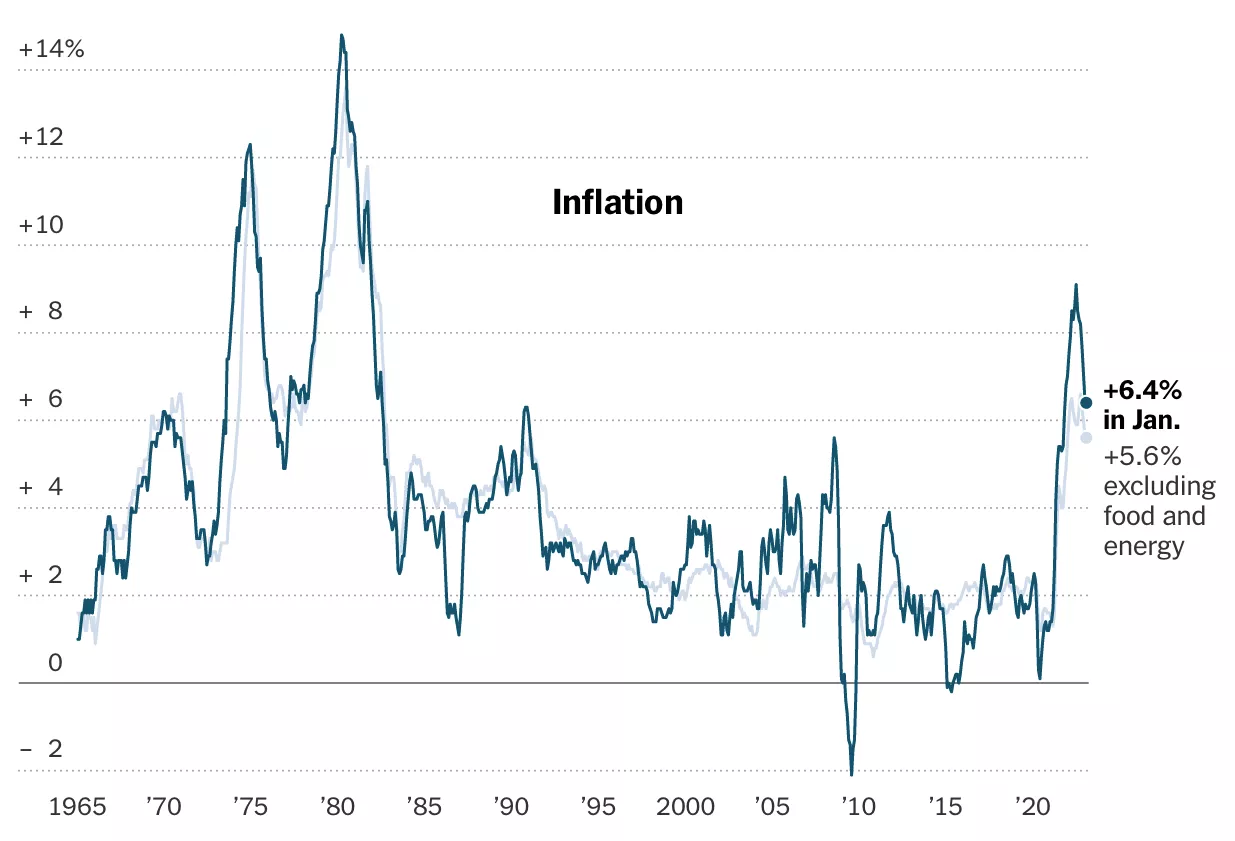

From An Annualized Peak Of 9.1% Last Summer, Inflation Has Dropped

At a gathering last week, Fed Chair Jerome H. Powell made a statement:

The most likely scenario, in my opinion, is that it will take some time and additional rate hikes before we can assess if we have accomplished enough.

The general decline in inflation in recent months has been caused by moderating price increases for goods and commodities.

(Click on image to enlarge)

It may turn out that service pricing are more closely correlated with the economy's underlying momentum: Industries are likely to charge more when unemployment is low and they have to raise wages to compete for workers because labor is a significant cost for many service businesses.

An unanticipatedly large number of jobs were created by employers in January, and while increases in average hourly wages and other pay metrics have slowed, they still remain rapid.

The central bank's effort to curb the economy has so far been unsuccessful.

On an MoM basis, core retail sales growth exceeded expectations, while the YoY dropped to just +4.4%, the lowest level since March.

(Click on image to enlarge)

More By This Author:

Deflation Has Begun

Expect Equities To Improve Before The Economy In 2023

The Strategic Asset Allocation Dilemma

These illustrations are not a solicitation to buy or sell any ETF. I am not an investment advisor/broker