Money-Market Fund Assets Hit Record Highs, Banks See Large Deposit Outflows As Stocks Crashed

As stocks continued to crash last week, money-market funds saw a second week of significant inflows (+$28.4BN) which together with the prior week's $52.7BN, pushed total MM assets under management to a new record high of $6.216 TN...

Source: Bloomberg

And while bank deposits also saw (huge) inflows the prior week, the week-ending 8/7 saw seasonally-adjusted (SA) US bank deposits plunge $77BN - the biggest weekly drop since Tax Day in April...

Source: Bloomberg

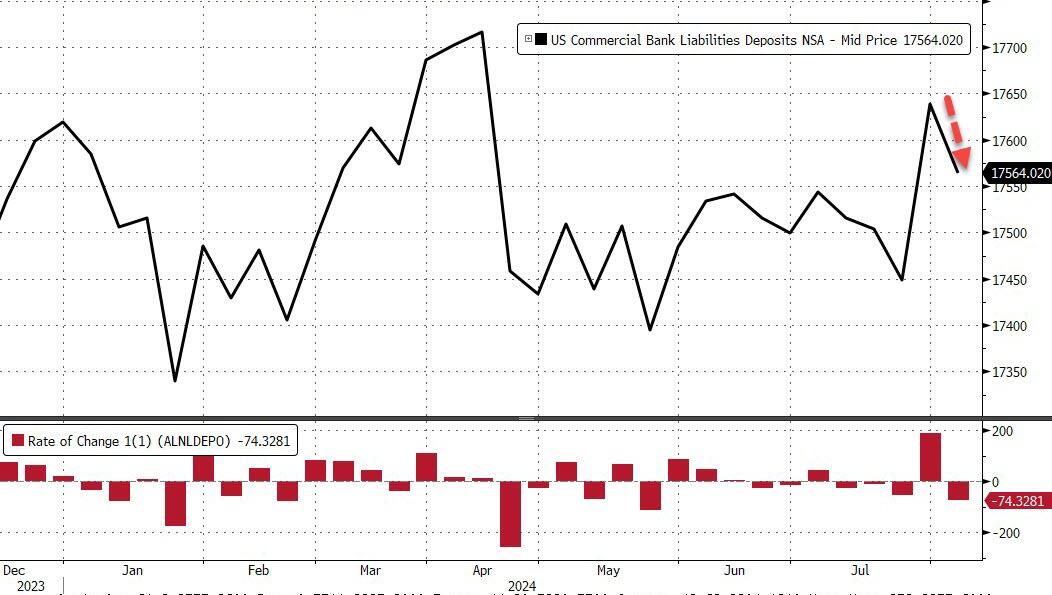

Non-seasonally-adjusted (NSA) deposits also tumbled (by $74BN)...

Source: Bloomberg

Excluding foreign deposits, US bank domestic deposits (SA and NSA) plunged as stocks tumbled (-$70BN and -$78BN respectively)...

Source: Bloomberg

On an SA basis, large banks saw $73.5BN of deposit outflows (the biggest since march 2023 - SVB!) and small banks $3.5BN on inflows. On an NSA basis, large banks suffered an $82BN deposits drawdown while small banks saw $4BN in inflows...

Source: Bloomberg

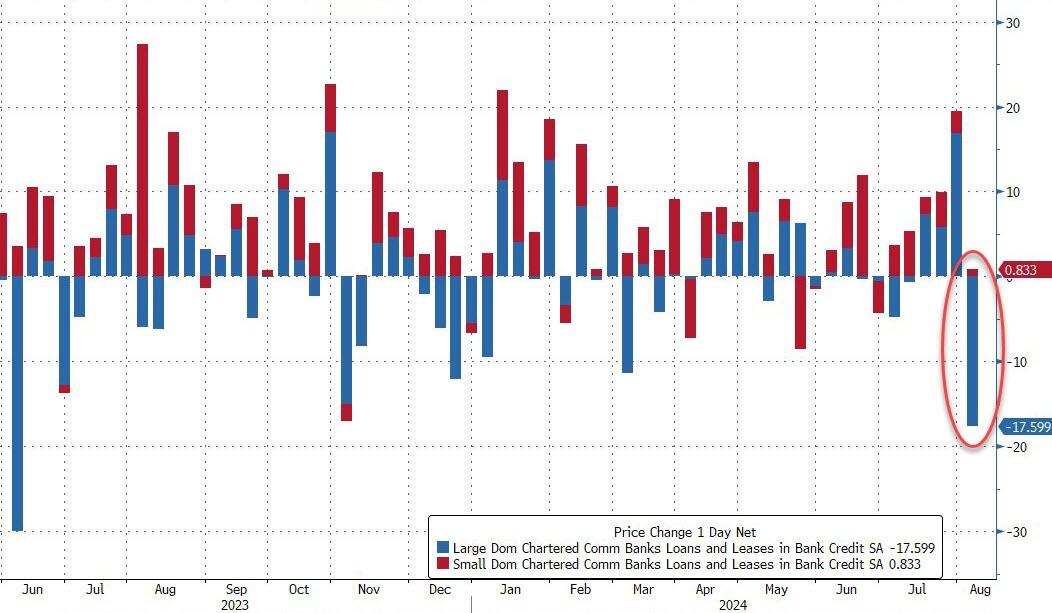

Fiittingly, on the other side of the ledger, bank loan volumes plunged last week (driven by a $17.6BN drop in loans at large banks offset very modestly by a $0.8BN increase in loan volumes at small banks)...

Source: Bloomberg

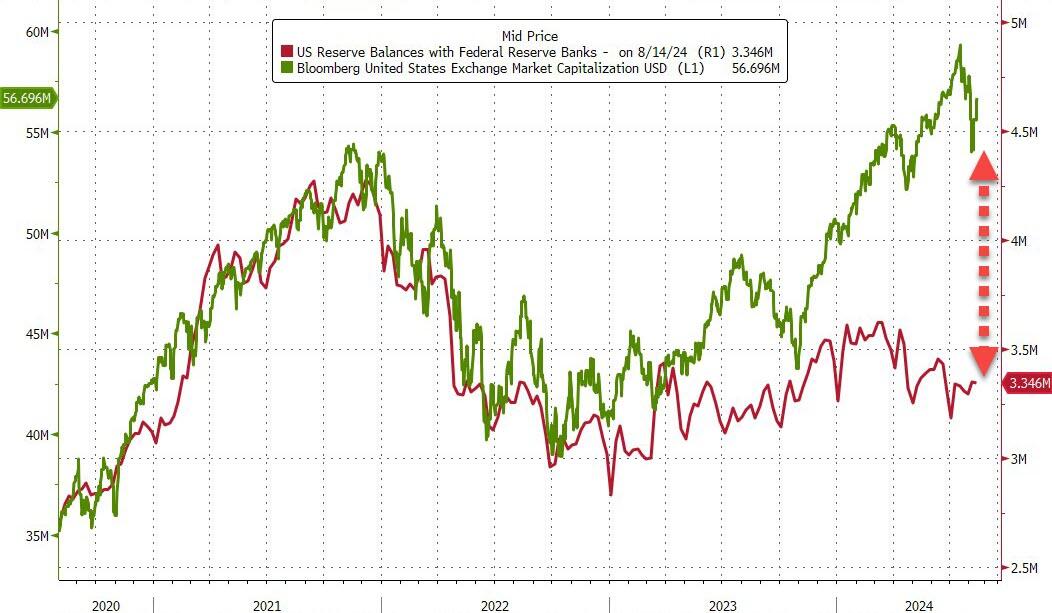

Finally, we note that the US equity market cap rose this week while bank deposits at The Fed remained flat...

Source: Bloomberg

Will this historically-strong relationship ever re-couple?

More By This Author:

Core Consumer Prices Hit New Record High - Up For 50th Straight MonthGM Cutting Jobs Amidst "Larger Structural Overhaul" In China

Producer Price Inflation Slows As Services Costs Slump

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more