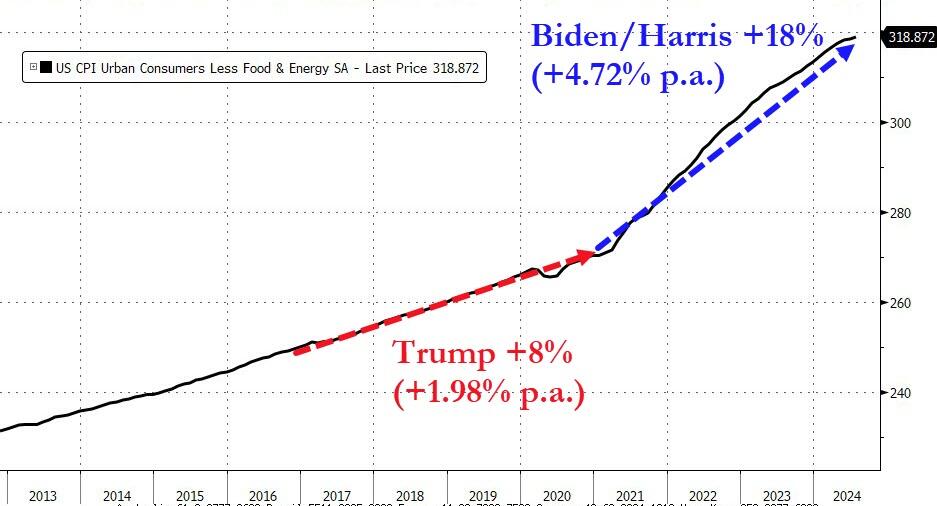

Core Consumer Prices Hit New Record High - Up For 50th Straight Month

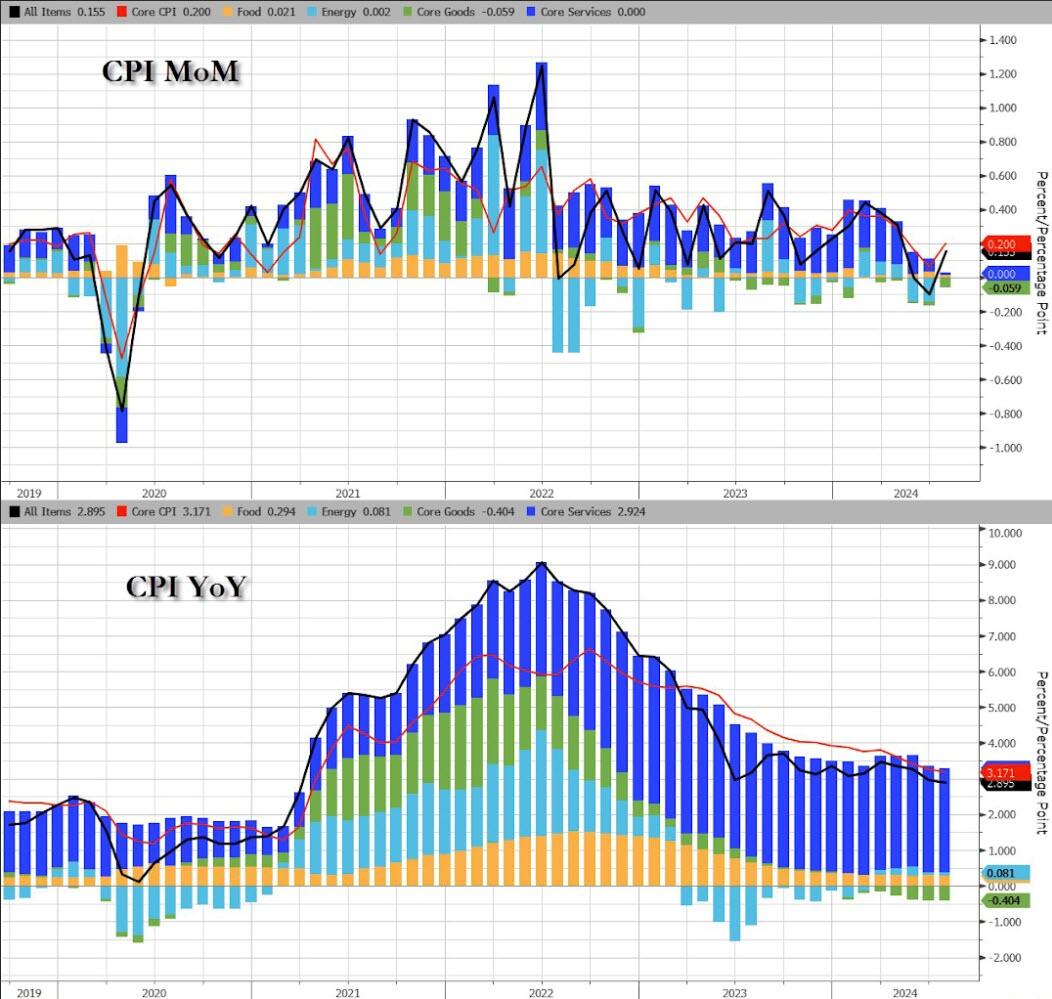

Following last month's 'deflationary' print (-0.1% MoM), analysts expected headline CPI to rise 0.2% MoM and they were spot on, shifting the YoY CPI print to 2.9% (from 3.0%) - the lowest since March 2021...

(Click on image to enlarge)

Source: Bloomberg

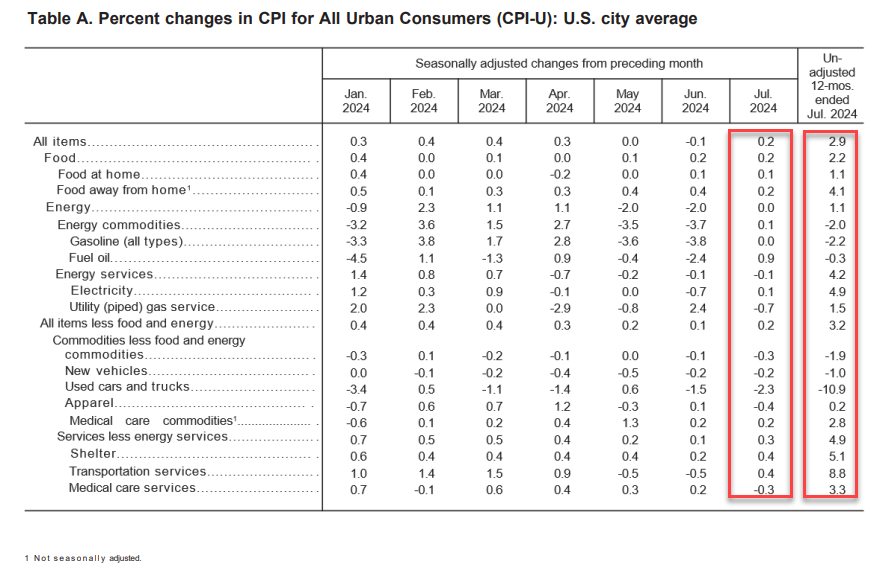

Goods deflation continues to drag overall CPI lower...

(Click on image to enlarge)

Source: Bloomberg

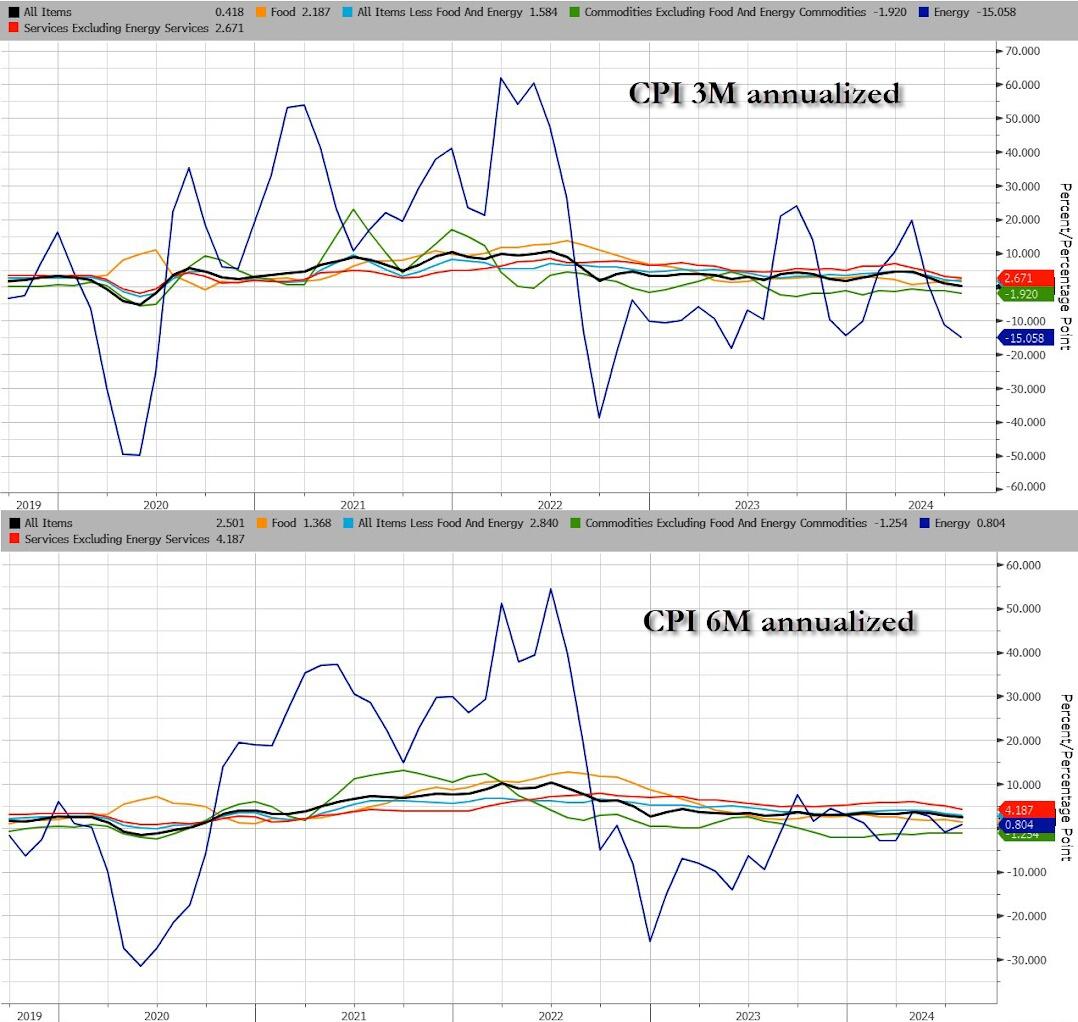

The 3m and 6m annualized CPI rates continue to trend lower (with Energy a particularly volatile factor)....

(Click on image to enlarge)

Source: Bloomberg

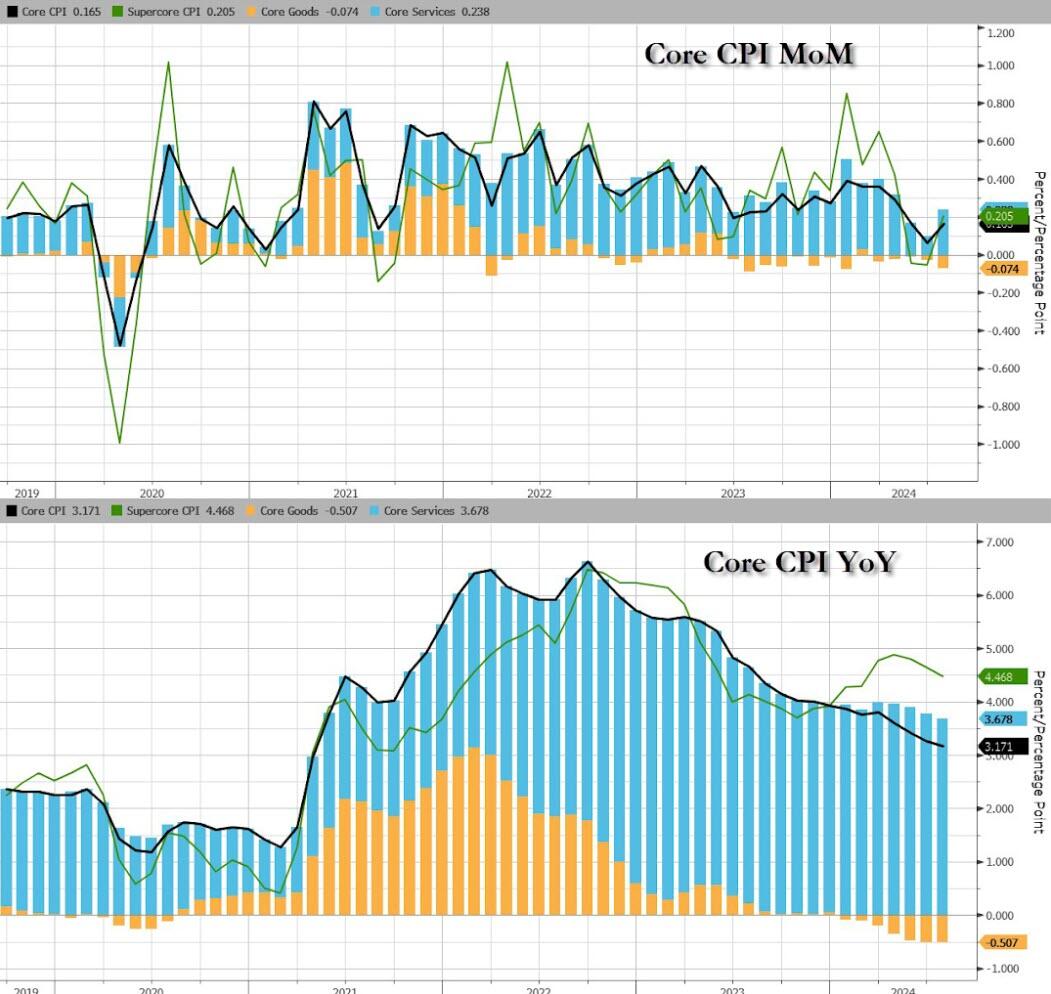

Core CPI also rose 0.2% MoM (as expected), and the YoY rate of inflation slowed to 3.2% (from 3.3%) - the lowest since April 2021...

(Click on image to enlarge)

Source: Bloomberg

While Core CPI is slowing YoY, the Core goods deflation appears to have stalled...

(Click on image to enlarge)

Source: Bloomberg

However, that is the 50th straight month of MoM increases in Core CPI, and a record high...

(Click on image to enlarge)

Source: Bloomberg

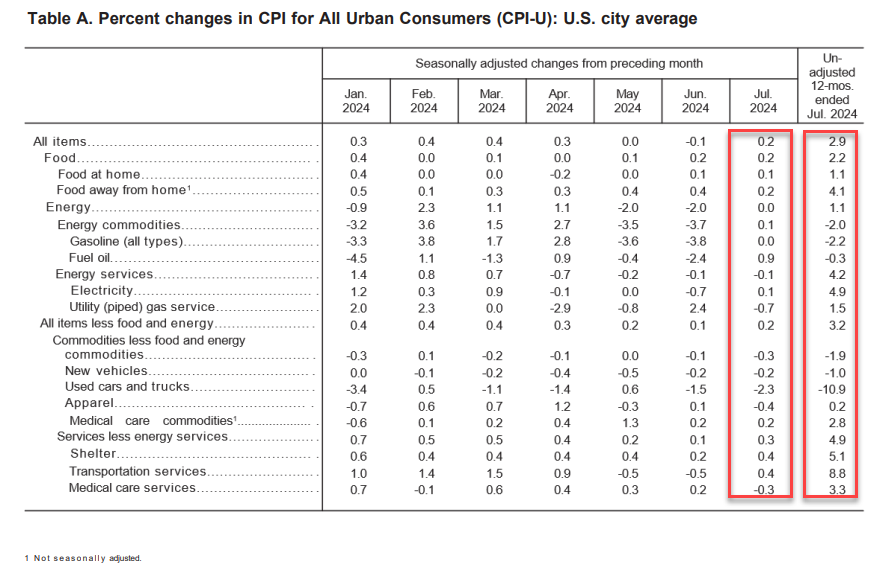

Under the hood, used car prices fell 2.3% along with airline fares (-1.2%) while Car insurance costs jumped 1.2% and furniture prices rose 0.3%...

(Click on image to enlarge)

Source: Bloomberg

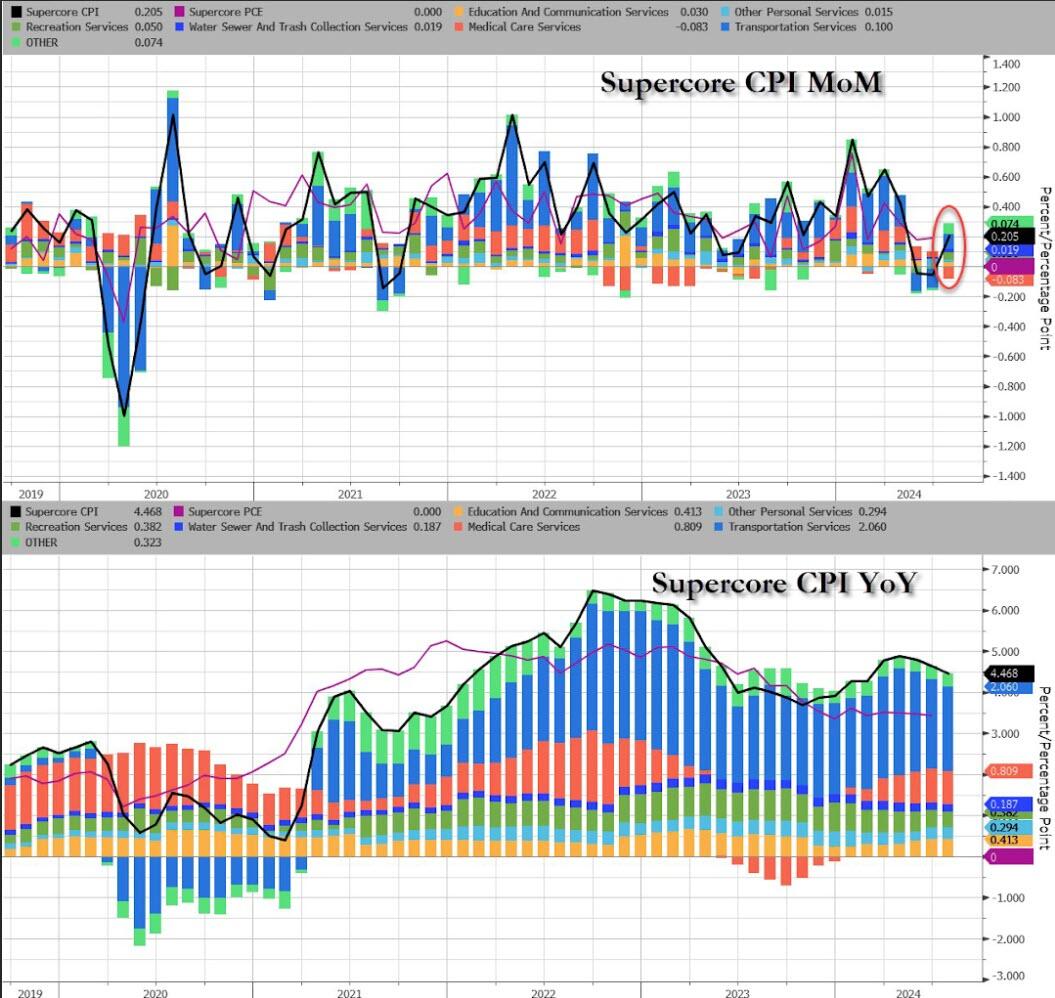

Finally, the so-called SuperCore CPI rose 0.2% MoM (same as the rest), dragging the YoY down to 4.73% (still notably elevated)...

(Click on image to enlarge)

Source: Bloomberg

Transportation Services jumped notably MoM..

(Click on image to enlarge)

Source: Bloomberg

So, is this 'good' news or bad news?

More By This Author:

GM Cutting Jobs Amidst "Larger Structural Overhaul" In ChinaProducer Price Inflation Slows As Services Costs Slump

US Records 2nd Biggest July Deficit In History As 25% Of Tax Revenue Go To Pay Interest

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more