y.

- Libya's Waha Oil Company says it is expecting to return to normal level within the coming hours; it has finished maintenance and pumping started from field to ES-Sider port (250k BPD capacity).

Middle East: Geopolitics

- US official said mediators concluded a 'constructive day' of discussions on Gaza ceasefire and talks are to continue on Friday, according to Reuters. It was separately reported that there is a high probability the Doha negotiations will continue until Saturday, according to Al Arabiya citing an Israeli official.

- US assessments are that Iran will not seek to disrupt ongoing cease-fire negotiations in Doha aimed at ending the Hamas-Israel war and technical talks could stretch into the weekend, but it is unclear how long Iran and its proxies may hold off, according to CBS.

- UK Foreign Minister Lammy is set to travel to Israel "in an attempt to prevent an all-out war in the Middle East", according to Sky News citing a diplomatic source.

- US CENTCOM said its forces “successfully destroyed one Iranian-backed Houthi ground control station in a Houthi-controlled area of Yemen” over the past 24 hours, according to Iran International.

- Hezbollah has said that the counterattack will not occur during talks with Qatar, via Kann's Kais citing the Washington Post; "The response can wait, it is not urgent and has no time limit.".

Middle East: Other

- Russian President Putin's aide said the attack on Kursk was planned with the participation of NATO and Western intelligence, and Ukraine would not have attacked Kursk without US support, according to Al Arabiya

- North Korean leader Kim said in a message to Russian President Putin that Russia will be victorious in a "sacred war" for peace and justice, while he added that the two countries will promote building a multi-polarised new world, according to KCNA. Furthermore, Russian President Putin reaffirmed a commitment to implement a strategic partnership agreement, in a message to- NYSE has withdrawn a proposed rule change application to list and trade options based on the Bitwise Bitcoin ETF and the Grayscale Bitcoin Trust, via CoinDesk citing an SEC filing North Korean leader Kim.

US Event Calendar

- 08:30: July Housing Starts, est. 1.33m, prior 1.35m

- 08:30: July Housing Starts MoM, est. -1.5%, prior 3.0%

- 08:30: July Building Permits, est. 1.43m, prior 1.45m, revised 1.45m

- 08:30: July Building Permits MoM, est. -2.0%, prior 3.4%, revised 3.9%

- 10:00: Aug. U. of Mich. Sentiment, est. 66.9, prior 66.4

- 10:00: Aug. U. of Mich. Current Conditions, est. 63.1, prior 62.7

- 10:00: Aug. U. of Mich. Expectations, est. 68.5, prior 68.8

- 10:00: Aug. U. of Mich. 1 Yr Inflation, est. 2.8%, prior 2.9%

- 10:00: Aug. U. of Mich. 5-10 Yr Inflation, est. 2.9%, prior 3.0%

Central Bank speakers

- 07:00: Fed’s Goolsbee on NPR’s Morning Edition

- 13:25: Fed’s Goolsbee Speaks in Fireside Chat

- 16:15: Fed’s Goolsbee on CNN

More By This Author:

China Coal Production Hits New All Time High For July

Money-Market Fund Assets Hit Record Highs, Banks See Large Deposit Outflows As Stocks Crashed

Core Consumer Prices Hit New Record High - Up For 50th Straight Month

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more