The Strategic Asset Allocation Dilemma

Harry Markowitz's book "Portfolio Selection," which was published around 70 years ago, is where Modern Portfolio Theory (MPT) got its start. The Markowitz framework's mean-variance analysis tools were a key component of the Capital Asset Pricing Model (CAPM).

Despite being used in business schools, CAPM has never been proven through empirical research.

The average funded status of US state-managed pension systems fell from about 100% in 2001 to roughly 74% in 2019 due to blind deference to MPT.

According to MPT, which uses mean-variance analysis as its main technique, diversification in investment has advantages. Investors who are trying to figure out the supposedly "optimal" allocation to diverse asset classes are led by it.

In their paper “Pension Funds Should Never Rely on Correlation,” Ronald Lagnadot and Nassim Nicholas Taleb make the case that when asset returns have fat-tailed distributions or when the relationship between the variables is nonlinear, both situations appear to apply to stocks and bonds, the key risk parameter, correlation, is neither robust nor reliable as a measure of dependency.

Stocks and bonds have blatantly non-Gaussian distributions, and that a substantial nonlinearity can be shown in the regressed relationship between the two.

Even if the correlation were predictable (which it isn't), it would still be a poor indicator of the relationship between non-Gaussian variables or where there was non-linear dependence.

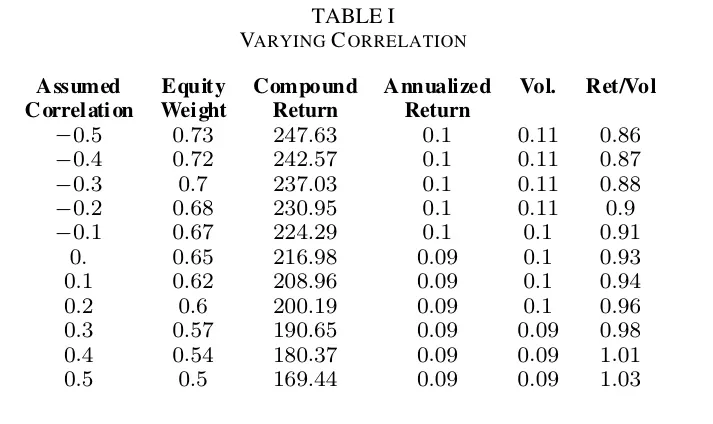

Figure 3's ensuing 60-year period is represented in Table 1 together with the range of realized returns; here, we can observe quite diverse outcomes. If the correlation had been taken to be —0.5 instead of 0.5, the total wealth would have been nearly 1.5 times higher.

Assuming that bonds and stocks are consistently inversely correlated would have led to a greater stock allocation of 73% as opposed to 50%. (and a better outcome.

Figure 3: Resulting Performance

The allocation of funds between stocks and bonds is the single investment choice that has the greatest financial impact on a pension and strategic asset allocation strategy.

A strategic allocation of a 60/40 stock-bond mix is typical among pension funds, which shows the influence of MPT on pension fund managers. The allocation decision is motivated by correlation, notwithstanding the absence of mathematical and empirical support for such an application.

The weak performance of pension funds during the Global Financial Crisis has been caused by shortcomings in MPT and dependence on correlation estimations.

The "ideal" portfolio that will offer the highest possible risk-adjusted return will never be reliably created through the application of correlation.

The supposedly "perfect" portfolio is actually the worst-case scenario.

In protracted periods of economic expansion, like the previous ten years, it achieves an under-allocation to the riskier assets with greater yields while providing insufficient protection against tail risk.

More By This Author:

Yield Spread Translates Into Greater Than 50% Chance Of Recession

Sustainability Ratings Appear To Be A Drag On Fund Performance

Price And Volume Wave-Trends Are In Conflict

These illustrations are not a solicitation to buy or sell any ETF. I am not an investment advisor/broker