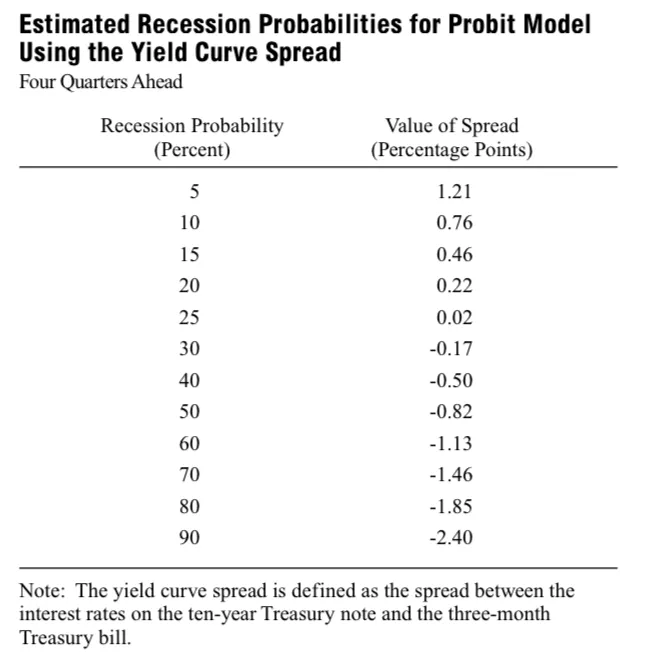

Yield Spread Translates Into Greater Than 50% Chance Of Recession

In their paper “The Yield Curve as a Predictor of U.S. Recessions,” Arturo Estrella and Frederic S. Mishkin find a useful forecasting tool is the yield curve, more precisely the difference in interest rates between the three-month Treasury bill and the ten-year Treasury note. It is easy to use and performs noticeably better in predicting recessions two to six quarters in advance than other financial and macroeconomic indicators.

More By This Author:

Sustainability Ratings Appear To Be A Drag On Fund Performance

Price And Volume Wave-Trends Are In Conflict

Yes, Combining Value And Momentum Can Be Effective

These illustrations are not a solicitation to buy or sell any ETF. I am not an investment advisor/broker